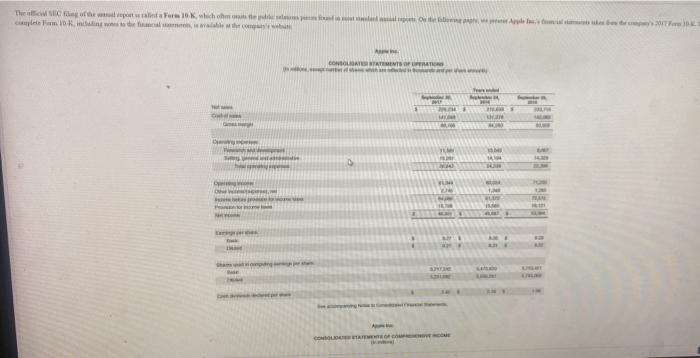

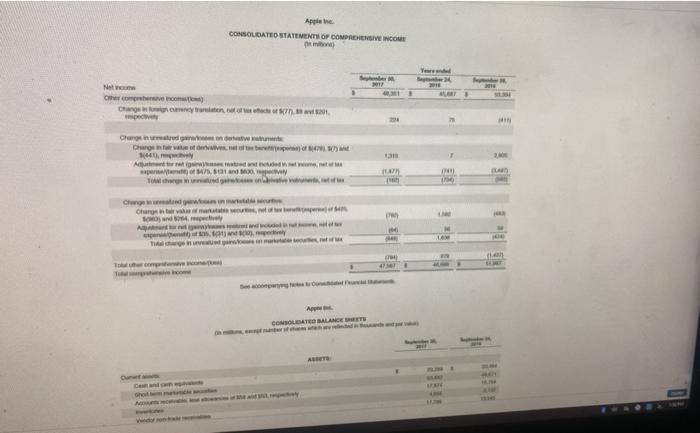

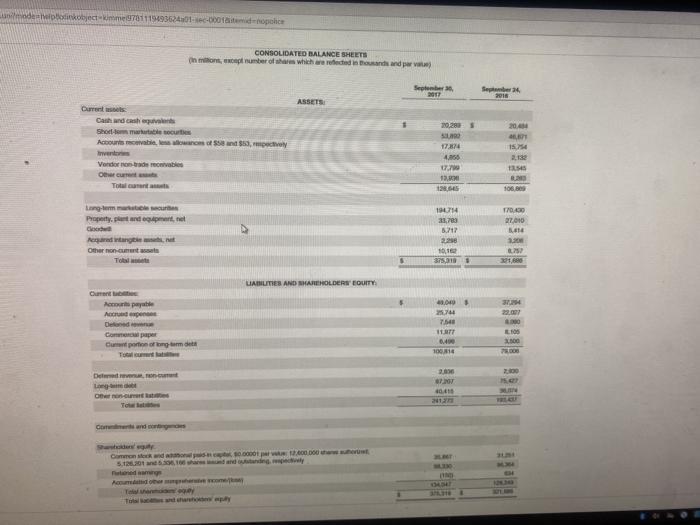

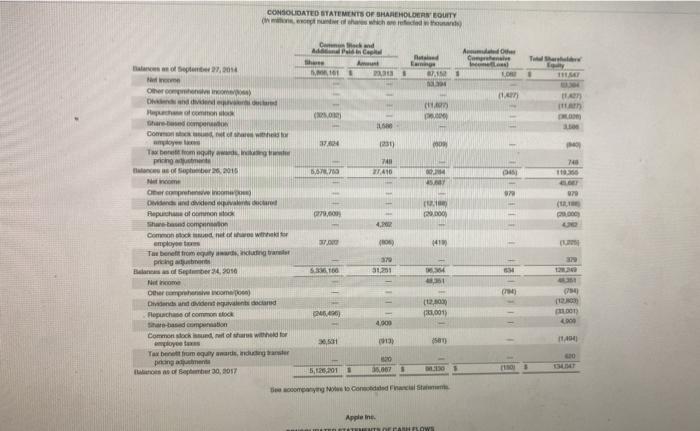

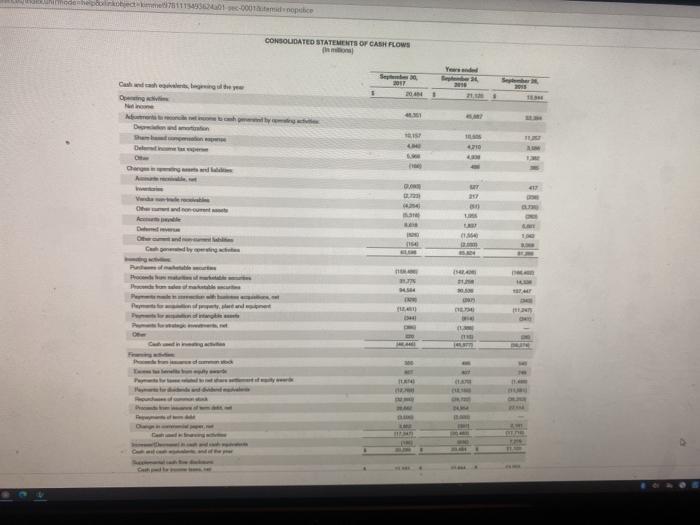

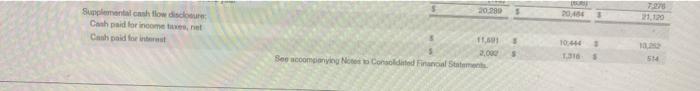

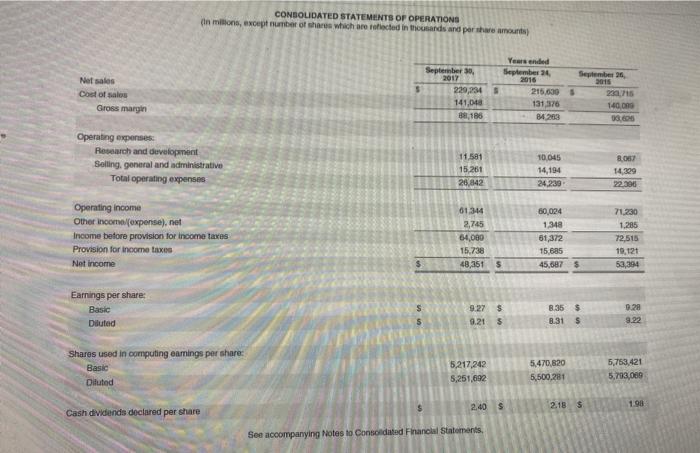

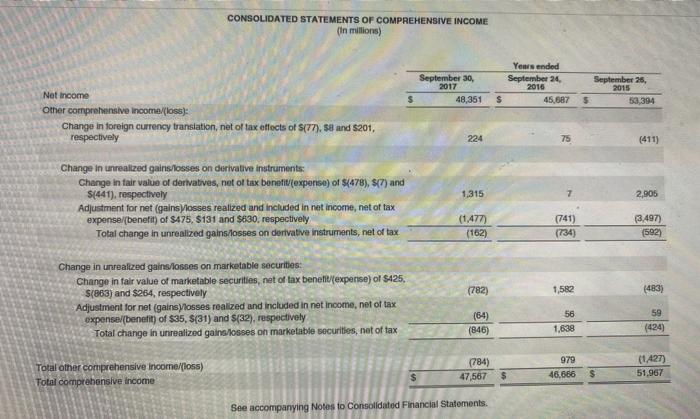

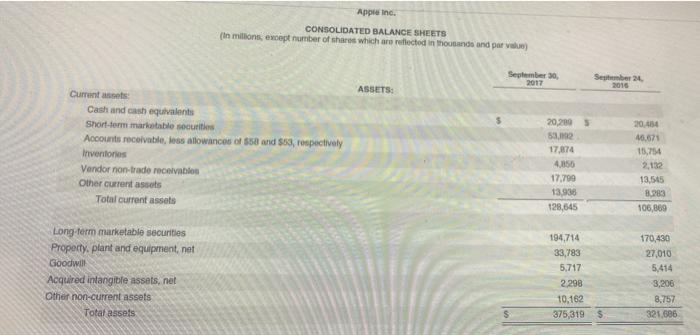

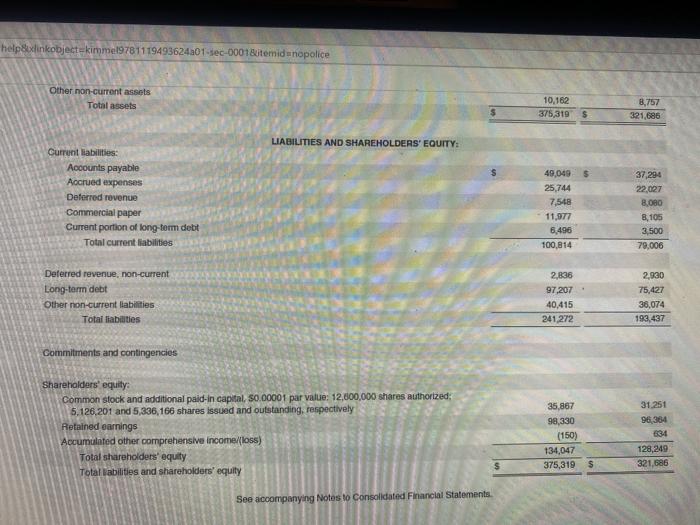

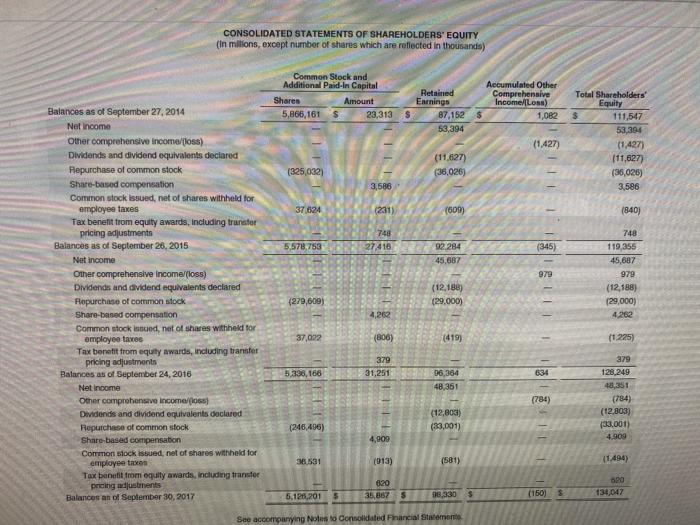

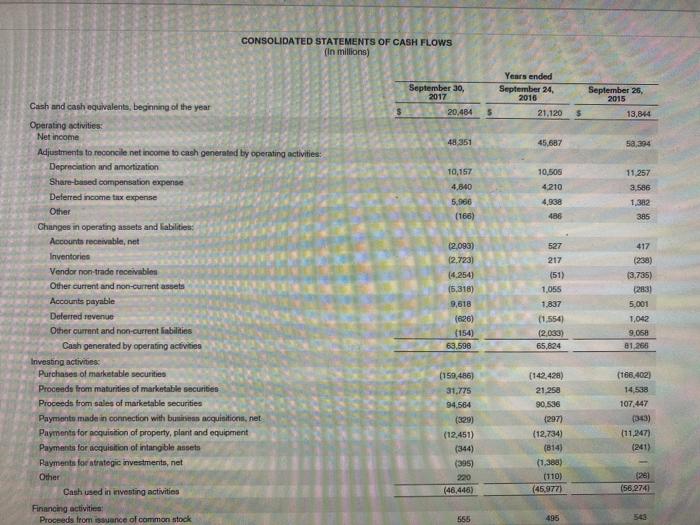

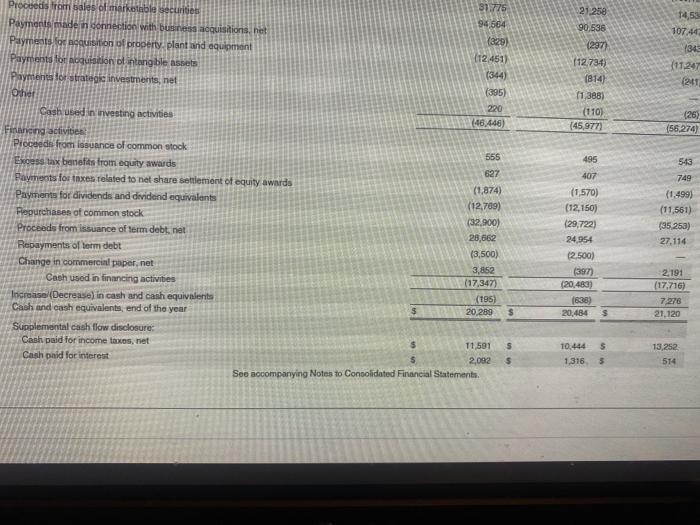

Question 2 What was Apple's largest current asset, largest current liability, and largest item under sat September 30, 20177 (Enter amounts in o) The financial statements of Apple are presented in Appendix A Click here to view Appendix Amount cld millions) Largest current asset Largest current liability Largest item under other assets The Color 10k, which heute camion w wallet AI CONSOLAT To Aprile CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Yere covercom Change raten, Chungen, 11. Artist BIC w und SOMOS phy CONSOLIDATO BALANCE ET objectme970711949362401-600ftopic CONSOLIDATED BALANCE SHEETS in ons, optuber of shares which are reflected in this and per September TT S. 2015 ASSETS 20.00 Durres Cash and cash Shombo Aboucles of $53, trente Vendor o movie Other current 15.754 29.288 SLAR 17.874 4,06 17. 13. 12. 1354 106.800 Kung-term ches Property and opene T.CO 27.010 19014 21,700 3.212 2020 101 3751 10 Regarding Other monument To LADIES AND SHAREHOLDERS BOUTY Current Actor paytle Arden De Copper portofotom To com 40.00 . 7.540 11. 0400 1001 LOS 100 2.000 Delen L Once To 21 Cannanore and many tons Come and .000.000 Ty CONSOLIDATED STATEMENTS OF SHAREHOLDER EOLITY month which reflected Coco Am Com th sep,2014 11 . DHE 11 1. ten . Other com Dhund Photo Share on Comowe (2 DO US 704 130 740 748 27,410 587 . 