Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Tinpot Resources (TR), an all-equity firm, is considering purchasing the rights to operate an iron ore mine in the Pilbara region of Western

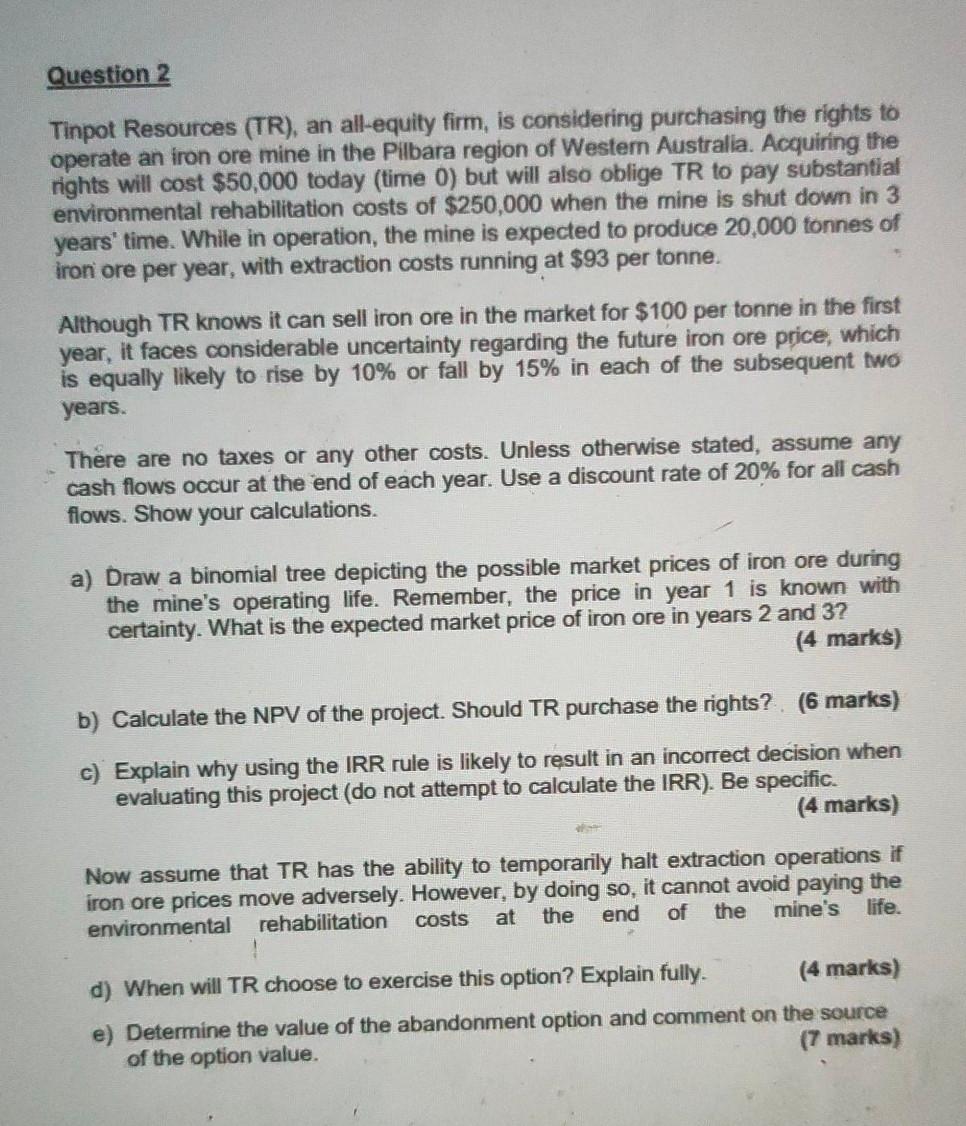

Question 2 Tinpot Resources (TR), an all-equity firm, is considering purchasing the rights to operate an iron ore mine in the Pilbara region of Western Australia. Acquiring the rights will cost $50,000 today (time 0) but will also oblige TR to pay substantial environmental rehabilitation costs of $250,000 when the mine is shut down in 3 years' time. While in operation, the mine is expected to produce 20.000 tonnes of iron ore per year, with extraction costs running at $93 per tonne. Although TR knows it can sell iron ore in the market for $100 per tonne in the first year, it faces considerable uncertainty regarding the future iron ore price, which is equally likely to rise by 10% or fall by 15% in each of the subsequent two years. There are no taxes or any other costs. Unless otherwise stated, assume any cash flows occur at the end of each year. Use a discount rate of 20% for all cash flows. Show your calculations. a) Draw a binomial tree depicting the possible market prices of iron ore during the mine's operating life. Remember, the price in year 1 is known with certainty. What is the expected market price of iron ore in years 2 and 3? (4 marks) b) Calculate the NPV of the project. Should TR purchase the rights?. (6 marks) c) Explain why using the IRR rule is likely to result in an incorrect decision when evaluating this project (do not attempt to calculate the IRR). Be specific. (4 marks) Now assume that TR has the ability to temporarily halt extraction operations if iron ore prices move adversely. However, by doing so, it cannot avoid paying the environmental rehabilitation costs at the end of the mine's life. ! d) When will TR choose to exercise this option? Explain fully. (4 marks) e) Determine the value of the abandonment option and comment on the source of the option value. (7 marks) Question 2 Tinpot Resources (TR), an all-equity firm, is considering purchasing the rights to operate an iron ore mine in the Pilbara region of Western Australia. Acquiring the rights will cost $50,000 today (time 0) but will also oblige TR to pay substantial environmental rehabilitation costs of $250,000 when the mine is shut down in 3 years' time. While in operation, the mine is expected to produce 20.000 tonnes of iron ore per year, with extraction costs running at $93 per tonne. Although TR knows it can sell iron ore in the market for $100 per tonne in the first year, it faces considerable uncertainty regarding the future iron ore price, which is equally likely to rise by 10% or fall by 15% in each of the subsequent two years. There are no taxes or any other costs. Unless otherwise stated, assume any cash flows occur at the end of each year. Use a discount rate of 20% for all cash flows. Show your calculations. a) Draw a binomial tree depicting the possible market prices of iron ore during the mine's operating life. Remember, the price in year 1 is known with certainty. What is the expected market price of iron ore in years 2 and 3? (4 marks) b) Calculate the NPV of the project. Should TR purchase the rights?. (6 marks) c) Explain why using the IRR rule is likely to result in an incorrect decision when evaluating this project (do not attempt to calculate the IRR). Be specific. (4 marks) Now assume that TR has the ability to temporarily halt extraction operations if iron ore prices move adversely. However, by doing so, it cannot avoid paying the environmental rehabilitation costs at the end of the mine's life. ! d) When will TR choose to exercise this option? Explain fully. (4 marks) e) Determine the value of the abandonment option and comment on the source of the option value. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started