Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 21 When completing a bank reconciliation, what action should you take regarding Deposits-In- Transit. Add the item to the Bank's side Subtract the item

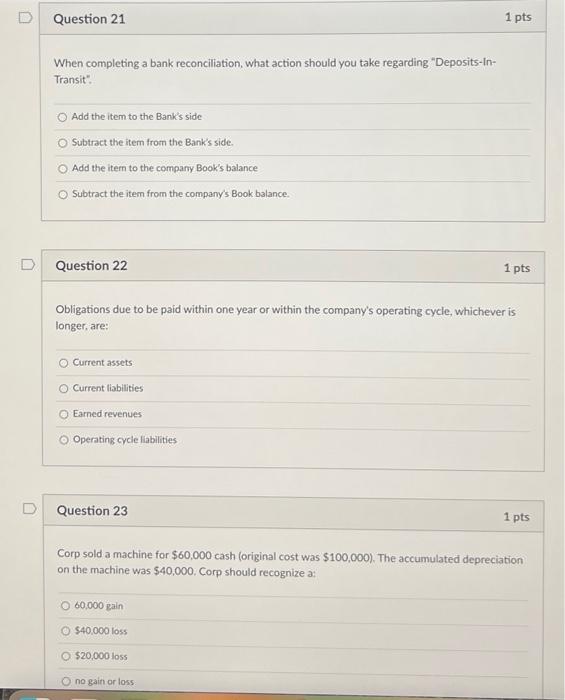

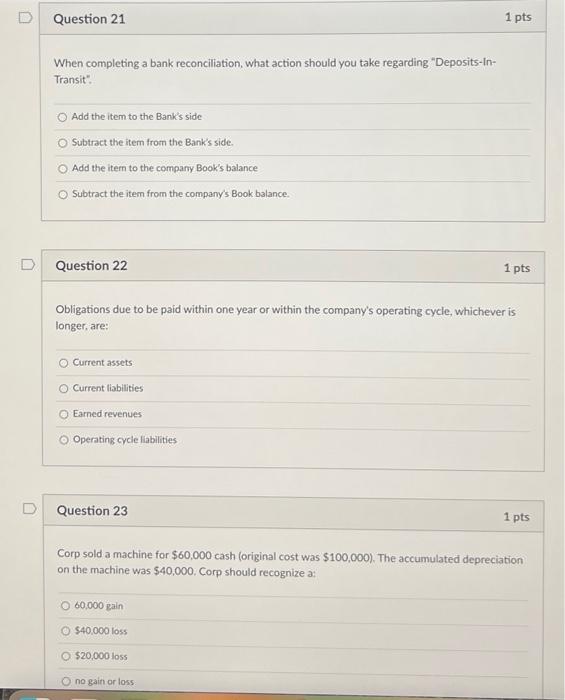

Question 21 When completing a bank reconciliation, what action should you take regarding "Deposits-In- Transit". Add the item to the Bank's side Subtract the item from the Bank's side. Add the item to the company Book's balance Subtract the item from the company's Book balance. Question 22 Current assets Obligations due to be paid within one year or within the company's operating cycle, whichever is longer, are: Current liabilities Earned revenues O Operating cycle liabilities Question 23 O 60,000 gain $40,000 loss 1 pts Corp sold a machine for $60,000 cash (original cost was $100,000). The accumulated depreciation on the machine was $40,000. Corp should recognize a: $20,000 loss 1 pts no gain or loss 1 pts

Can someone help with these three questions? Thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started