Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 22 (1 point) The Clarion Keg Corporation is considering expanding operations to meet growing demand. With the capital expansion, the current accounts are expected

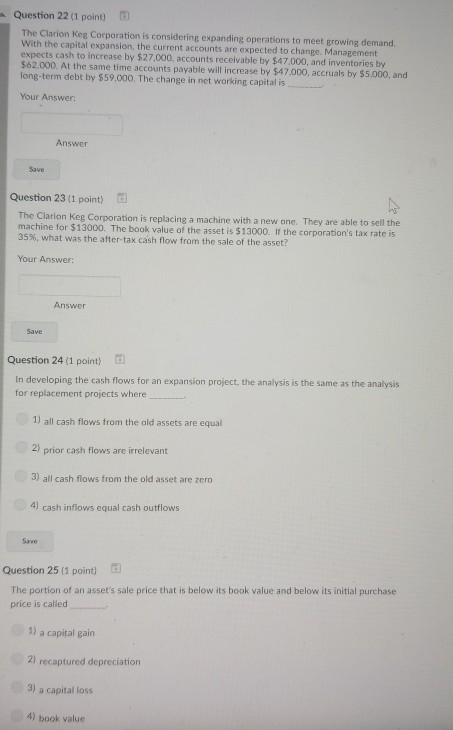

Question 22 (1 point) The Clarion Keg Corporation is considering expanding operations to meet growing demand. With the capital expansion, the current accounts are expected to change. Management expects cash to increase by $27,000, accounts receivable by $47.000, and inventories by $62.000. At the same time accounts payable will increase by $47,000, accruals by $5,000, and long-term debt by $59.000. The change in net working capital is Your Answer: Answer Save Question 23 (1 point) The Clarion machine for $13000. The book value of the asset is $13000. If the corporation's tax rate is 35%, what was the after-tax cash flow from the sale of the asset? Keg Corporation is replacing a machine with a new ane. They are able to sell the Your Answer: Answer Save Question 24 (1 point) In developing the cash flows for an expansion project, the analysis is the same as the analysis for replacement projects where 1) all cash flows from the old assets are equal 2) prior cash flows are irrelevant 3) all cash flows from the old asset are zero 4) cash inflows equal cash outflows Save Question 25 (1 point) G The portion of an asset's sale price that is below its book value and below its initial purchase price is called 1) a capital gain 2) recaptured depreciation 3) a capital loss 4) book value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started