Answered step by step

Verified Expert Solution

Question

1 Approved Answer

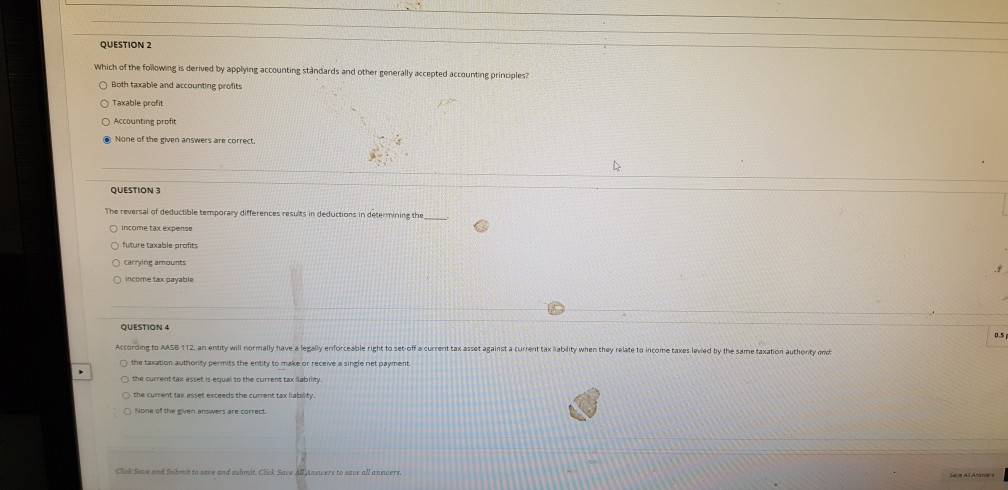

QUESTION 2 Which of the following is derived by applying accounting standards and other generally accepted accounting principles? Both taxable and accounting profits Taxable profit

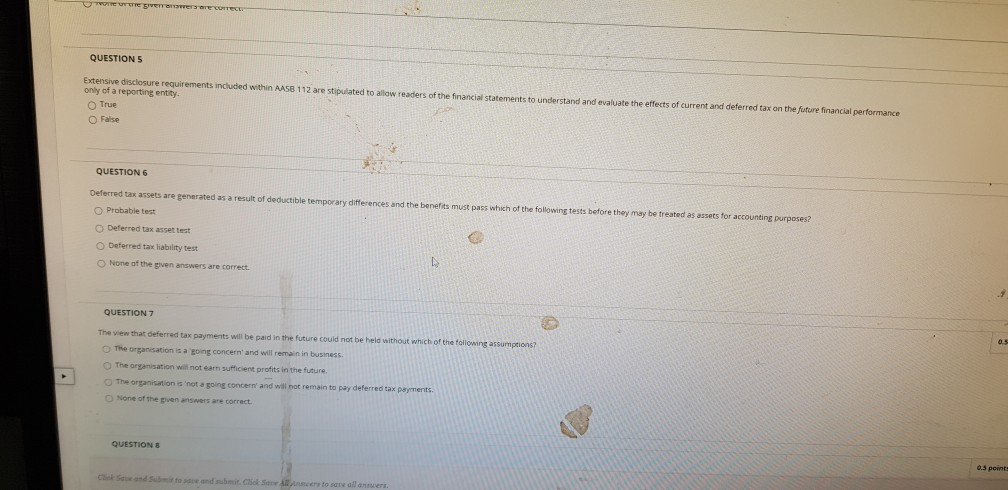

QUESTION 2 Which of the following is derived by applying accounting standards and other generally accepted accounting principles? Both taxable and accounting profits Taxable profit Accounting profit None of the given answers are correct. QUESTION 3 The reversal of deductible temporary differences results in deductions in determining the Income tax expense future taxable profits carrying amounts income tax payable 05 QUESTION 4 According to AASB 112. an entity will normally have a legally enforceable right to set-off a current tax asset against a current tax liability when they relate to income taxes loved by the same taxation authonty and the taxation authority permits the entity to make or receive a single net payment the current tax asset is equal to the current taxability the current tax asset exceeds the current tax liability None of the given answers are correct. Click Save and submit to me and submit Chick Save answers to sou all att MORE UT LITE SVETES TUTTE QUESTIONS Extensive disclosure requirements included within AASB 112 are stipulated to allow readers of the financial Statements to understand and evaluate the effects of current and deferred tax on the future financial performance only of a reporting entity. True False QUESTION 6 Deferred tax assets are generated as a result of deductible temporary differences and the benefits must pass which of the following tests before they may be treated as assets for accounting purposes? Probable test Deferred tax asset test Deferred tax liability test None of the given answers are correct QUESTION 7 os The view that deferred tax payments will be paid in the future could not be held without which of the following assumptions? The organisation is a 'going concern and will remain in business. The organisation will not earn sufficient profits in the future The organisation is not going concern' and will not remain to pay deferred tax payments. None of the ven answers are correct. QUESTIONS 0.5 point Cecond to and it seems to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started