Answered step by step

Verified Expert Solution

Question

1 Approved Answer

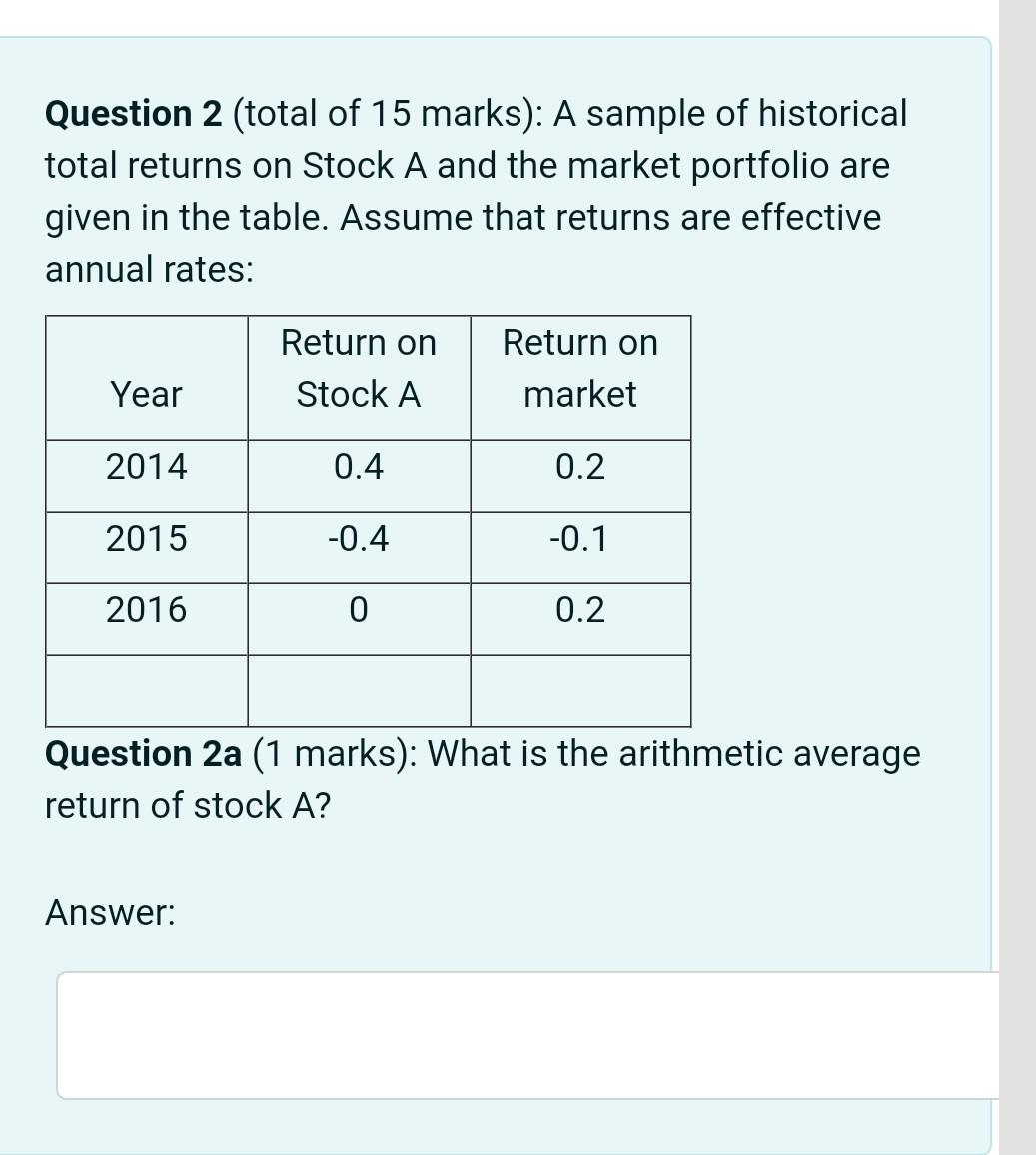

Question 2 (total of 15 marks): A sample of historical total returns on Stock A and the market portfolio are given in the table. Assume

