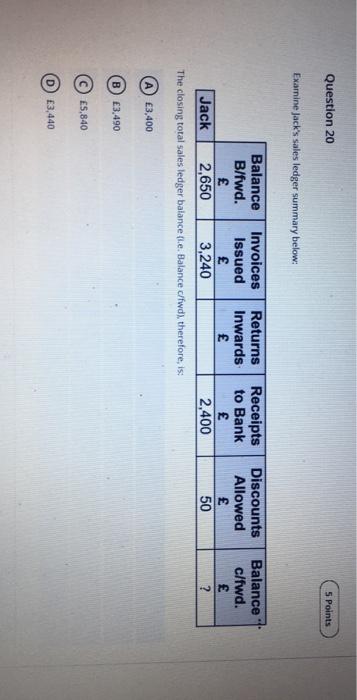

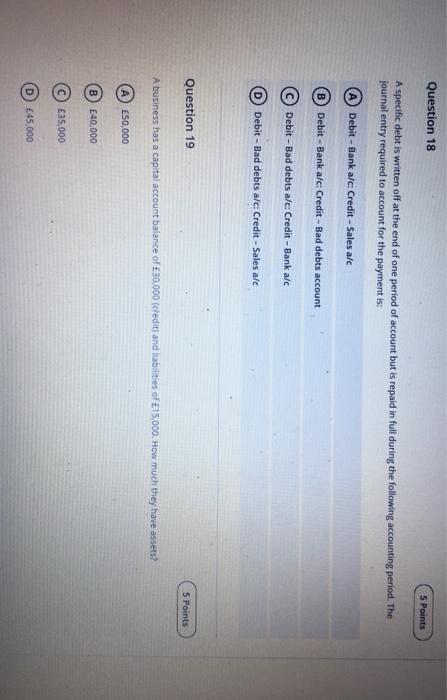

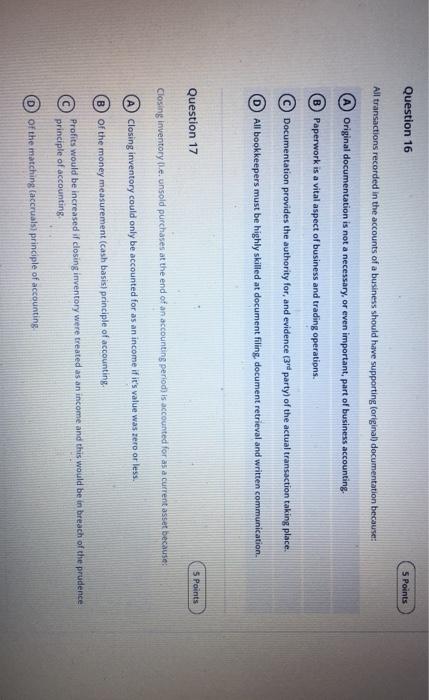

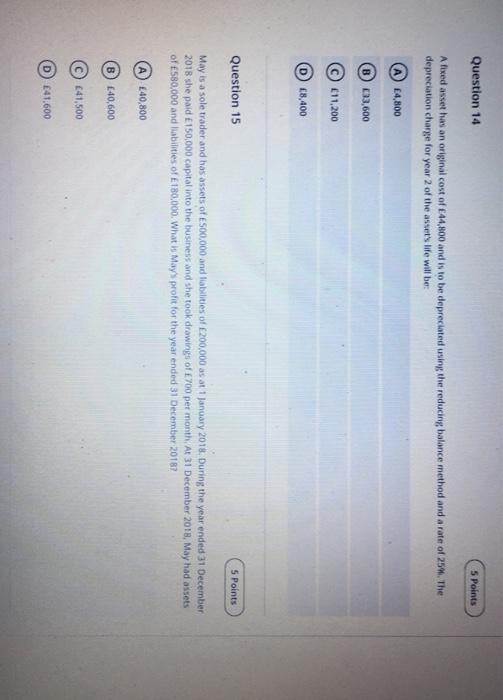

Question 20 5 Points Examine Jack's sales ledger summary below: Balance c/fwd. Balance Invoices Returns B/fwd. Issued Inwards Jack 2,650 3,240 The closing total sales ledger balance (.e. Balance c/fwd, therefore, is: Receipts to Bank 2,400 Discounts Allowed 50 ? A) 3,400 B) 3.490 E5,840 E3,440 Question 18 5 Points A specific debt is written off at the end of one period of account but is repaid in full during the following accounting period. The journal entry required to account for the payment is: Debit - Bank a/c: Credit - Sales a/c Debit - Bank a/c: Credit - Bad debts account Debit - Bad debts a/e Credit Bank a/c Debit - Bad debts a/c: Credit - Sales ale Question 19 5 Points A business has a capital account balance of 30,000 (credit and liabilities of 15,000. How much they have assets A 50,000 B) 40,000 35,000 D) 45,000 Question 16 S Points All transactions recorded in the accounts of a business should have supporting foriginal documentation because: Original documentation is not a necessary, or even important part of business accounting Paperwork is a vital aspect of business and trading operations. Documentation provides the authority for, and evidence (3 party) of the actual transaction taking place. All bookkeepers must be highly skilled at document filing, document retrieval and written communication Question 17 5 Points Closing inventory lie unsold purchases at the end of an accounting period is accounted for as a current asset because Closing inventory could only be accounted for as an income if it's value was zero or less. B of the money measurement (cash basis principle of accounting. Profits would be increased if closing inventory were treated as an income and this would be in breach of the prudence principle of accounting of the matching taccruals principle of accounting Question 14 5 Points A fixed asset has an original cost of 44,800 and is to be depreciated using the reducing balance method and a rate of 25. The depreciation charge for year 2 of the assets life will be 4,800 B) 33,600 (11,200 8,400 Question 15 5 Points May is a sole trader and has assets of E500,000 and abilities of 200,000 as at 1 January 2018. During the year ended 31 December 2018 she paid 150,000 capital into the business and she took drawings of 700 per month at 31 December 2018, May had assets of 580,000 and liabilities of E180,000. What h May profit for the year ended 31 December 2017 A) 40,800 B) 40,600 41,500 D) 41,600