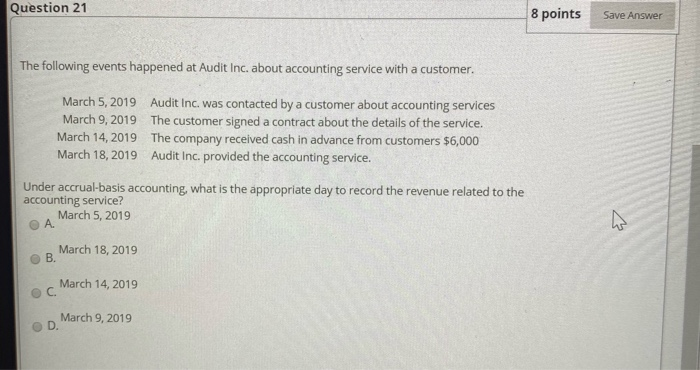

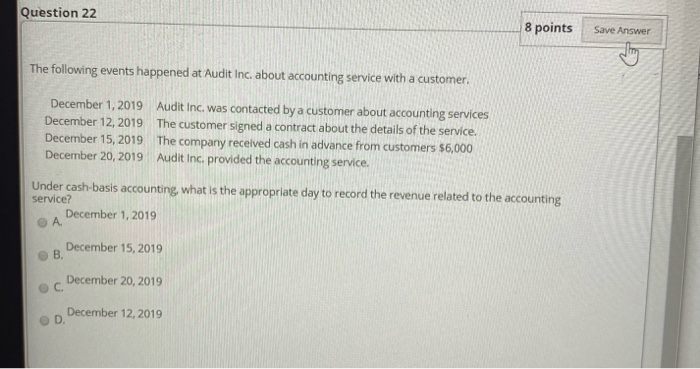

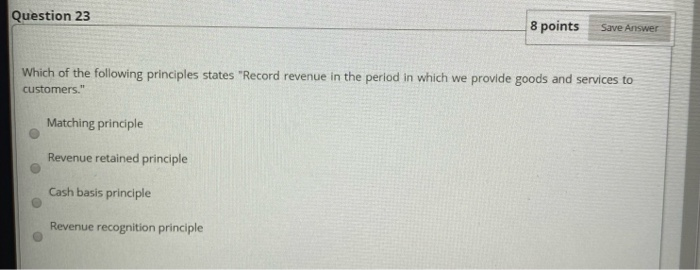

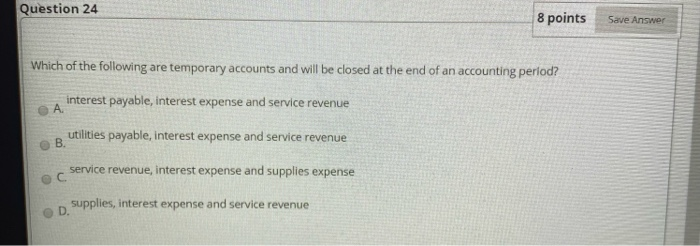

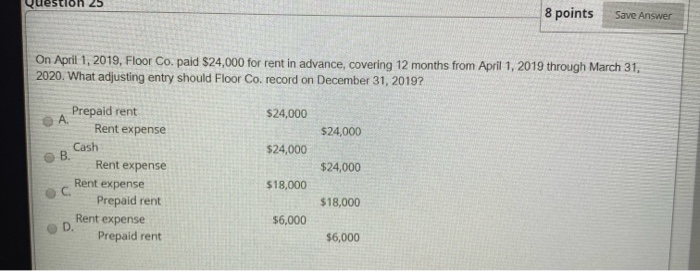

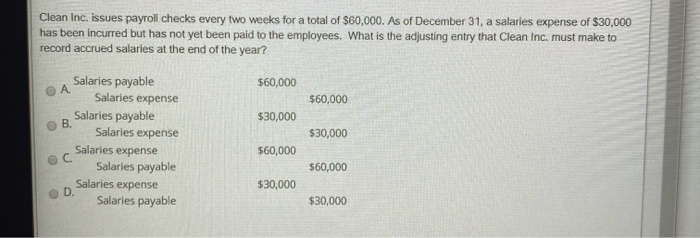

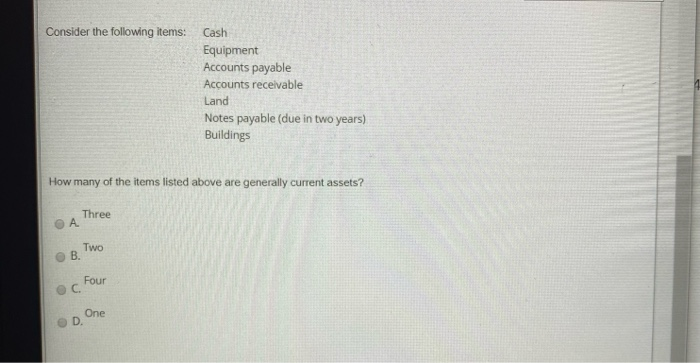

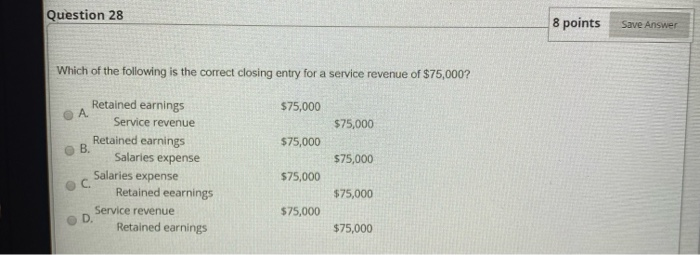

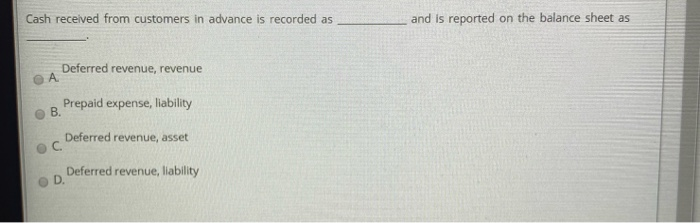

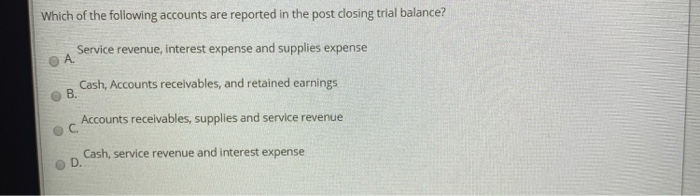

Question 21 8 points Save Answer The following events happened at Audit Inc. about accounting service with a customer. March 5, 2019 Audit Inc. was contacted by a customer about accounting services March 9, 2019 The customer signed a contract about the details of the service. March 14, 2019 The company received cash in advance from customers $6,000 March 18, 2019 Audit Inc. provided the accounting service. Under accrual-basis accounting, what is the appropriate day to record the revenue related to the accounting service? March 5, 2019 March 18, 2019 c. March 14, 2019 D. March 9, 2019 Question 22 8 points Save Answer The following events happened at Audit Inc. about accounting service with a customer. December 1, 2019 December 12, 2019 December 15, 2019 December 20, 2019 Audit Inc. was contacted by a customer about accounting services The customer signed a contract about the details of the service. The company received cash in advance from customers $6,000 Audit Inc. provided the accounting service. Under cash-basis accounting, what is the appropriate day to record the revenue related to the accounting Service? A December 1, 2019 December 15, 2019 December 20, 2019 p. December 12, 2019 Question 23 8 points Save Answer Which of the following principles states "Record revenue in the period in which we provide goods and services to customers." Matching principle Revenue retained principle Cash basis principle Revenue recognition principle Question 24 8 points Save Answer Which of the following are temporary accounts and will be closed at the end of an accounting period? interest payable, interest expense and service revenue utilities