Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: To measure profitability managers may use the following ratios: ROA, ROC, and ROE. Discuss these returns and what they measure. Do you

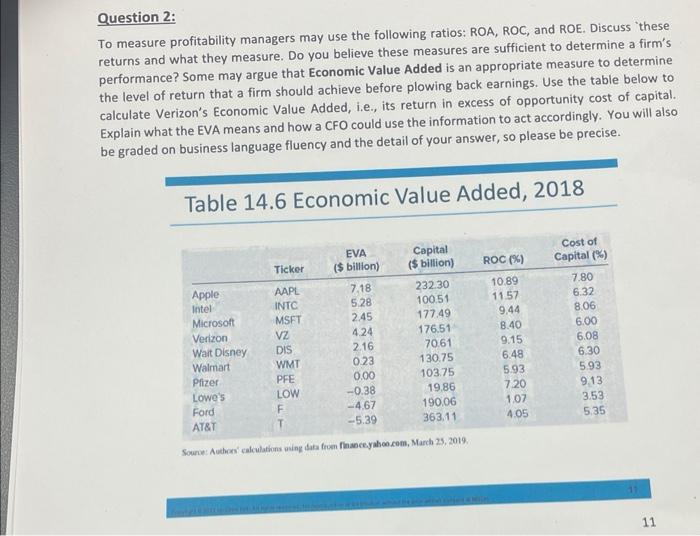

Question 2: To measure profitability managers may use the following ratios: ROA, ROC, and ROE. Discuss these returns and what they measure. Do you believe these measures are sufficient to determine a firm's performance? Some may argue that Economic Value Added is an appropriate measure to determine the level of return that a firm should achieve before plowing back earnings. Use the table below to calculate Verizon's Economic Value Added, i.e., its return in excess of opportunity cost of capital. Explain what the EVA means and how a CFO could use the information to act accordingly. You will also be graded on business language fluency and the detail of your answer, so please be precise. Table 14.6 Economic Value Added, 2018 EVA Ticker ($ billion) Capital ($ billion) ROC (%) Cost of Capital (%) Apple AAPL 7.18 232.30 10.89 7.80 Intel INTC 5.28 100.51 11.57 6.32 Microsoft MSFT 2.45 177.49 9.44 8.06 Verizon VZ 4.24 176.51 8.40 6.00 Walt Disney DIS 2.16 70.61 9.15 6.08 Walmart WMT 0.23 130.75 6.48 6.30 Pfizera PFE 0.00 103.75 5.93 5.93 Lowe's LOW -0.38 19.86 7.20 9.13 Ford F -4.67 190.06 1.07 3.53 AT&T T -5.39 363.11 4.05 5.35 Source: Authors' calculations using data from finance.yahoo.com, March 25, 2019. 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started