Answered step by step

Verified Expert Solution

Question

1 Approved Answer

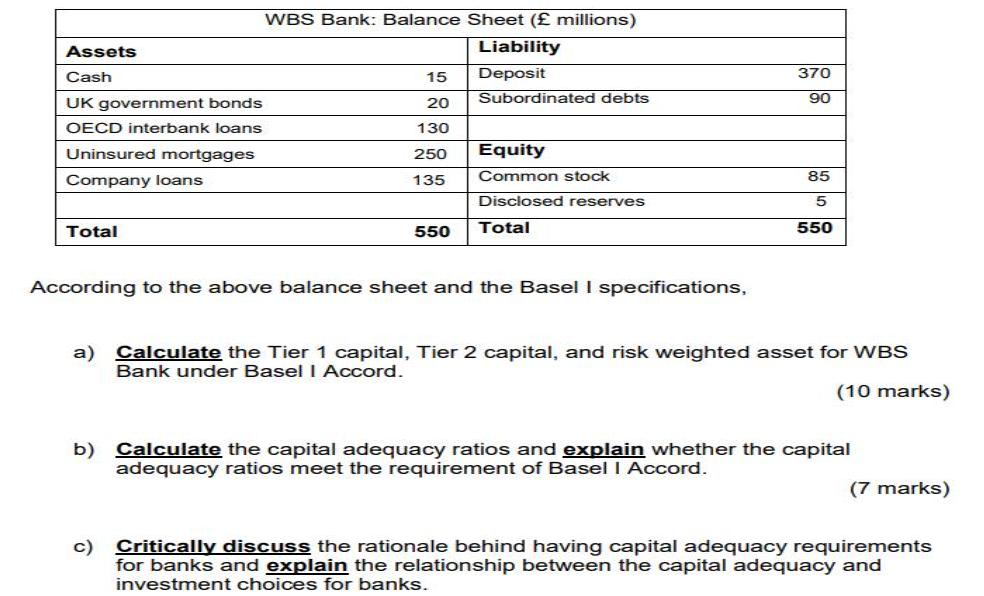

WBS Bank: Balance Sheet ( millions) Assets Liability Cash 15 Deposit 370 Subordinated debts 90 UK government bonds 20 OECD interbank loans 130 Uninsured

WBS Bank: Balance Sheet ( millions) Assets Liability Cash 15 Deposit 370 Subordinated debts 90 UK government bonds 20 OECD interbank loans 130 Uninsured mortgages Equity 250 Common stock 85 Company loans 135 Disclosed reserves Total 550 Total 550 According to the above balance sheet and the Basel I specifications, a) Calculate the Tier 1 capital, Tier 2 capital, and risk weighted asset for WBS Bank under Basel I Accord. (10 marks) b) Calculate the capital adequacy ratios and explain whether the capital adequacy ratios meet the requirement of Basel I Accord. (7 marks) c) Critically discuss the rationale behind having capital adequacy requirements for banks and explain the relationship between the capital adequacy and investment choices for banks.

Step by Step Solution

★★★★★

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

CAR 4380 As per BaselI accord CAR should be 8 since this bank holds ratio of 4380 it meets the requi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started