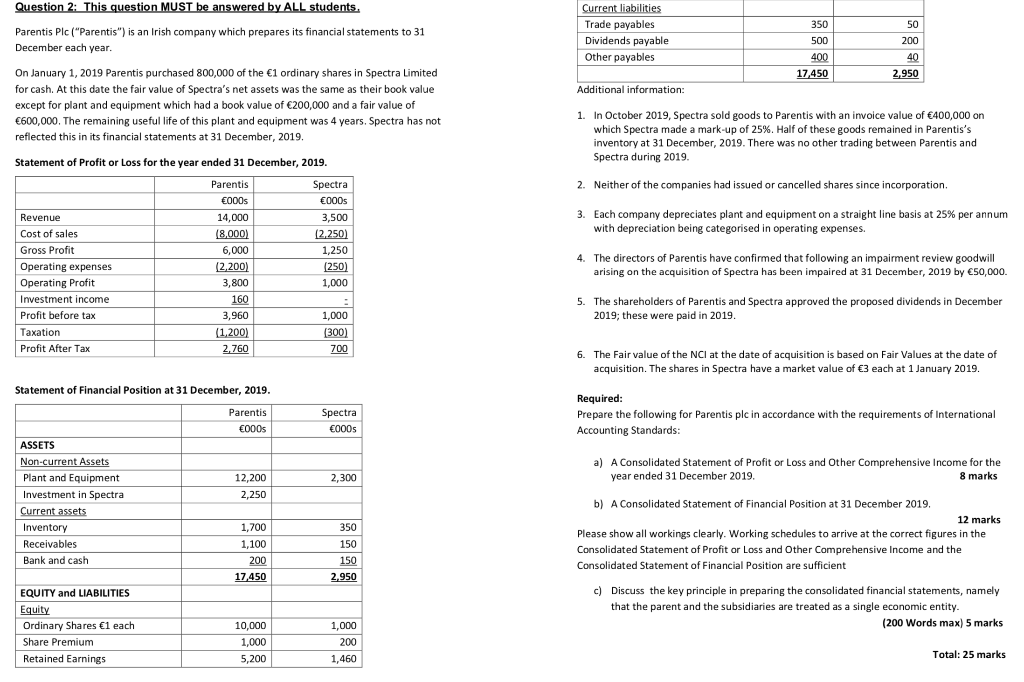

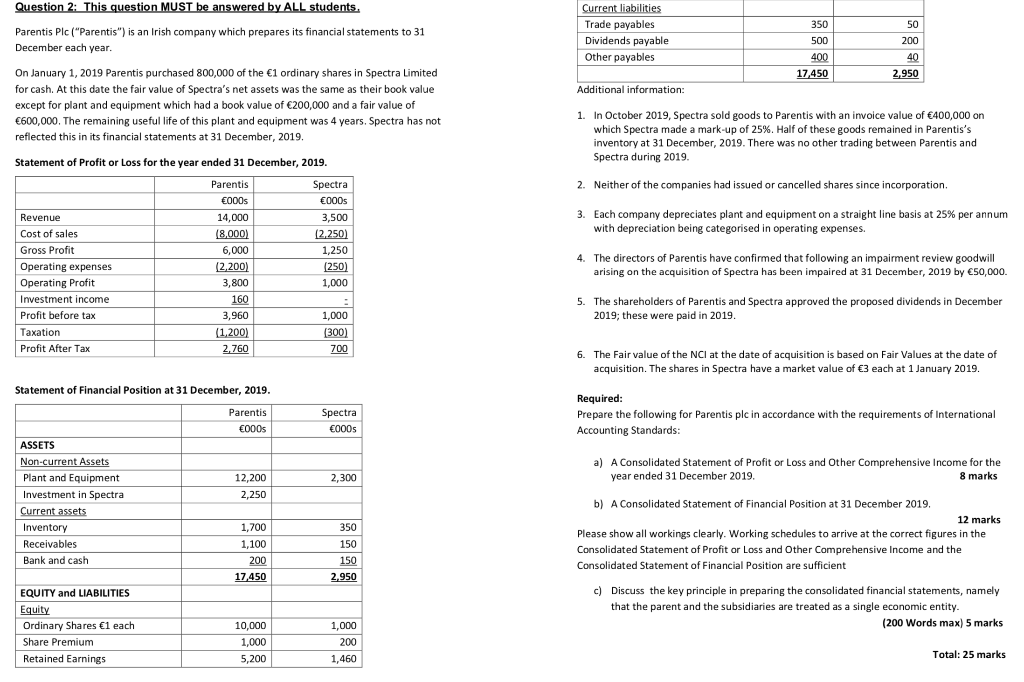

Question 2: This question MUST be answered by ALL students. Current liabilities Trade payables Dividends payable Other payables 350 500 400 17,450 50 200 40 2.950 Parentis Plc ("Parentis") is an Irish company which prepares its financial statements to 31 December each year. On January 1, 2019 Parentis purchased 800,000 of the 1 ordinary shares in Spectra Limited for cash. At this date the fair value of Spectra's net assets was the same as their book value except for plant and equipment which had a book value of 200,000 and a fair value of 600,000. The remaining useful life of this plant and equipment was 4 years. Spectra has not reflected this in its financial statements at 31 December, 2019. Additional information: 1. In October 2019, Spectra sold goods to Parentis with an invoice value of 400,000 on which Spectra made a mark-up of 25%. Half of these goods remained in Parentis's inventory at 31 December, 2019. There was no other trading between Parentis and Spectra during 2019. 2. Neither of the companies had issued or cancelled shares since incorporation, 3. Each company depreciates plant and equipment on a straight line basis at 25% per annum with depreciation being categorised in operating expenses. Statement of Profit or Loss for the year ended 31 December, 2019. Parentis Spectra 000s 000s Revenue 14,000 3,500 Cost of sales (8,000) (2.250) Gross Profit 6,000 1,250 Operating expenses (2,200) (250) Operating Profit 3,800 1,000 Investment income 160 Profit before tax 3,960 1,000 Taxation (1,200 (300) Profit After Tax 2.760 700 4. The directors of Parentis have confirmed that following an impairment review goodwill arising on the acquisition of Spectra has been impaired at 31 December, 2019 by 50,000. 5. The shareholders of Parentis and Spectra approved the proposed dividends in December 2019; these were paid in 2019. 6. The Fair value of the NCI at the date of acquisition is based on Fair Values at the date of acquisition. The shares in Spectra have a market value of 3 each at 1 January 2019. Statement of Financial Position at 31 December, 2019. Parentis 000s Spectra 000s Required: Prepare the following for Parentis plc in accordance with the requirements of International Accounting Standards: : a) A lidated Statement of Profit or Loss and Other Comprehensive Income for year ended 31 December 2019. 2,300 8 marks 12,200 2,250 ASSETS Non-current Assets Plant and Equipment Investment in Spectra Current assets Inventory Receivables Bank and cash 350 1,700 1,100 200 17,450 b) A Consolidated Statement of Financial Position at 31 December 2019, 12 marks Please show all workings clearly. Working schedules to arrive at the correct figures in the Consolidated Statement of Profit or Loss and Other Comprehensive Income and the Consolidated Statement of Financial Position are sufficient 150 150 2.950 EQUITY and LIABILITIES Equity Ordinary Shares 1 each Share Premium Retained Earnings c) Discuss the key principle in preparing the consolidated financial statements, namely that the parent and the subsidiaries are treated as a single economic entity. (200 Words max) 5 marks 10,000 