97 ( 0779,600 DOO MI Tabem prising of Sale 2016 Nincome CercoIncome Dodards and dividende Papuchinox Shado Common now employees Tae benefit from ang pricing Ben Selber 24, 2010 Nutcome Other comprome) Didends and vident card Flouch of common como Common stock und als with loyees Tax bent from emas, pang os of Babe 30, 2017 30 31201 38.00 6 35 754 12. (12.09 17,001 26.490) 4000 0 30.01 (13) 1580 11 0 5,125,2018 35.000 150 No Coded Facial Apple in PASOWE c71113495.000 opice CONSOLIDATED STATEMENTS OF CASH FLOWS This 2018 Cashda, begewing the Opg 2017 20 TEN ST 4710 Cheng med 412 251 1424 . W 10 Pue Hoe om w w - 20.280 720 2010 Supplemental cash flow disclosure Cash paid for income Cash paid for it 11. 3.000 See accompanying Noro Consolidated Financial Statement 10:40 1316 $ SH CONSOLIDATED STATEMENTS OF OPERATIONS (in Millions, exceptumber of shares which are relected in thousands and pershare amounts Net sales Cost of sales Gross margin September 30, 2017 229,234 141.00 8186 Years ended September 2016 215.000 131,376 84263 September 26 2018 230.715 140,00 Operating expenses Research and development Soling, general and administrative Total operating expenses 11 581 15,261 26,842 10.045 14,194 24,239 8.07 14 309 22.300 Operating income Other income (expense). net Income before provision for income taxes Provision for income taxes Net income 61344 2,745 64,000 15,738 48,351 S 80,024 1,348 61,372 15.685 45,587 $ 71.230 1,285 72,515 19,121 53,394 Earnings per share Basic Diluted $ 9:27 9.21 8,35$ 8.31 $ 9.28 9.22 $ Shares used in computing eamings per share Basic Diluted 5,217,242 5,251,692 5,470,820 5,500,281 5,753.421 5,703,089 2.40 $ 2.18 $ 1.981 Cash dividends declared