Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 You are a Senior Audit Clerk at Finley Auditors and are currently finalising the audit of Gillman Manufacturer (Gillman) for the June

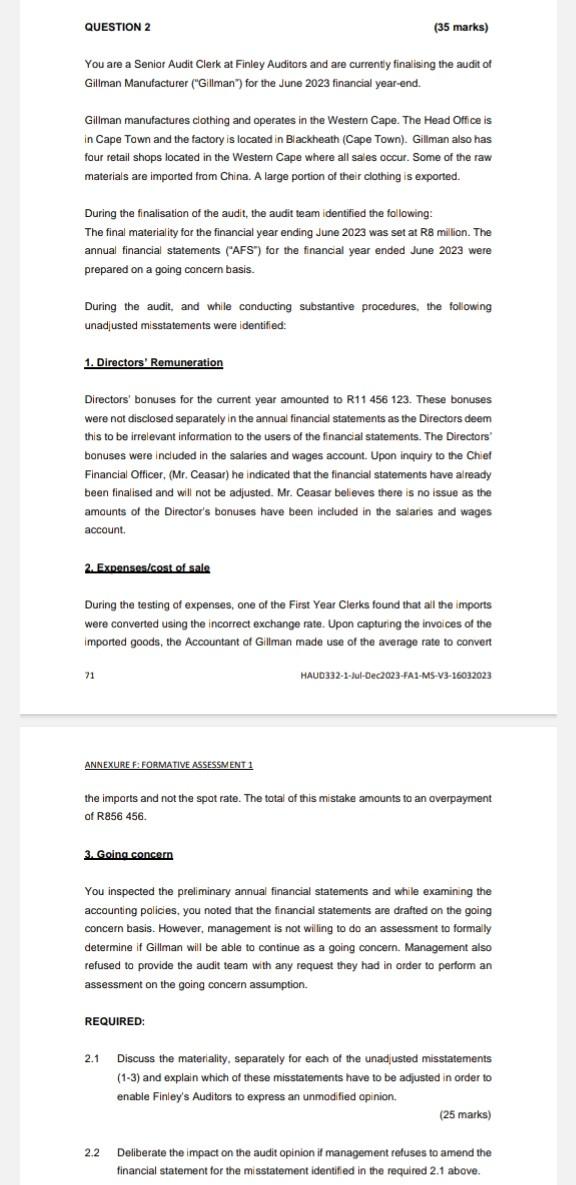

QUESTION 2 You are a Senior Audit Clerk at Finley Auditors and are currently finalising the audit of Gillman Manufacturer ("Gillman") for the June 2023 financial year-end. Gillman manufactures clothing and operates in the Western Cape. The Head Office is in Cape Town and the factory is located in Blackheath (Cape Town). Gillman also has four retail shops located in the Western Cape where all sales occur. Some of the raw materials are imported from China. A large portion of their clothing is exported. During the finalisation of the audit, the audit team identified the following: The final materiality for the financial year ending June 2023 was set at R8 million. The annual financial statements ("AFS") for the financial year ended June 2023 were prepared on a going concern basis. During the audit, and while conducting substantive procedures, the following unadjusted misstatements were identified: 1. Directors' Remuneration Directors' bonuses for the current year amounted to R11 456 123. These bonuses were not disclosed separately in the annual financial statements as the Directors deem this to be irrelevant information to the users of the financial statements. The Directors bonuses were included in the salaries and wages account. Upon inquiry to the Chief Financial Officer, (Mr. Ceasar) he indicated that the financial statements have already been finalised and will not be adjusted. Mr. Ceasar believes there is no issue as the amounts of the Director's bonuses have been included in the salaries and wages account. 2. Expenses/cost of sale (35 marks) During the testing of expenses, one of the First Year Clerks found that all the imports were converted using the incorrect exchange rate. Upon capturing the invoices of the imported goods, the Accountant of Gillman made use of the average rate to convert 71 ANNEXURE F: FORMATIVE ASSESSMENT 1 3. Going concern the imports and not the spot rate. The total of this mistake amounts to an overpayment of R856 456. REQUIRED: HAUD332-1-Jul-Dec2023-FA1-MS-V3-16032023 You inspected the preliminary annual financial statements and while examining the accounting policies, you noted that the financial statements are drafted on the going concern basis. However, management is not willing to do an assessment to formally determine if Gillman will be able to continue as a going concern. Management also refused o provide the audit team with any request they had in order to perform an assessment on the going concern assumption. 2.1 Discuss the materiality, separately for each of the unadjusted misstatements (1-3) and explain which of these misstatements have to be adjusted in order to enable Finley's Auditors to express an unmodified opinion. (25 marks) 2.2 Deliberate the impact on the audit opinion if management refuses to amend the financial statement for the misstatement identified in the required 2.1 above.

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

21 Discussing the materiality and adjustment requirements for each unadjusted misstatement 1 Directors Remuneration The unadjusted misstatement relates to the disclosure of directors bonuses which wer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started