1,000 5,200 1,000 200 1,460 Total: 25 marks Question 2: This question MUST be answered by ALL students. Current liabilities Trade payables Dividends payable Other payables 350 500 400 17,450 50 200 40 2.950 Parentis Plc ("Parentis") is an Irish company which prepares its financial statements to 31 December each year. On January 1, 2019 Parentis purchased 800,000 of the 1 ordinary shares in Spectra Limited for cash. At this date the fair value of Spectra's net assets was the same as their book value except for plant and equipment which had a book value of 200,000 and a fair value of 600,000. The remaining useful life of this plant and equipment was 4 years. Spectra has not reflected this in its financial statements at 31 December, 2019. Additional information: 1. In October 2019, Spectra sold goods to Parentis with an invoice value of 400,000 on which Spectra made a mark-up of 25%. Half of these goods remained in Parentis's inventory at 31 December, 2019. There was no other trading between Parentis and Spectra during 2019. 2. Neither of the companies had issued or cancelled shares since incorporation, 3. Each company depreciates plant and equipment on a straight line basis at 25% per annum with depreciation being categorised in operating expenses. Statement of Profit or Loss for the year ended 31 December, 2019. Parentis Spectra 000s 000s Revenue 14,000 3,500 Cost of sales (8,000) (2.250) Gross Profit 6,000 1,250 Operating expenses (2,200) (250) Operating Profit 3,800 1,000 Investment income 160 Profit before tax 3,960 1,000 Taxation (1,200 (300) Profit After Tax 2.760 700 4. The directors of Parentis have confirmed that following an impairment review goodwill arising on the acquisition of Spectra has been impaired at 31 December, 2019 by 50,000. 5. The shareholders of Parentis and Spectra approved the proposed dividends in December 2019; these were paid in 2019. 6. The Fair value of the NCI at the date of acquisition is based on Fair Values at the date of acquisition. The shares in Spectra have a market value of 3 each at 1 January 2019. Statement of Financial Position at 31 December, 2019. Parentis 000s Spectra 000s Required: Prepare the following for Parentis plc in accordance with the requirements of International Accounting Standards: : a) A lidated Statement of Profit or Loss and Other Comprehensive Income for year ended 31 December 2019. 2,300 8 marks 12,200 2,250 ASSETS Non-current Assets Plant and Equipment Investment in Spectra Current assets Inventory Receivables Bank and cash 350 1,700 1,100 200 17,450 b) A Consolidated Statement of Financial Position at 31 December 2019, 12 marks Please show all workings clearly. Working schedules to arrive at the correct figures in the Consolidated Statement of Profit or Loss and Other Comprehensive Income and the Consolidated Statement of Financial Position are sufficient 150 150 2.950 EQUITY and LIABILITIES Equity Ordinary Shares 1 each Share Premium Retained Earnings c) Discuss the key principle in preparing the consolidated financial statements, namely that the parent and the subsidiaries are treated as a single economic entity. (200 Words max) 5 marks 10,000 1,000 5,200 1,000 200 1,460 Total: 25 marks