Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2.2 (11 marks) Maizes Pty (Ltd) is currently planning their cash requirements for the next quarter, April 2020 to June 2020. The company sells

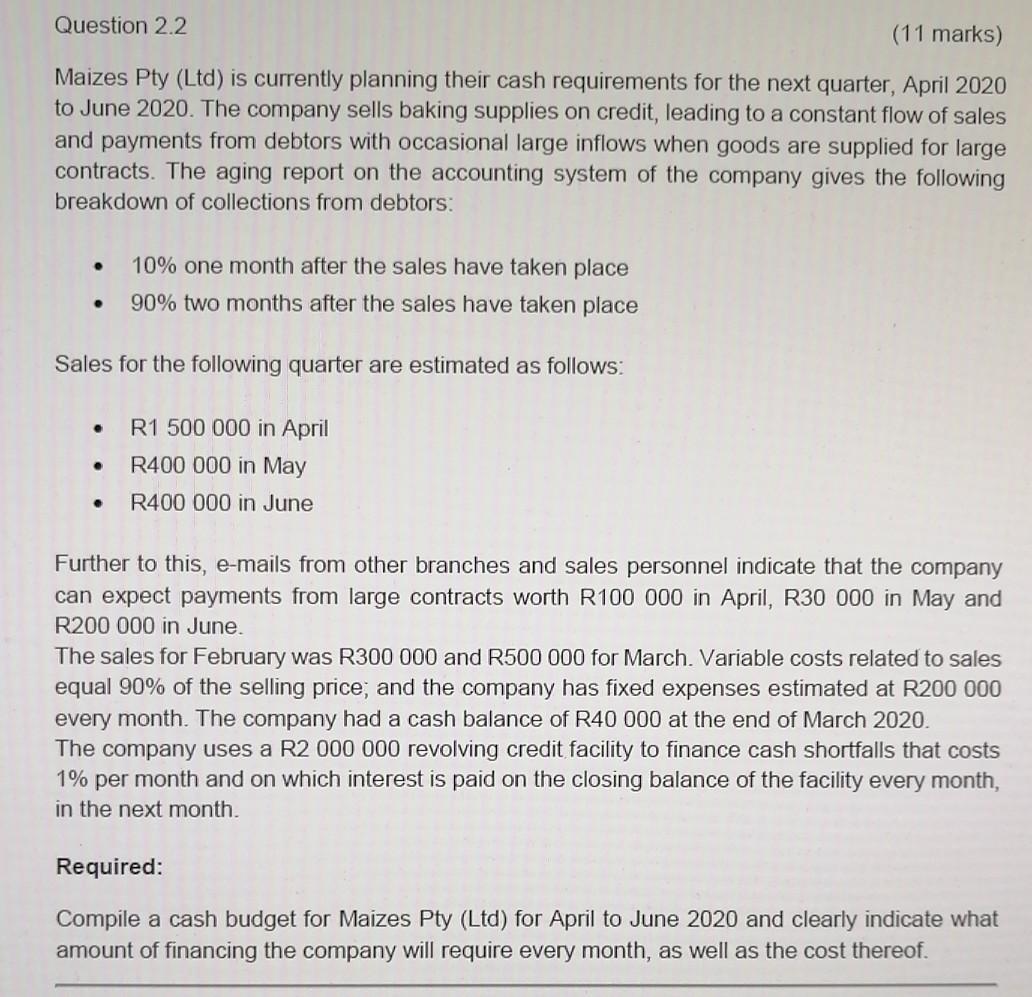

Question 2.2 (11 marks) Maizes Pty (Ltd) is currently planning their cash requirements for the next quarter, April 2020 to June 2020. The company sells baking supplies on credit, leading to a constant flow of sales and payments from debtors with occasional large inflows when goods are supplied for large contracts. The aging report on the accounting system of the company gives the following breakdown of collections from debtors: 10% one month after the sales have taken place 90% two months after the sales have taken place Sales for the following quarter are estimated as follows: . R1 500 000 in April R400 000 in May R400 000 in June . Further to this, e-mails from other branches and sales personnel indicate that the company can expect payments from large contracts worth R100 000 in April, R30 000 in May and R200 000 in June. The sales for February was R300 000 and R500 000 for March. Variable costs related to sales equal 90% of the selling price, and the company has fixed expenses estimated at R200 000 every month. The company had a cash balance of R40 000 at the end of March 2020. The company uses a R2 000 000 revolving credit facility to finance cash shortfalls that costs 1% per month and on which interest is paid on the closing balance of the facility every month, in the next month. Required: Compile a cash budget for Maizes Pty (Ltd) for April to June 2020 and clearly indicate what amount of financing the company will require every month, as well as the cost thereof. Question 2.2 (11 marks) Maizes Pty (Ltd) is currently planning their cash requirements for the next quarter, April 2020 to June 2020. The company sells baking supplies on credit, leading to a constant flow of sales and payments from debtors with occasional large inflows when goods are supplied for large contracts. The aging report on the accounting system of the company gives the following breakdown of collections from debtors: 10% one month after the sales have taken place 90% two months after the sales have taken place Sales for the following quarter are estimated as follows: . R1 500 000 in April R400 000 in May R400 000 in June . Further to this, e-mails from other branches and sales personnel indicate that the company can expect payments from large contracts worth R100 000 in April, R30 000 in May and R200 000 in June. The sales for February was R300 000 and R500 000 for March. Variable costs related to sales equal 90% of the selling price, and the company has fixed expenses estimated at R200 000 every month. The company had a cash balance of R40 000 at the end of March 2020. The company uses a R2 000 000 revolving credit facility to finance cash shortfalls that costs 1% per month and on which interest is paid on the closing balance of the facility every month, in the next month. Required: Compile a cash budget for Maizes Pty (Ltd) for April to June 2020 and clearly indicate what amount of financing the company will require every month, as well as the cost thereof

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started