per share See accompanying Notes to Consordited Financial Statements, Apple Inc. CONSOLIDATED BALANCE SHEETS (to millions, except number of shares which are relected in thousands and pur) September 30, 2017 Sember 24 2015 ASSETS: Current Cash and cash equivalents Short-term maktable securities Accounts receivable, les allowances of $50 and SSS, respectively Inventories Vendor non-trade reconbon Other current assets Total current assets 20,2805 53, 17,874 4,856 17,790 13,936 128,645 20.454 46,073 15,754 2,132 13,545 3.383 106,800 Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other non-current assets Total assets 194,714 33,783 5,717 2.298 10.162 375,319 170,430 27,010 5,414 3,206 8.757 321.686 helpixlinkobjecte kimme19781119493624201-sec-0001&itemidu nopolice Other non-current assets Total assets 10,162 375,319 $ 8,757 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities 49,049 25,744 7,548 11,977 6.490 100,814 37,294 22,027 8,080 8,105 3.500 79,006 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2,836 97,207 40,415 241,272 2.930 75,427 36,074 193,437 Commitments and contingencies Shareholders' equity Common stock and additional paid in capital. SO 00001 par value: 12,000,000 shares authorized: 5.126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/loss) Total shareholders' equity Total abilities and shareholders' equity 35,867 98,330 (150) 134,047 375,319 31.251 96,364 634 128,249 321,686 $ See accompanying Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in milions, except number of shares which are reflected in thousands) Common Stock and Additional Paid-In Capital Shares Amount 5,866,161 $ 23,313 Total Shareholders' Equity $ $ Accumulated Other Retained Comprehensive Enrnings Income/[Loss) 87,152 $ 1,082 53,394 (1,427) (11,627) (36,026) 