Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 21, P22-14 HW Score: 62%, 62 of 100 (similar to) points Points: 0 of 4 You are an analyst working for Goldman Sachs, and

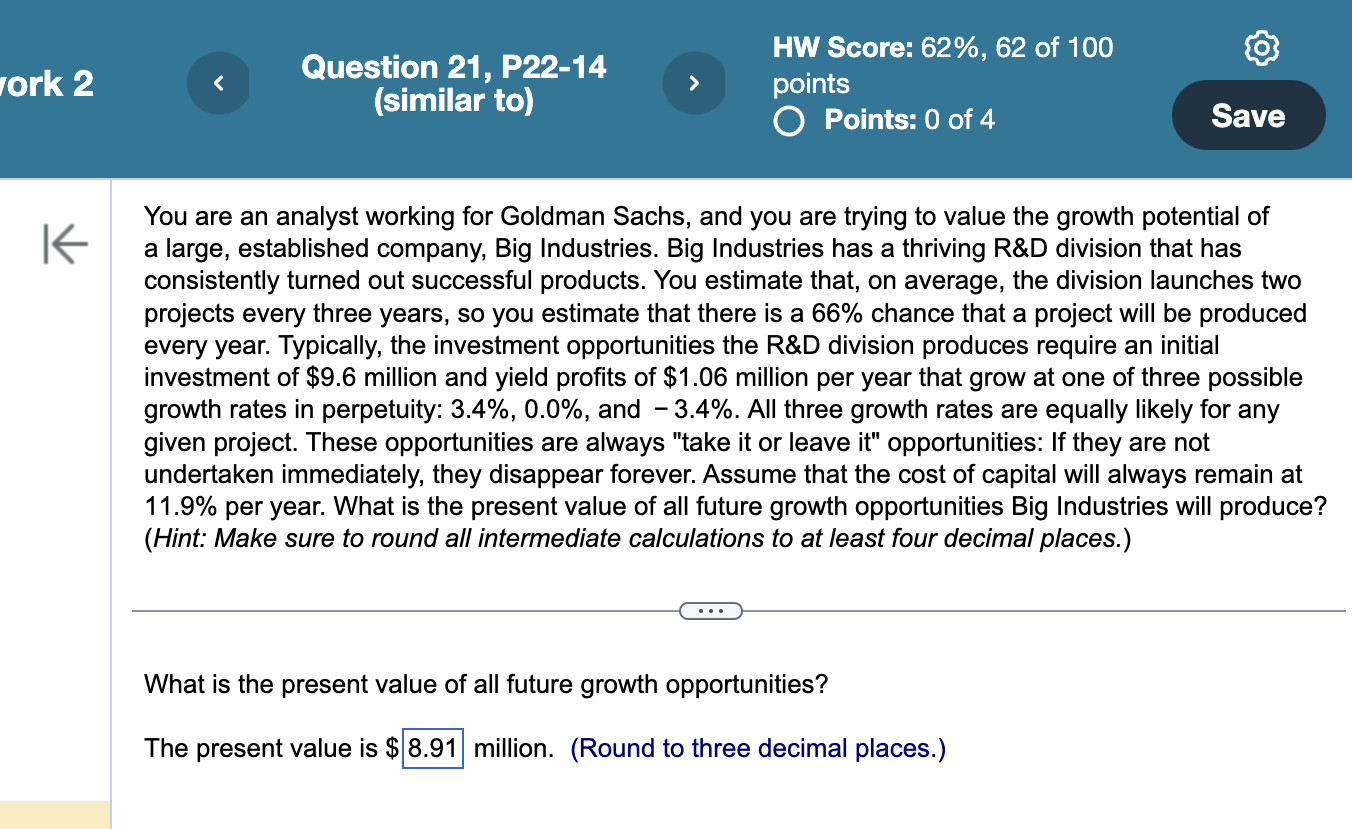

Question 21, P22-14 HW Score: 62\%, 62 of 100 (similar to) points Points: 0 of 4 You are an analyst working for Goldman Sachs, and you are trying to value the growth potential of a large, established company, Big Industries. Big Industries has a thriving R\&D division that has consistently turned out successful products. You estimate that, on average, the division launches two projects every three years, so you estimate that there is a 66% chance that a project will be produced every year. Typically, the investment opportunities the R\&D division produces require an initial investment of $9.6 million and yield profits of $1.06 million per year that grow at one of three possible growth rates in perpetuity: 3.4%,0.0%, and 3.4%. All three growth rates are equally likely for any given project. These opportunities are always "take it or leave it" opportunities: If they are not undertaken immediately, they disappear forever. Assume that the cost of capital will always remain at 11.9% per year. What is the present value of all future growth opportunities Big Industries will produce? (Hint: Make sure to round all intermediate calculations to at least four decimal places.) What is the present value of all future growth opportunities? The present value is $ million. (Round to three decimal places.)

Question 21, P22-14 HW Score: 62\%, 62 of 100 (similar to) points Points: 0 of 4 You are an analyst working for Goldman Sachs, and you are trying to value the growth potential of a large, established company, Big Industries. Big Industries has a thriving R\&D division that has consistently turned out successful products. You estimate that, on average, the division launches two projects every three years, so you estimate that there is a 66% chance that a project will be produced every year. Typically, the investment opportunities the R\&D division produces require an initial investment of $9.6 million and yield profits of $1.06 million per year that grow at one of three possible growth rates in perpetuity: 3.4%,0.0%, and 3.4%. All three growth rates are equally likely for any given project. These opportunities are always "take it or leave it" opportunities: If they are not undertaken immediately, they disappear forever. Assume that the cost of capital will always remain at 11.9% per year. What is the present value of all future growth opportunities Big Industries will produce? (Hint: Make sure to round all intermediate calculations to at least four decimal places.) What is the present value of all future growth opportunities? The present value is $ million. (Round to three decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started