Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 XYZ Berhad closes its accounts on 31 December annually. In January 2018, the company issued 25 million 4% redeemable preference shares at

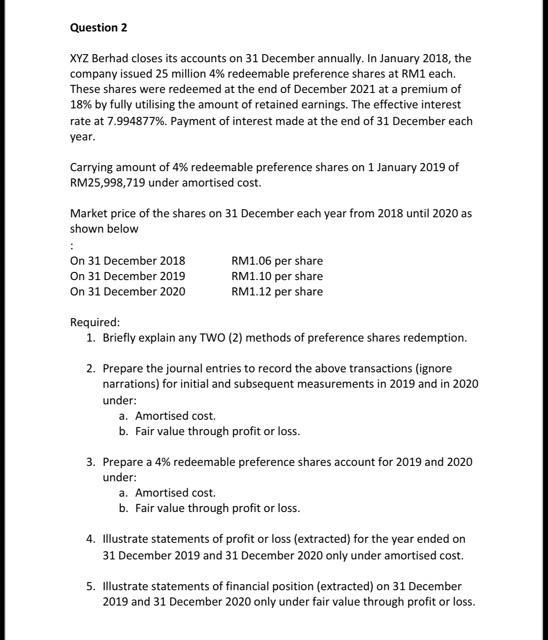

Question 2 XYZ Berhad closes its accounts on 31 December annually. In January 2018, the company issued 25 million 4% redeemable preference shares at RM1 each. These shares were redeemed at the end of December 2021 at a premium of 18% by fully utilising the amount of retained earnings. The effective interest rate at 7.994877%. Payment of interest made at the end of 31 December each year. Carrying amount of 4% redeemable preference shares on 1 January 2019 of RM25,998,719 under amortised cost. Market price of the shares on 31 December each year from 2018 until 2020 as shown below On 31 December 2018 On 31 December 2019 On 31 December 2020 RM1.06 per share RM1.10 per share RM1.12 per share Required: 1. Briefly explain any TWO (2) methods of preference shares redemption. 2. Prepare the journal entries to record the above transactions (ignore narrations) for initial and subsequent measurements in 2019 and in 2020 under: a. Amortised cost. b. Fair value through profit or loss. 3. Prepare a 4% redeemable preference shares account for 2019 and 2020 under: a. Amortised cost. b. Fair value through profit or loss. 4. Illustrate statements of profit or loss (extracted) for the year ended on 31 December 2019 and 31 December 2020 only under amortised cost. 5. Illustrate statements of financial position (extracted) on 31 December 2019 and 31 December 2020 only under fair value through profit or loss.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Briefly explain any TWO 2 methods of preference shares redemption There are two methods of prefere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started