111,547 53,394 (1,427) (11,827) (36,026) 3,586 (325,032) 3,586 37,624 (231) (600) (840) 748 27,410 5,578,753 (345) 92284 45,687 979 Balances as of September 27, 2014 Net Income Other comprehensive income/loss) Dividends and dividend equivalents deciared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances as of September 26, 2015 Net income Other comprehensive Income (oss) Dividends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances as of September 24, 2016 Net income Other comprehensive Income (6) Dividends and dividend equivalents declared Repurchase of common stock Share-based compensation Common stock issued, net of shares withheld for employee taxes Tax benefit from equity awards, including transfer pricing adjustments Balances an of September 30, 2017 748 119,055 45,687 979 (12.188) (29,000 4262 (12,188) (29,000) (279,609) 4,262 37,092 (806) (419) (1 225) 379 379 31,251 5.336,166 634 96,364 48,351 (784) 128,249 43,351 (784) (12,803) (33,001) 4.909 (12,803) (33,001) (246,406) 4,900 36.531 (913) (581) 11.494) 820 020 5,126,201 5 35,887 S 16,330 $ (150) 134,047 See accompanying Notes to consolidated Financial Statements CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) September 30, 2017 20.484 Years ended September 24, 2016 September 26, 2015 13,844 5 21,120 $ 48 351 45.687 58,394 11.257 10,167 4,840 10,505 4210 4,938 486 3.586 1.382 5.986 (166) 385 417 527 217 Cash and cash equivalents, beginning of the year Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense Other Changes in operating assets and abilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payment made in connection with buis acquisitions.net Payments for nequisition of property, plant and equipment Payments for acquisition of intangible assets Rayments