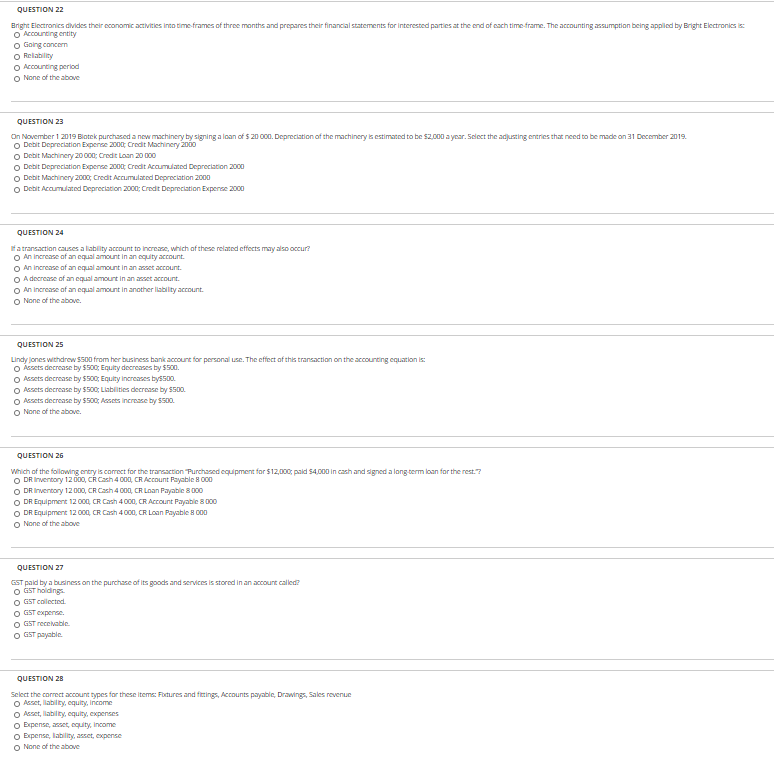

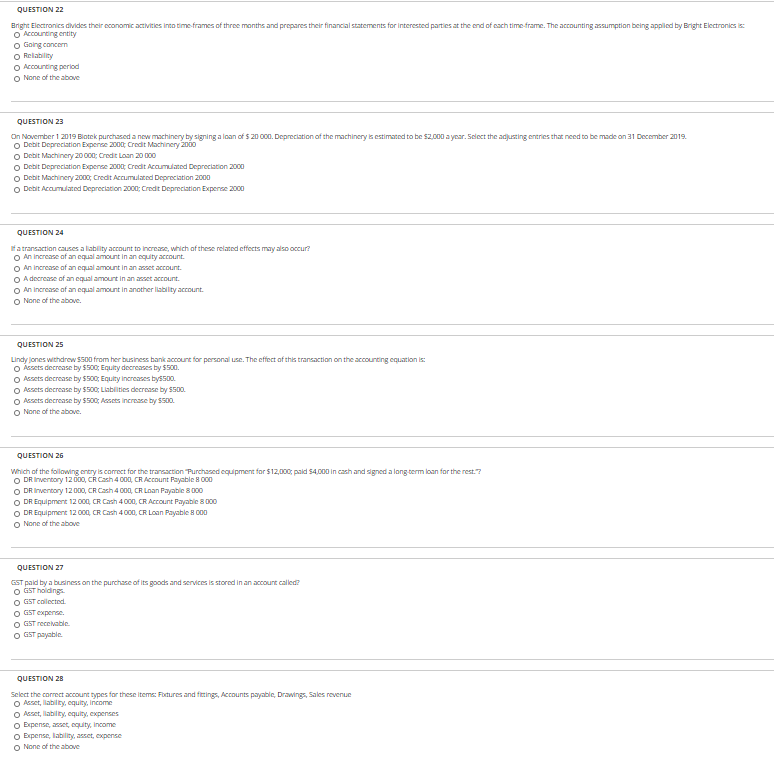

QUESTION 22 Bright Electronics divides their economic activities into time frames of three months and prepares their financial statements for interested parties at the end of each time frame. The accounting assumption being appiled by Bright Electronics is Accounting entity O Going concern Reability Accounting period None of the above QUESTION 23 On November 2019 Blotek purchased a new machinery by signing a loan of s 20 000. Depreciation of the machinery is estimated to be $2,000 a year. Select the adjusting entries that need to be made on 31 December 2019. Debit Depreciation Experiee 2000: Credit Machinery 2060 Debit Machinery 20 000: Credit Loan 20 000 Debit Depreciation Expense 2000 Credit Accumulated Depreciation 2000 Debit Machinery 2000 Credit Accumulated Depreciation 2000 Debit Accumulated Depreciation 2000: Credit Depreciation Expense 2000 QUESTION 24 of a transaction causes a liability account to increase, which of these related effects may also occur? An increase of an equal amount in an equity account. An increase of an equal amount in an asset account. A decrease of an equal amount in an et account. An increase of an equal amount in another ability account. None of the above QUESTION 25 Lindy Jones withdrew $500 from her business bank account for personal use. The effect of this transaction on the accounting equation is: Assets decrease by 5500Equity decreases by 5500. Assets decrease by $500 Equity increases by500 Assets decrease by S500 Liabilities decrease by S500 Assets decrease by $500, lases increase by SSOO. None of the above. QUESTION 2G Which of the following entry is correct for the transaction Purchased equipment for $12,000; paid $4,000 in cash and signed a long term loan for the rest.? O DR Inventory 12000, Ch.Cash 4 000 CR Account Payable 8000 O DR Inventory 12000, CR. Cash 4 000, CR Loan Payable 8000 DR. Equipment 12.000 CR Cash 4000, CR Account Payable 3000 ODR Equipment 12.000 CR Cash 4000, CR Loan Payable 8000 o None of the above QUESTION 27 GST paid by a business on the purchase of its goods and services is stored in an account called? O GST holdings O GST collected O GST expense O GST receivable O GST payable QUESTION 28 Select the correct account types for these terms: Foures and fittings, Accounts payable, Drawings, Sales revenue Asset,lability, equity, income Asset,lability, equity, expenses Expense, zoet, equity, Income o Expense, ability asset, expense None of the above