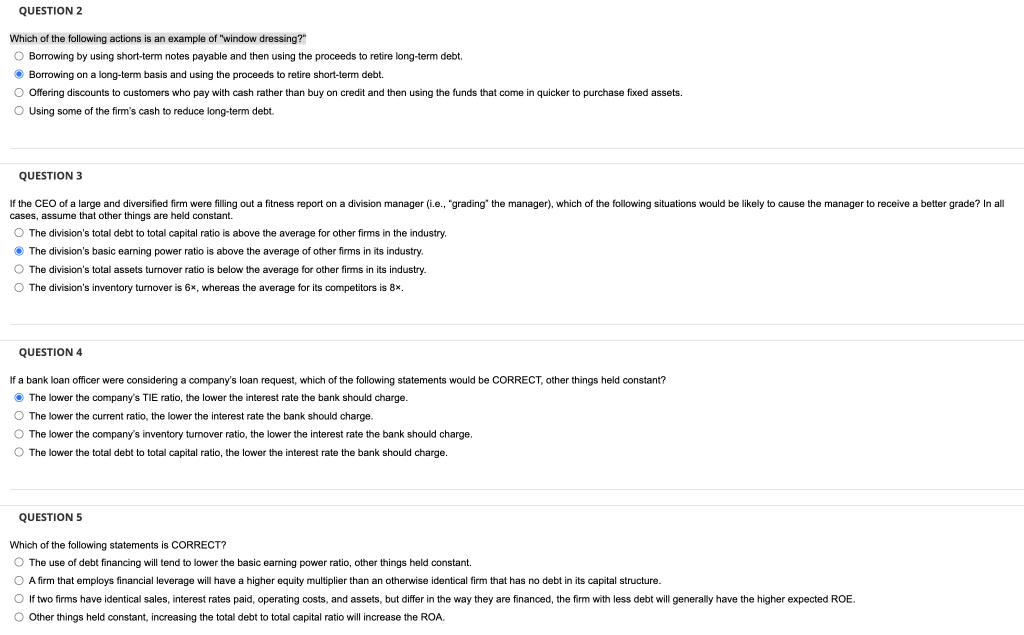

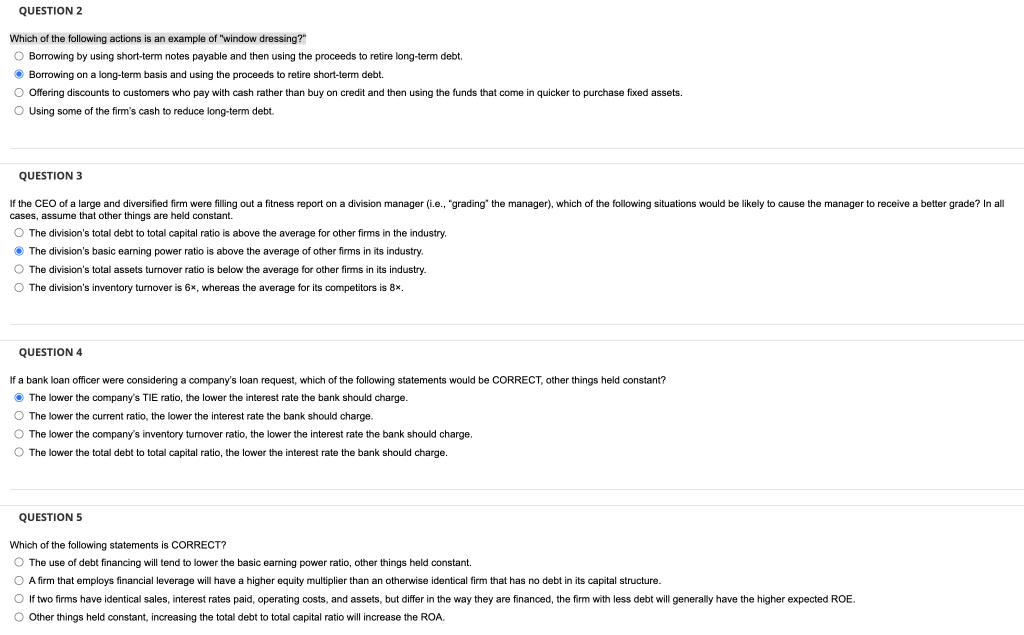

QUESTION 2 Which of the following actions is an example of "window dressing?" O Borrowing by using short-term notes payable and then using the proceeds to retire long-term debt. Borrowing on a long-term basis and using the proceeds retire short-term debt. O Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase fixed assets. Using some of the firm's cash to reduce long-term debt. QUESTION 3 If the CEO of a large and diversified firm were filling out a fitness report on a division manager (i.e., "grading the manager), which of the following situations would be likely to cause the manager to receive a better grade? In all cases, assume that other things are held constant. The division's total debt to total capital ratio is above the average for other firms in the industry. The division's basic earning power ratio is above the average of other firms in its industry. The division's total assets turnover ratio is below the average for other firms in its industry. The division's inventory turnover is 6x, whereas the average for its competitors is 8x. QUESTION 4 If a bank loan officer were considering a company's loan request, which of the following statements would be CORRECT, other things held constant? The lower the company's TIE ratio, the lower the interest rate the bank should charge. The lower the current ratio, the lower the interest rate the bank should charge. O The lower the company's inventory turnover ratio, the lower the interest rate the bank should charge. The lower the total debt to total capital ratio, the lower the interest rate the bank should charge. QUESTIONS Which of the following statements is CORRECT? The use of debt financing will tend to lower the basic earning power ratio, other things held constant. O A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure. O If two firms have identical sales, interest rates paid, operating costs, and assets, but differ in the way they are financed, the firm with less debt will generally have the higher expected ROE. Other things held constant, increasing the total debt to total capital ratio will increase the ROA