payable, interest expense and service revenue service revenue, interest expense and supplies expense supplies, interest expense and service revenue Question 25 8 points Save Answer On April 1, 2019, Floor Co. paid $24,000 for rent in advance, covering 12 months from April 1, 2019 through March 31, 2020. What adjusting entry should Floor Co. record on December 31, 2019? $24,000 Prepaid rent Rent expense $24,000 $24,000 B Cash $24,000 $18,000 Rent expense Rent expense Prepaid rent Rent expense Prepaid rent $18,000 $6,000 D." $6,000 Clean Inc. issues payroll checks every two weeks for a total of $60,000. As of December 31, a salaries expense of $30,000 has been incurred but has not yet been paid to the employees. What is the adjusting entry that Clean Inc. must make to record accrued salaries at the end of the year? $60,000 $60,000 $30,000 Salaries payable Salaries expense Salaries payable Salaries expense Salaries expense Salaries payable $30,000 Salari $60,000 c $60,000 Salaries expense $30,000 Salaries payable $30,000 Consider the following items: Cash Equipment Accounts payable Accounts receivable Land Notes payable (due in two years) Buildings How many of the items listed above are generally current assets? O A Three U Question 28 8 points Save Answer Which of the following is the correct closing entry for a service revenue of $75,000? $75,000 $75,000 $75,000 $75,000 Retained earnings Service revenue Retained earnings Salaries expense Salaries expense Retained eearnings Service revenue Retained earnings $75,000 $75,000 $75,000 $75,000 Cash received from customers in advance is recorded as and is reported on the balance sheet as Deferred revenue, revenue Prepaid expense, liability Deferred revenue, asset Deferred revenue, liability Which of the following accounts are reported in the post closing trial balance? Service revenue, interest expense and supplies expense Cash, Accounts receivables, and retained earnings Accounts receivables, supplies and service revenue B. Cash, Aca oc Accounts D. Cash.se Cash, service revenue and interest expense