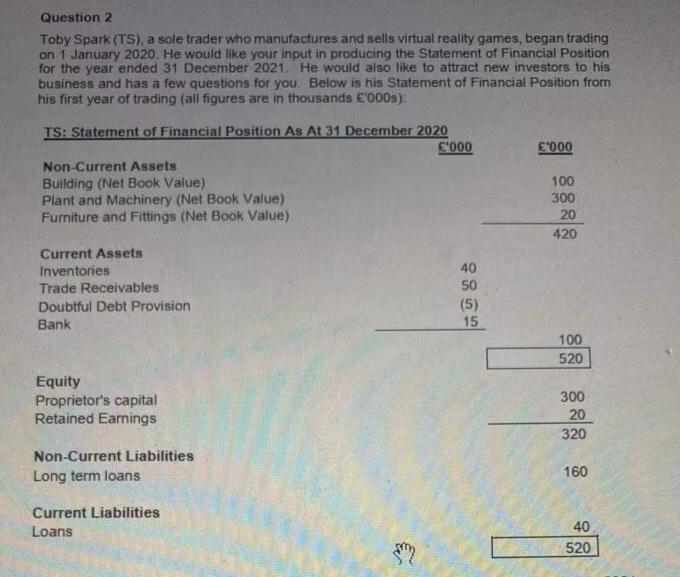

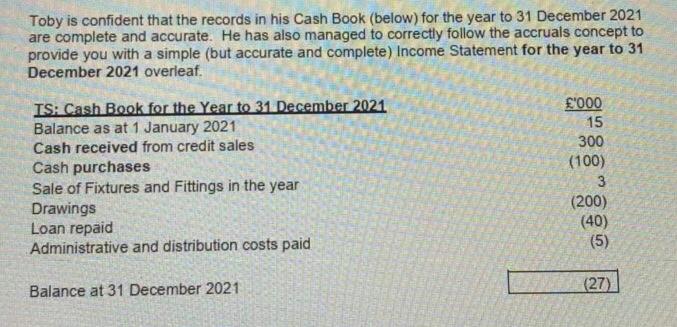

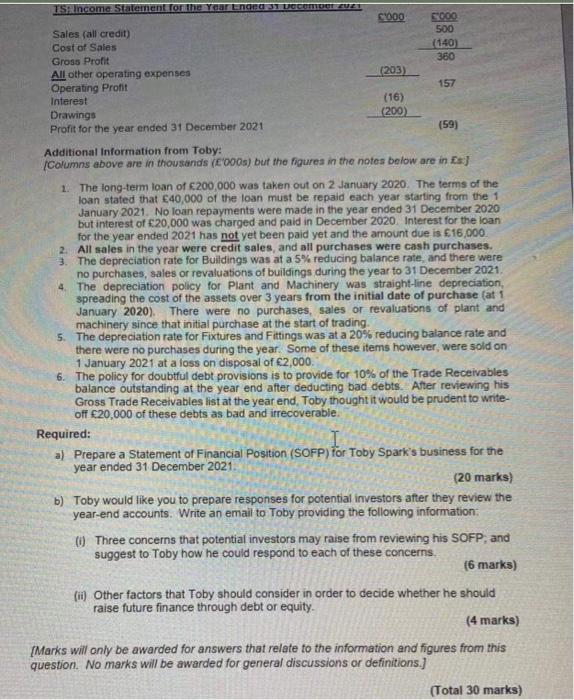

Question 2 Toby Spark (TS), a sole trader who manufactures and sells virtual reality games, began trading on 1 January 2020. He would like your input in producing the Statement of Financial Position for the year ended 31 December 2021. He would also like to attract new investors to his business and has a few questions for you. Below is his Statement of Financial Position from his first year of trading (all figures are in thousands '000s) f'000 TS: Statement of Financial Position As At 31 December 2020 E'000 Non-Current Assets Building (Net Book Value) Plant and Machinery (Net Book Value) Furniture and Fittings (Net Book Value) 100 300 20 420 Current Assets Inventories Trade Receivables Doubtful Debt Provision Bank 40 50 (5) 15 100 520 Equity Proprietor's capital Retained Earnings 300 20 320 Non-Current Liabilities Long term loans 160 Current Liabilities Loans 40 520 Toby is confident that the records in his Cash Book (below) for the year to 31 December 2021 are complete and accurate. He has also managed to correctly follow the accruals concept to provide you with a simple (but accurate and complete) Income Statement for the year to 31 December 2021 overleaf. IS. Cash Book for the Year to 31 December 2021 Balance as at 1 January 2021 Cash received from credit sales Cash purchases Sale of Fixtures and Fittings in the year Drawings Loan repaid Administrative and distribution costs paid '000 15 300 (100) 3 (200) (40) (5) Balance at 31 December 2021 (27) DOCOMOTEUE1 TSAIncome Statement for the Year Lnong 000 5000 Sales (all credit) 500 Cost of Sales (140) Gross Profit 360 All other operating expenses (203) Operating Profit 157 Interest (16) Drawings (200) Profit for the year ended 31 December 2021 (59) Additional Information from Toby: Columns above are in thousands (E000s) but the figures in the notes below are in Es:) 1. The long-term loan of 200,000 was taken out on 2 January 2020. The terms of the loan stated that 40,000 of the loan must be repaid each year starting from the 1 January 2021. No loan repayments were made in the year ended 31 December 2020 but interest of 20,000 was charged and paid in December 2020. Interest for the loan for the year ended 2021 has not yet been paid yet and the amount due is 16,000 2. All sales in the year were credit sales, and all purchases were cash purchases. 3. The depreciation rate for Buildings was at a 5% reducing balance rate, and there were no purchases, sales or revaluations of buildings during the year to 31 December 2021, 4. The depreciation policy for Plant and Machinery was straight-line depreciation, spreading the cost of the assets over 3 years from the initial date of purchase (at 1 January 2020). There were no purchases, sales or revaluations of plant and machinery since that initial purchase at the start of trading. 5. The depreciation rate for Fixtures and Fittings was at a 20% reducing balance rate and there were no purchases during the year. Some of these items however, were sold on 1 January 2021 at a loss on disposal of 2,000. 6. The policy for doubtful debt provisions is to provide for 10% of the Trade Receivables balance outstanding at the year end after deducting bad debts. After reviewing his Gross Trade Receivables list at the year end, Toby thought it would be prudent to write- off 20,000 of these debts as bad and irrecoverable. Required: a) Prepare a statement of Financial Position (SOFP) for Toby Spark's business for the year ended 31 December 2021. (20 marks) b) Toby would like you to prepare responses for potential investors after they review the year-end accounts. Write an email to Toby providing the following information: Three concerns that potential investors may raise from reviewing his SOFP, and suggest to Toby how he could respond to each of these concerns. (6 marks) (ii) Other factors that Toby should consider in order to decide whether he should raise future finance through debt or equity. (4 marks) Marks will only be awarded for answers that relate to the information and figures from this question. No marks will be awarded for general discussions or definitions.) (Total 30 marks)