for strategic investments, net Other Cash used in investing activities Financing activities: Proceeds from issuance of common stock (2.090) (2,723) 14.254) (6,318) 9,618 (626) (154) 63,598 (51) 1,055 1.837 (1.554 (2.033) 65,824 (238) (3,735) (283) 5.001 1,042 9.058 81.266 (159,486) 31.775 94.564 (329) (12.451) (344) (395) 220 (46.446) (142.428) 21 258 90.536 (2977 (12,734) (814) (1.388) (110) (45,977) (166.4021 14,538 107.447 (303) (11,2471 (241) (259 (56.274) 555 495 21.258 90,536 1297 14,53 107.44 (343 (11.247 1241 112.734) (814) 11,388) (110) (45,977) (26) (56274) 495 543 407 Proceeds ratibles al marketable securites 31.775 Payments made in connection with business acquisitions, net 94664 Payments to acquisition of property, plant and equipment (12.451) Payments fotoquisition of intangible assets (344) Payments for strategic investments, net Other (395) 220 Cash used in investing activities (46.446) Financing activities Proceeds from issuance of common stock 555 Excess tax benefits from equity awards 627 Payments for taxes related to net share settlement of equity awards (1,874) Payments for dividends and dividend equivalents (12.709) Repurchases of common stock (32.900) Proceeds from issuance of term debt.net 28,662 Repayments of term debt (3,500) Change in commercial paper, net 3,852 Cash used in financing activities (17.347) Increase (Decrease in cash and cash equivalents (195) Cash and cash equivalents, end of the year 20.289 $ Supplemental cash flow disclosure: Cash paid for income taxes, net $ 11,591 5 Cash paid for interest 2.092 5 See accompanying Notes to Consolidated Financial Statements 749 (1.499) (11,561) (35.253) 27.114 (1570) (12, 1501 (29,722) 24 954 (2.500) (397) (20.483) (638 20.484 $ 2191 (17.716) 7276 21.120 $ 10.444 1.316 13,252 514 5