Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: X. Corporation paid $200,000 cash for 40% of the voting common stock of Y. Inc. on January 1, 2019. The fair value/book

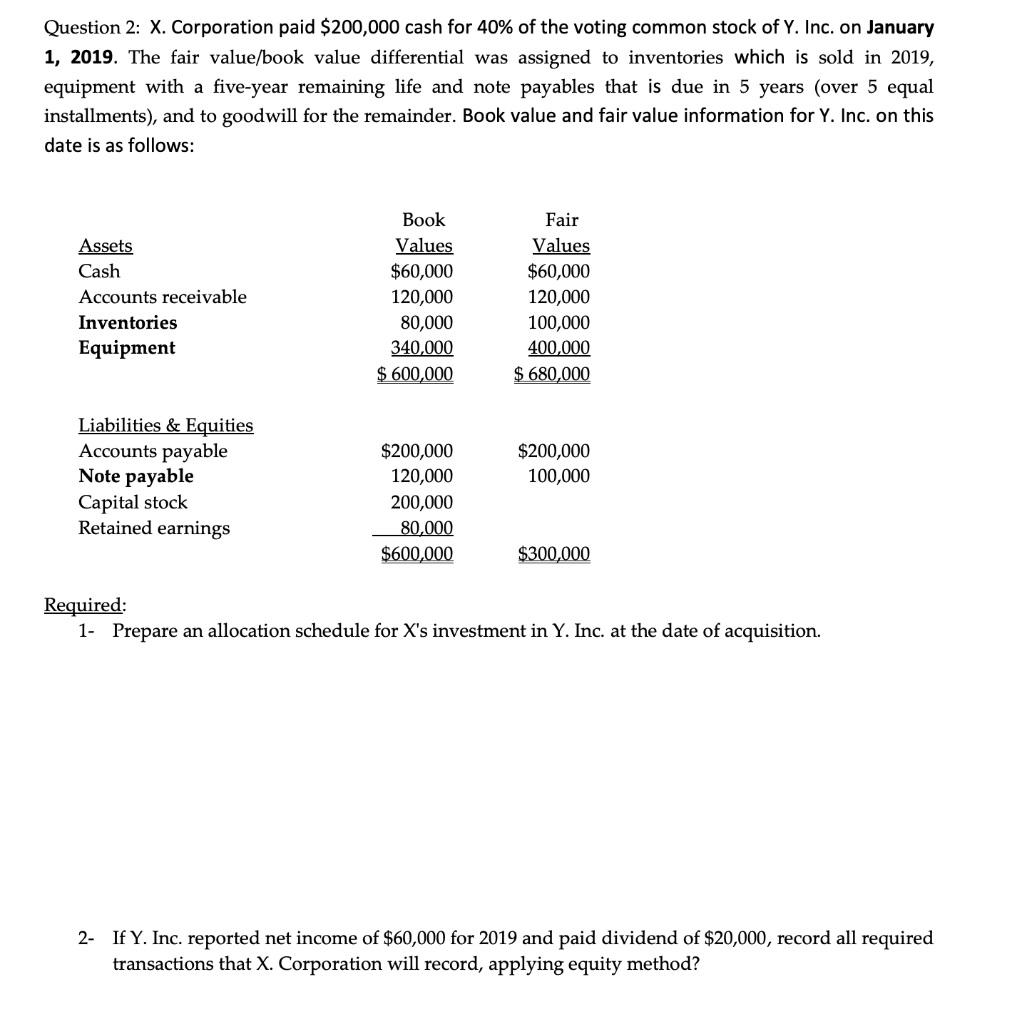

Question 2: X. Corporation paid $200,000 cash for 40% of the voting common stock of Y. Inc. on January 1, 2019. The fair value/book value differential was assigned to inventories which is sold in 2019, equipment with a five-year remaining life and note payables that is due in 5 years (over 5 equal installments), and to goodwill for the remainder. Book value and fair value information for Y. Inc. on this date is as follows: Book Fair Assets Values Values Cash $60,000 $60,000 Accounts receivable 120,000 120,000 Inventories 80,000 100,000 Equipment 340,000 400,000 $ 600,000 $ 680,000 Liabilities & Equities Accounts payable $200,000 $200,000 120,000 100,000 Note payable Capital stock 200,000 Retained earnings 80,000 $600,000 $300,000 Required: 1- Prepare an allocation schedule for X's investment in Y. Inc. at the date of acquisition. 2- If Y. Inc. reported net income of $60,000 for 2019 and paid dividend of $20,000, record all required transactions that X. Corporation will record, applying equity method?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Fair value of net assets Cash 60000 Accounts receivables 120000 inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started