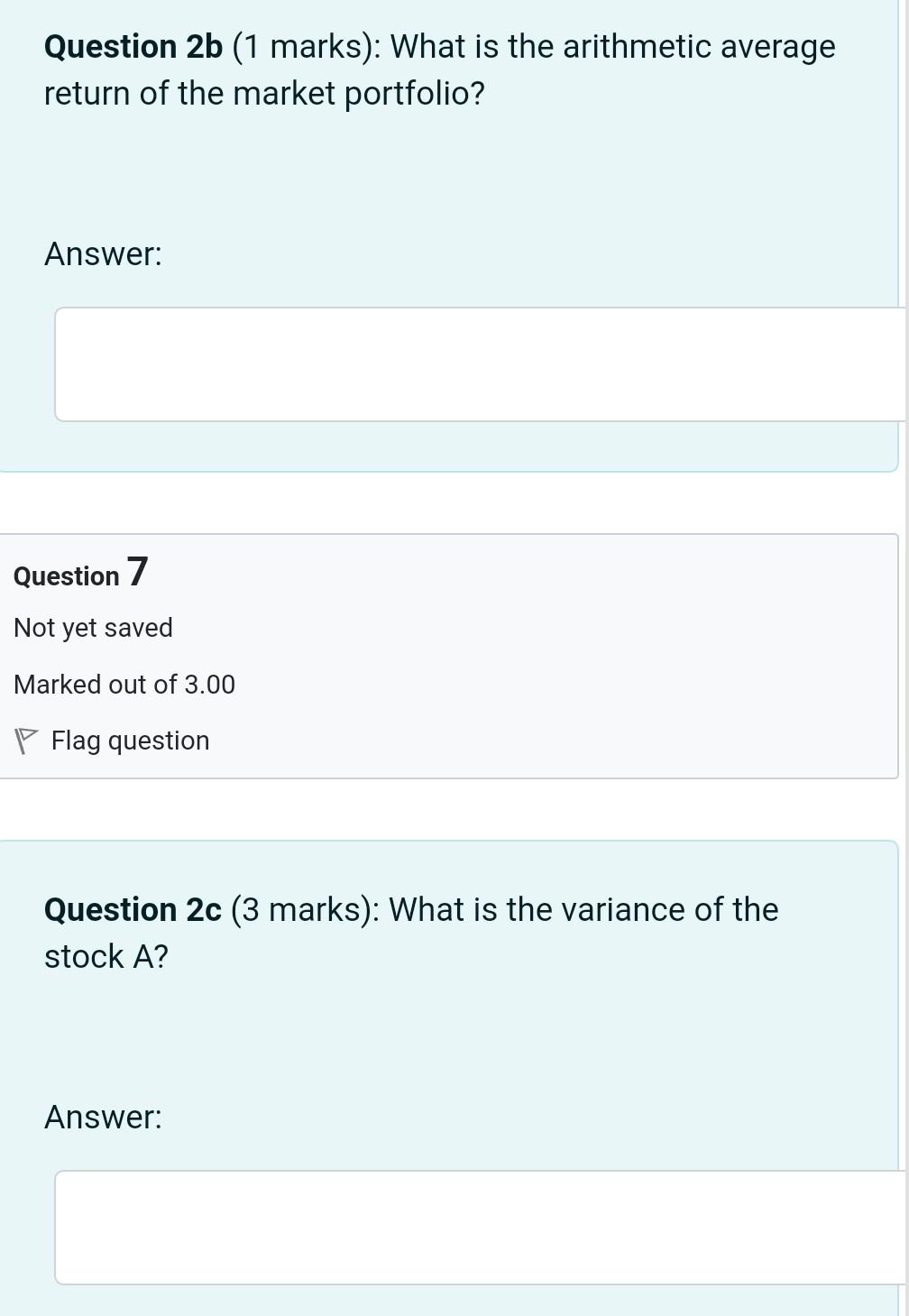

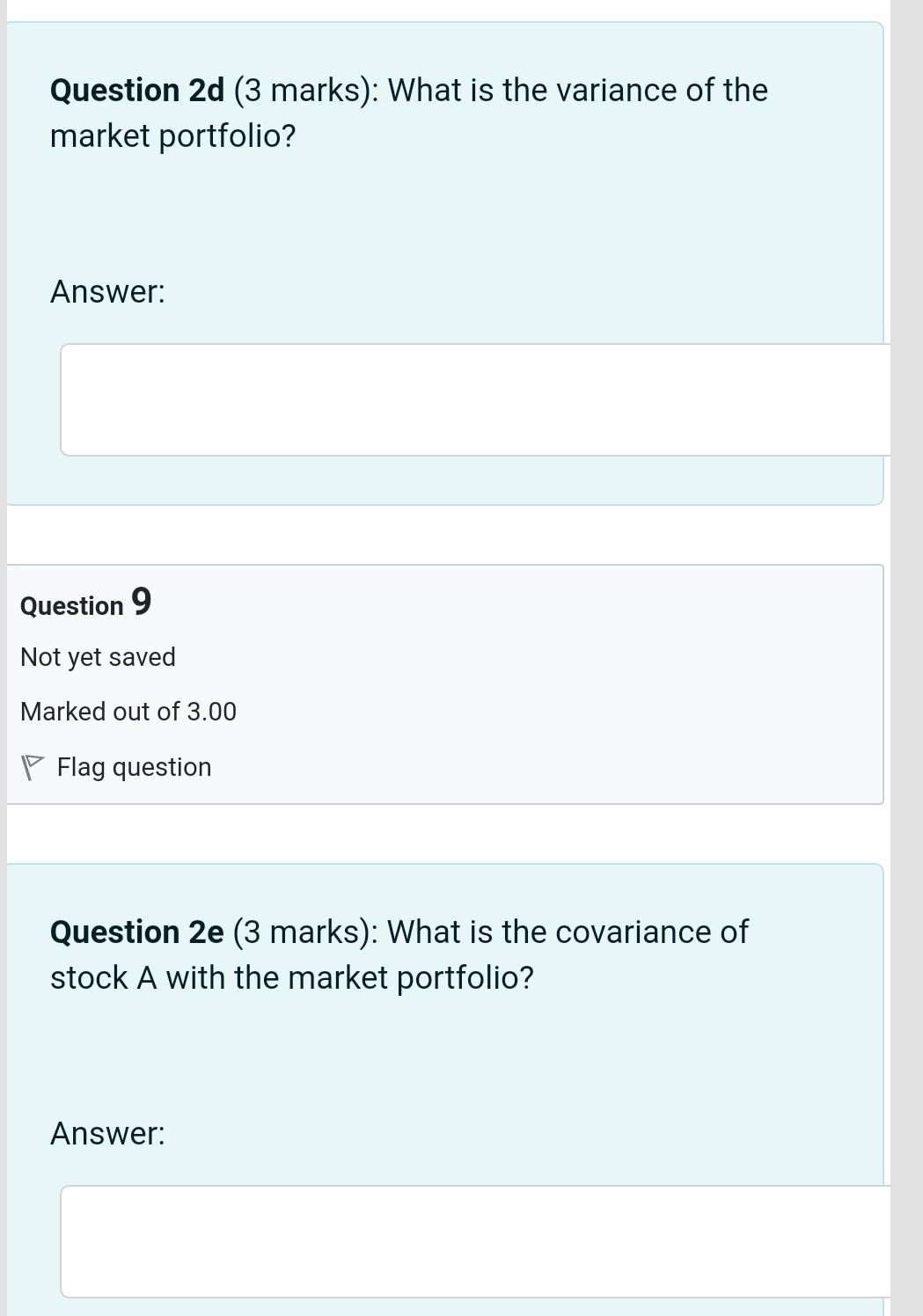

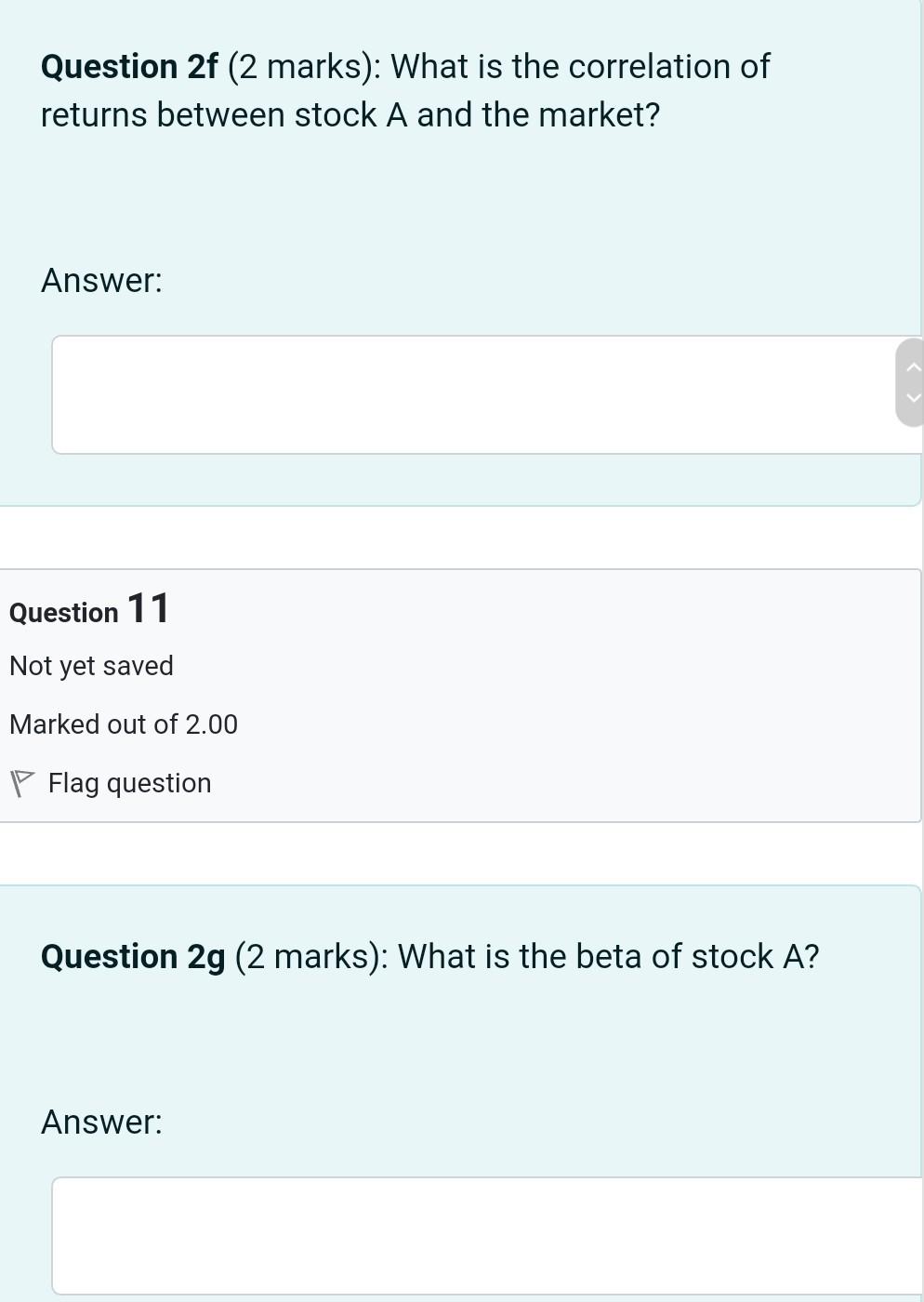

Question 2 (total of 15 marks): A sample of historical total returns on Stock A and the market portfolio are given in the table. Assume that returns are effective annual rates: Return on Stock A Return on market Year 2014 0.4 0.2 2015 -0.4 -0.1 2016 0 0.2 Question 2a (1 marks): What is the arithmetic average return of stock A? Answer: Question 2b (1 marks): What is the arithmetic average return of the market portfolio? Answer: Question 7 Not yet saved Marked out of 3.00 P Flag question Question 2c (3 marks): What is the variance of the stock A? Answer: Question 2d (3 marks): What is the variance of the market portfolio? Answer: Question 9 Not yet saved Marked out of 3.00 P Flag ion Question 2e (3 marks): What is the covariance of stock A with the market portfolio? Answer: Question 2f (2 marks): What is the correlation of returns between stock A and the market? Answer: Question 11 Not yet saved Marked out of 2.00 P Flag question Question 2g (2 marks): What is the beta of stock A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started