Question

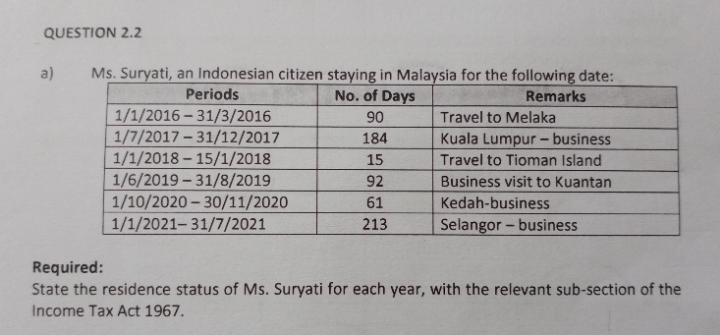

QUESTION 2.2 a) Ms. Suryati, an Indonesian citizen staying in Malaysia for the following date: Periods No. of Days Remarks 90 1/1/2016 31/3/2016 1/7/2017-31/12/2017

QUESTION 2.2 a) Ms. Suryati, an Indonesian citizen staying in Malaysia for the following date: Periods No. of Days Remarks 90 1/1/2016 31/3/2016 1/7/2017-31/12/2017 184 15 1/1/2018 - 15/1/2018 1/6/2019-31/8/2019 92 1/10/2020-30/11/2020 61 1/1/2021-31/7/2021 213 Travel to Melaka Kuala Lumpur-business Travel to Tioman Island Business visit to Kuantan Kedah-business Selangor-business Required: State the residence status of Ms. Suryati for each year, with the relevant sub-section of the Income Tax Act 1967.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the residence status of Ms Suryati for each year we need to consider her physical presence in Malaysia and the purpose of her stay Accord...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Federal Income Taxation In Canada

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

33rd Edition

1554965020, 978-1554965021

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App