Answered step by step

Verified Expert Solution

Question

1 Approved Answer

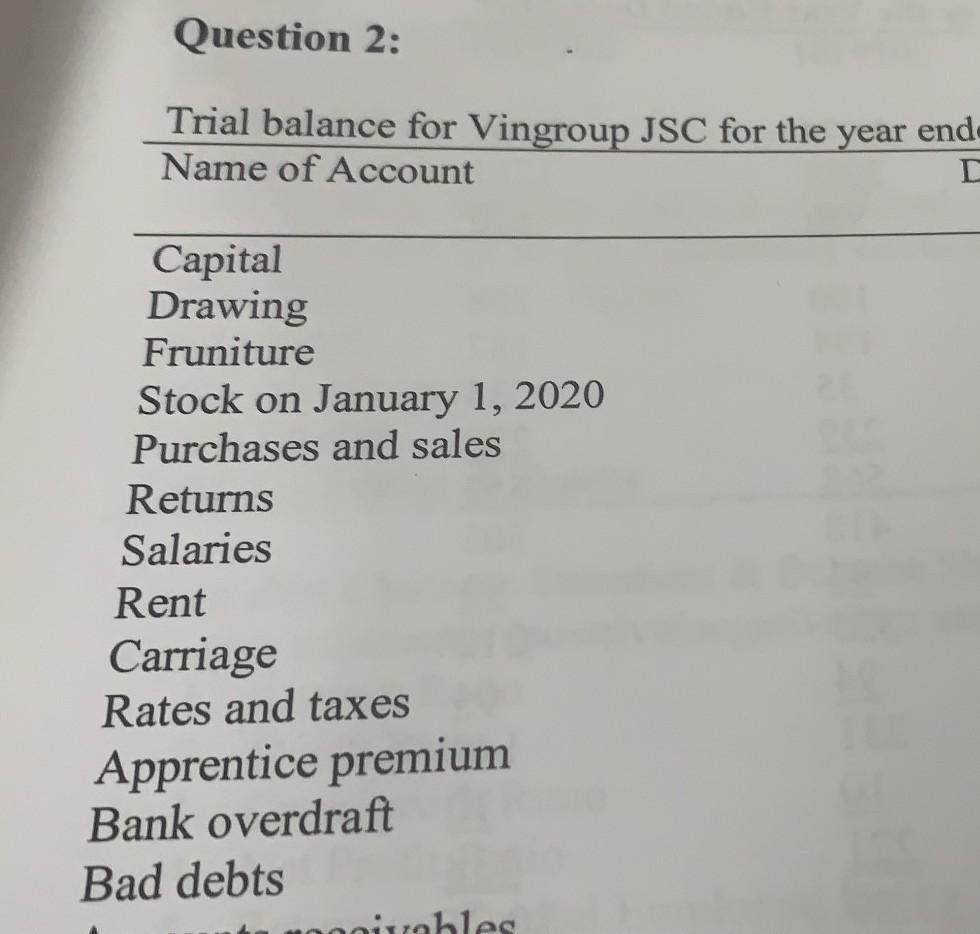

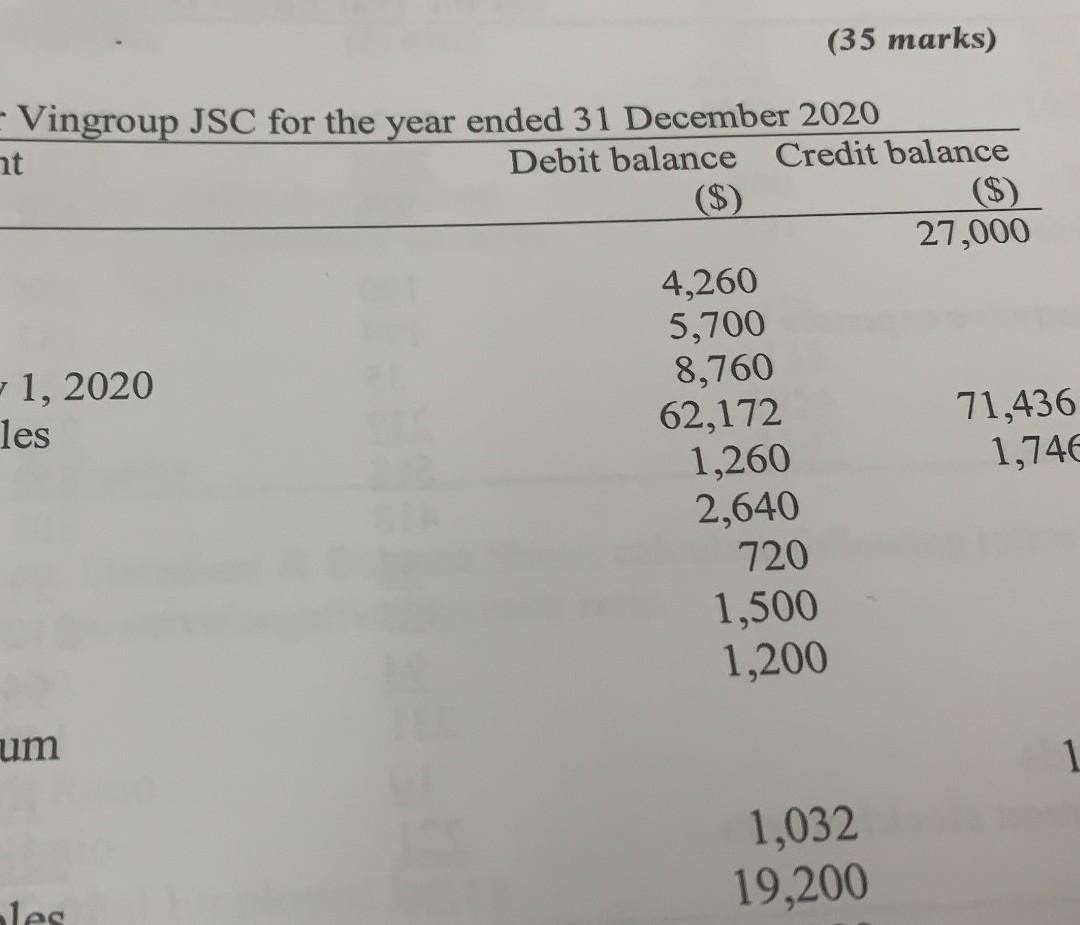

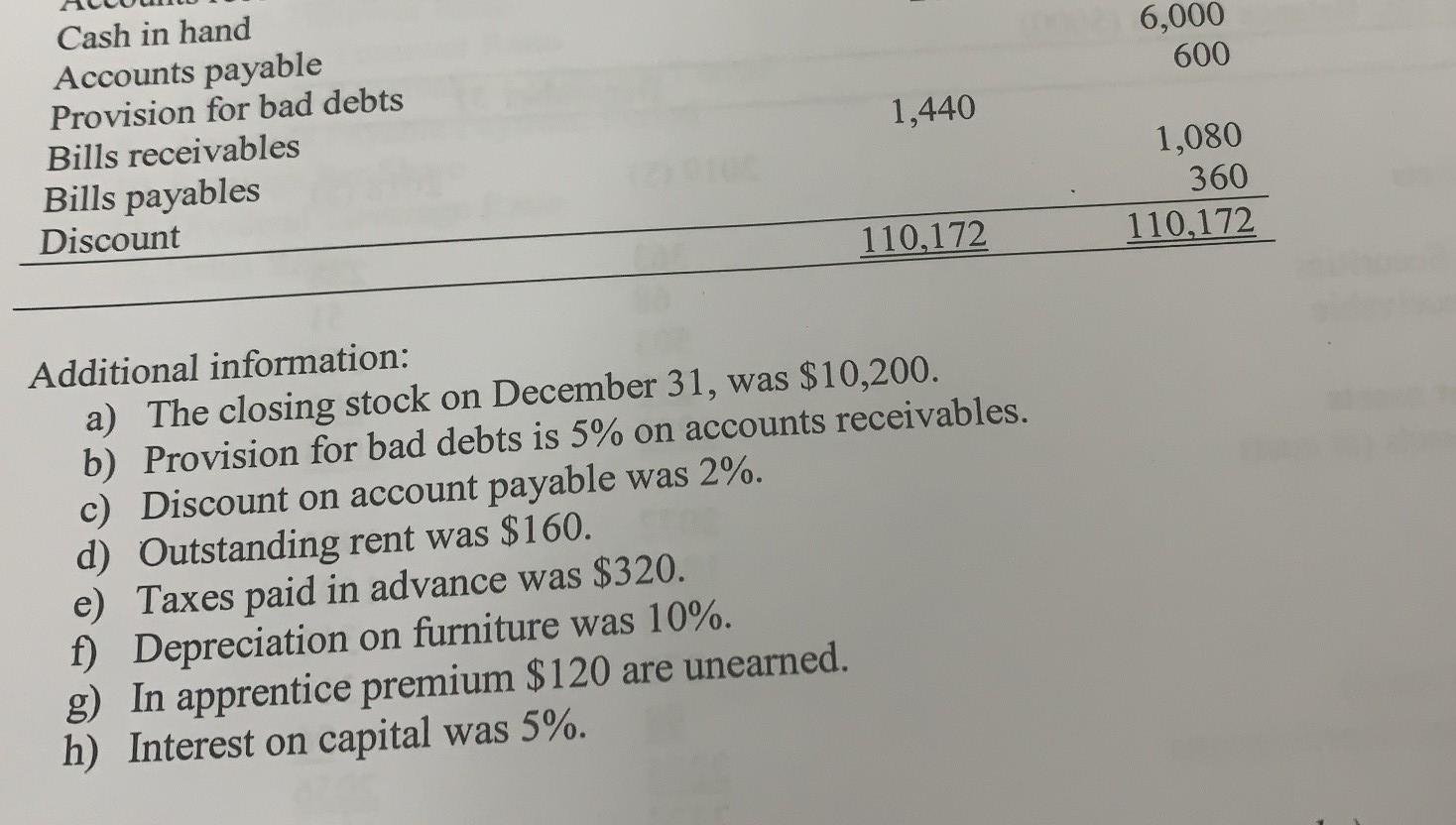

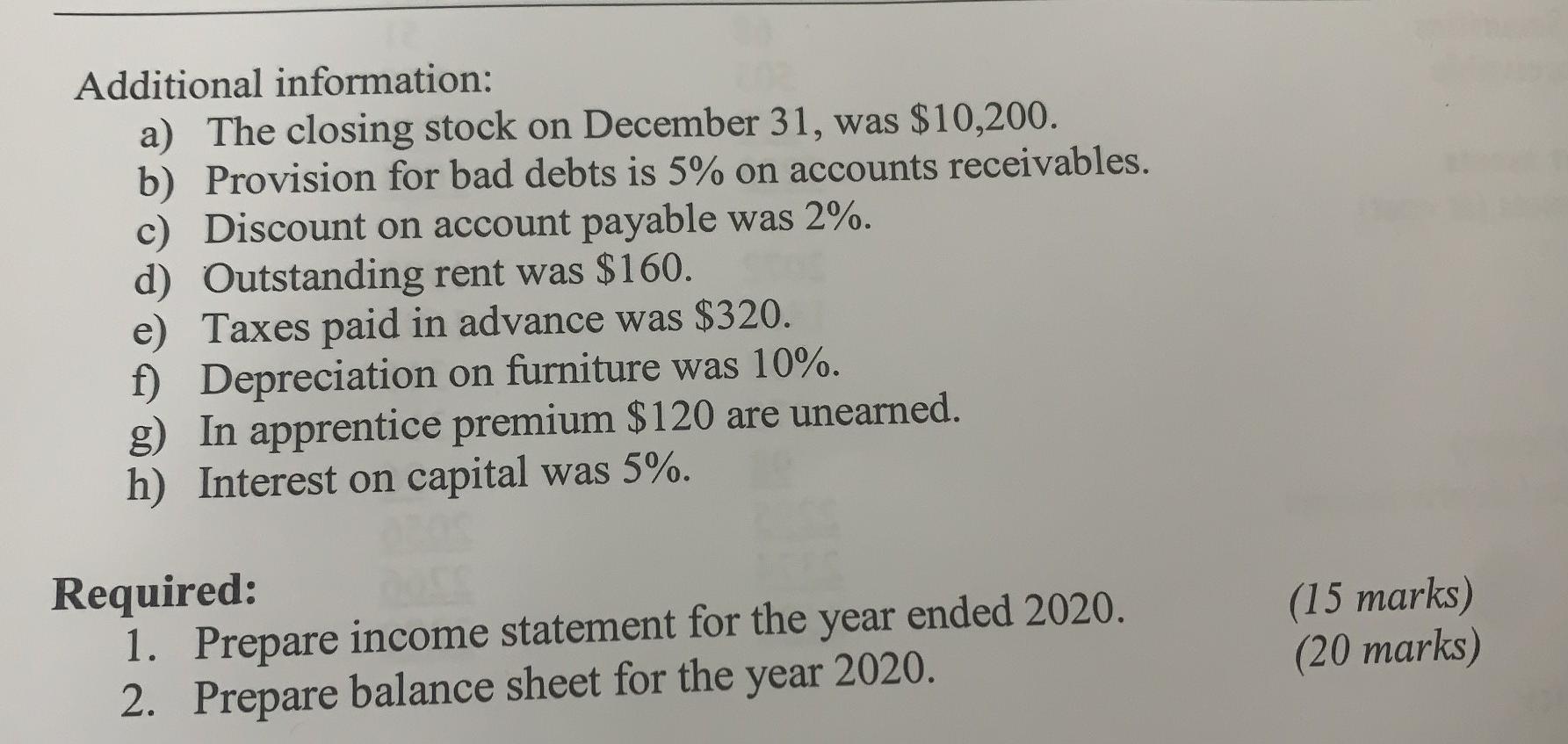

Question 2: Trial balance for Vingroup JSC for the year ende Name of Account I Capital Drawing Fruniture Stock on January 1, 2020 Purchases and

Question 2: Trial balance for Vingroup JSC for the year ende Name of Account I Capital Drawing Fruniture Stock on January 1, 2020 Purchases and sales Returns Salaries Rent Carriage Rates and taxes Apprentice premium Bank overdraft Bad debts ables (35 marks) - Vingroup JSC for the year ended 31 December 2020 at Debit balance Credit balance ($) ($) 27,000 4,260 5,700 -1, 2020 8,760 les 62,172 71,436 1,260 1,74 2,640 720 1,500 