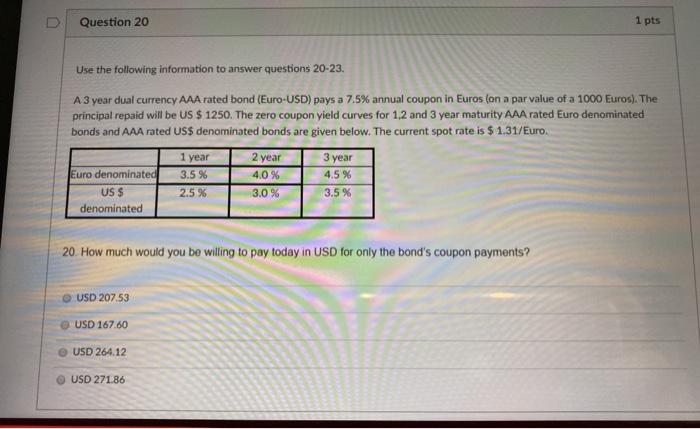

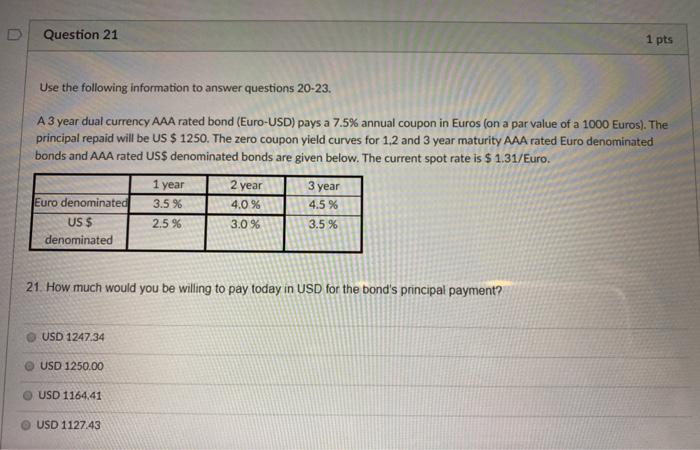

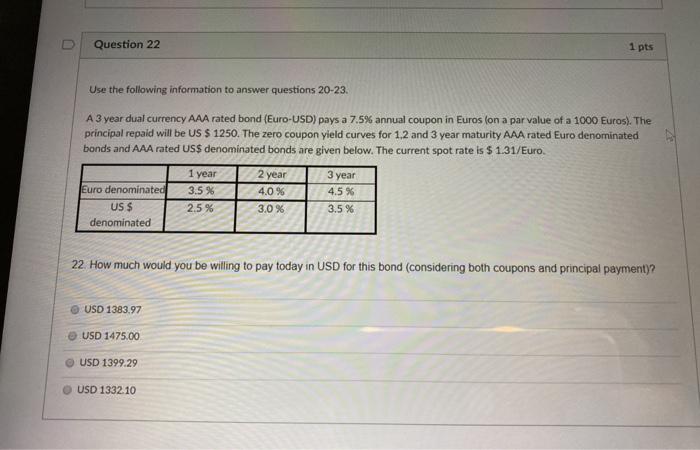

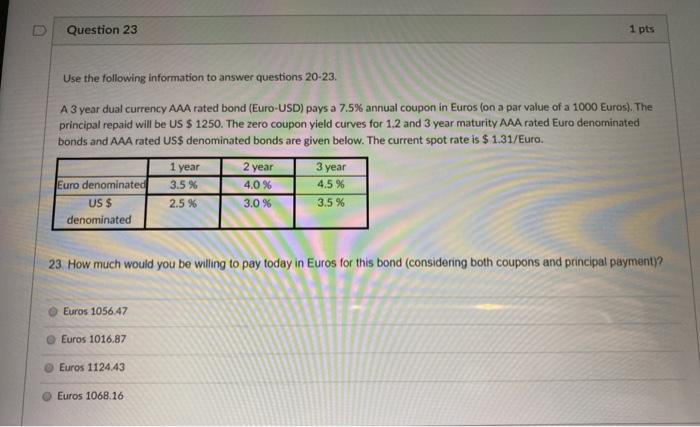

Question 20 1 pts Use the following information to answer questions 20-23. A 3 year dual currency AAA rated bond (Euro-USD) pays a 7.5% annual coupon in Euros (on a par value of a 1000 Euros). The principal repaid will be US S 1250. The zero coupon yield curves for 1,2 and 3 year maturity AAA rated Euro denominated bonds and AAA rated US$ denominated bonds are given below. The current spot rate is $ 1.31/Euro. 1 year 3 year Euro denominated US $ denominated 3.5 % 2.5 % 2 year 4.0 % 3.0 % 4.5% 3.5 % 20. How much would you be willing to pay today in USD for only the bond's coupon payments? USD 207.53 USD 167.60 USD 264.12 USD 271.86 Question 21 1 pts Use the following information to answer questions 20-23. A 3 year dual currency AAA rated bond (Euro-USD) pays a 7.5% annual coupon in Euros (on a par value of a 1000 Euros). The principal repaid will be US $ 1250. The zero coupon yield curves for 1.2 and 3 year maturity AAA rated Euro denominated bonds and AAA rated US$ denominated bonds are given below. The current spot rate is $ 1.31/Euro. 2 year 3 year Euro denominated 3.5 % 4.0 % 4.5 % US $ 2.5% 3.0 % 3.5 % denominated 1 year 21. How much would you be willing to pay today in USD for the bond's principal payment? USD 1247.34 USD 1250.00 USD 1164.41 USD 1127,43 U Question 22 1 pts Use the following information to answer questions 20-23. A 3 year dual currency AAA rated bond (Euro-USD) pays a 7.5% annual coupon in Euros (on a par value of a 1000 Euros). The principal repaid will be US $ 1250. The zero coupon yield curves for 1.2 and 3 year maturity AAA rated Euro denominated bonds and AAA rated US$ denominated bonds are given below. The current spot rate is $ 1.31/Euro. Euro denominated US $ denominated 1 year 3.5 % 2.5% 2 year 4.0% 3.0% 3 year 4.5 % 3.5% 22. How much would you be willing to pay today in USD for this bond (considering both coupons and principal payment)? USD 1383.97 USD 1475.00 USD 1399.29 USD 1332.10 Question 23 1 pts Use the following information to answer questions 20-23. A 3 year dual currency AAA rated bond (Euro-USD) pays a 7.5% annual coupon in Euros (on a par value of a 1000 Euros). The principal repaid will be US $ 1250. The zero coupon yield curves for 1.2 and 3 year maturity AAA rated Euro denominated bonds and AAA rated USS denominated bonds are given below. The current spot rate is $ 1.31/Euro. 1 year 3 year Euro denominated US $ denominated 3.5% 2.5 % 2 year 4.0 % 3.0 % 4.5 % 3.5 % 23. How much would you be willing to pay today in Euros for this bond (considering both coupons and principal payment? Euros 1056,47 Euros 1016.87 Euros 1124.43 Euros 1068.16