Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #2 You are working as a junior analyst for a buy-side firm and the associate you work for wants you to get started

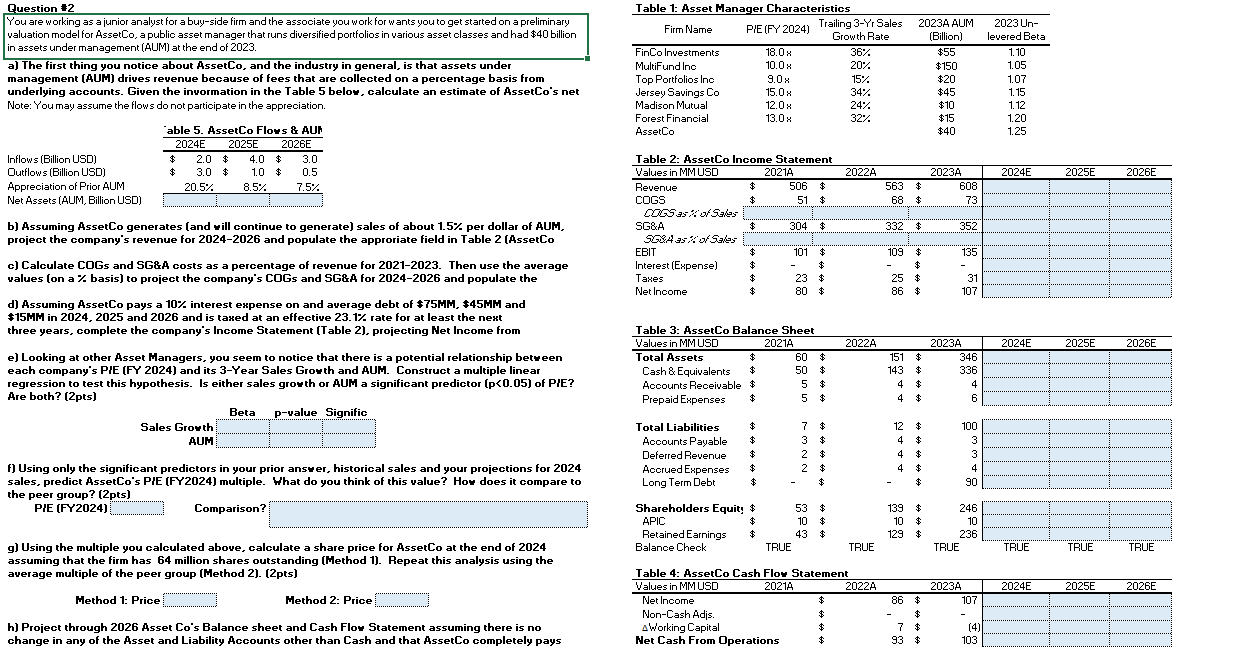

Question #2 You are working as a junior analyst for a buy-side firm and the associate you work for wants you to get started on a preliminary valuation model for AssetCo, a public asset manager that runs diversified portfolios in various asset classes and had $40 billion in assets under management (AUM) at the end of 2023. a) The first thing you notice about AssetCo, and the industry in general, is that assets under management (AUM) drives revenue because of fees that are collected on a percentage basis from underlying accounts. Given the invormation in the Table 5 below, calculate an estimate of AssetCo's net Note: You may assume the flows do not participate in the appreciation. Inflows (Billion USD) Outflows (Billion USD) Appreciation of Prior AUM Net Assets (AUM, Billion USD) able 5. AssetCo Flows & AUN 2024E 2025E 2026E $ 2.0 $ 4.0 $ 3.0 1.0 $ 0.5 8.5% 7.5% $ 3.0 $ 20.5% b) Assuming AssetCo generates (and will continue to generate) sales of about 1.5% per dollar of AUM, project the company's revenue for 2024-2026 and populate the approriate field in Table 2 (AssetCo c) Calculate COGs and SG&A costs as a percentage of revenue for 2021-2023. Then use the average values (on a % basis) to project the company's COGs and SG&A for 2024-2026 and populate the d) Assuming AssetCo pays a 10% interest expense on and average debt of $75MM, $45MM and $15MM in 2024, 2025 and 2026 and is taxed at an effective 23.1% rate for at least the next three years, complete the company's Income Statement (Table 2), projecting Net Income from e) Looking at other Asset Managers, you seem to notice that there is a potential relationship between each company's PIE (FY 2024) and its 3-Year Sales Growth and AUM. Construct a multiple linear regression to test this hypothesis. Is either sales growth or AUM a significant predictor (p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started