1,200 um 1 1,032 les 19,200 6,000 600 1,440 Cash in hand Accounts payable Provision for bad debts Bills receivables Bills payables Discount 1,080 360 110,172 110,172 Additional information: a) The closing stock on December 31, was $10,200. b) Provision for bad debts is 5% on accounts receivables. c) Discount on account payable was 2%. d) Outstanding rent was $160. e) Taxes paid in advance was $320. f) Depreciation on furniture was 10%. g) In apprentice premium $120 are unearned. h) Interest on capital was 5%. Additional information: a) The closing stock on December 31, was $10,200. b) Provision for bad debts is 5% on accounts receivables. c) Discount on account payable was 2%. d) Outstanding rent was $160. e) Taxes paid in advance was $320. f) Depreciation on furniture was 10%. g) In apprentice premium $120 are unearned. h) Interest on capital was 5%. Required: 1. Prepare income statement for the year ended 2020. 2. Prepare balance sheet for the year 2020. (15 marks) (20 marks) Question 2: Trial balance for Vingroup JSC for the year ende Name of Account I Capital Drawing Fruniture Stock on January 1, 2020 Purchases and sales Returns Salaries Rent Carriage Rates and taxes Apprentice premium Bank overdraft Bad debts ables (35 marks) - Vingroup JSC for the year ended 31 December 2020 at Debit balance Credit balance ($) ($) 27,000 4,260 5,700 -1, 2020 8,760 les 62,172 71,436 1,260 1,74 2,640 720 1,500 1,200 um 1 1,032 les 19,200 6,000 600 1,440 Cash in hand Accounts payable Provision for bad debts Bills receivables Bills payables Discount 1,080 360 110,172 110,172 Additional information: a) The closing stock on December 31, was $10,200. b) Provision for bad debts is 5% on accounts receivables. c) Discount on account payable was 2%. d) Outstanding rent was $160. e) Taxes paid in advance was $320. f) Depreciation on furniture was 10%. g) In apprentice premium $120 are unearned. h) Interest on capital was 5%. Additional information: a) The closing stock on December 31, was $10,200. b) Provision for bad debts is 5% on accounts receivables. c) Discount on account payable was 2%. d) Outstanding rent was $160. e) Taxes paid in advance was $320. f) Depreciation on furniture was 10%. g) In apprentice premium $120 are unearned. h) Interest on capital was 5%. Required: 1. Prepare income statement for the year ended 2020. 2. Prepare balance sheet for the year 2020. (15 marks) (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started