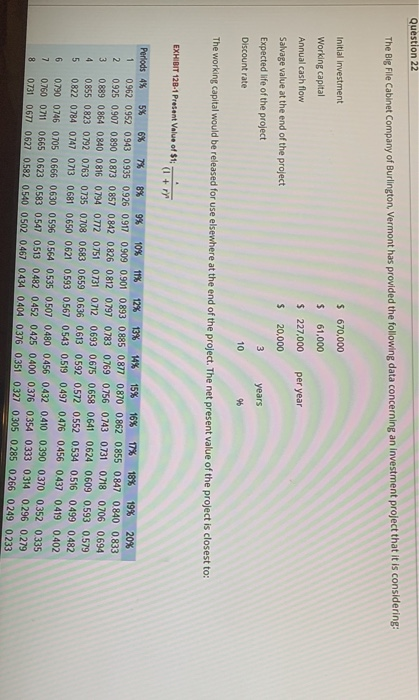

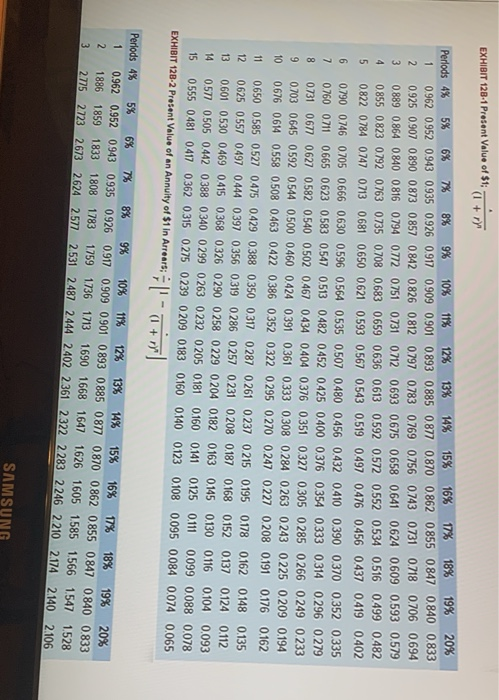

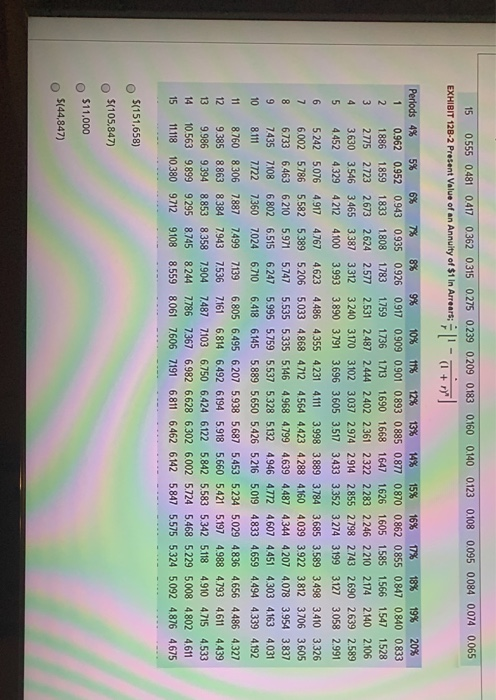

Question 22 The Big File Cabinet Company of Burlington, Vermont has provided the following data concerning an investment project that it is considering: Initial Investment $ 670,000 Working capital $ 61,000 Annual cash flow $ 227,000 per year $ 20,000 Salvage value at the end of the project Expected life of the project 3 years Discount rate 10 96 The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to: EXHIBIT 128-1 Present Value of $1; (1 + ry 1 2 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.962 0.952 0943 0935 0.926 0917 0.909 0.901 0.893 0885 0.877 0.870 0.862 0855 0847 0.840 0.833 0925 0907 0890 0873 0857 0842 0826 0812 0797 0783 0769 0.756 0.743 0731 0.7180.706 0694 0889 0864 0840 0816 0794 0720751 0731 0712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.855 0823 0792 0763 0735 0708 0683 0659 0636 0.613 0.592 0.572 0.552 0534 0.516 0.499 0.482 5 0822 0784 0747 0713 0681 0650 0621 0593 0567 0.543 0.519 0497 0.476 0456 0.437 0.419 0.402 6 0790 0746 0705 0666 0630 0.596 0.564 0535 0.507 0.480 0.456 0.432 0410 0.390 0370 0.352 0.335 0760 0711 0665 0.623 0583 0.547 0513 0.482 0.452 0425 0400 0376 0.354 0.333 0.314 0.296 0.279 8 0731 0677 0627 0582 0540 0502 0.467 0.434 0404 0376 0.351 0327 0305 0.285 0 266 0249 0233 EXHIBIT 128:1 Present Value of $1; + ry 20% Perlods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 1 0.962 0.952 0943 0935 0.926 0.917 0.909 0.901 0893 0.885 0.877 0.870 0,862 0855 0.847 0.840 0.833 20.925 0.907 0.890 0.873 0857 0.842 0.826 0.812 0797 0783 0.769 0.756 0743 0731 0.7180.706 0.694 3 0889 0.864 0840 0816 0794 07172 0.751 0.731 0712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 4 0.855 0823 0.792 0763 0.735 0.708 0.683 0659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0499 0.482 5 0822 0.784 0.747 0713 0.681 0.650 0.621 0.593 0.567 0,543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 6 0790 0.746 0705 0.666 0.630 0596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 7 0760 0711 0665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 8 0731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0327 0.305 0.285 0.266 0.249 0.233 9 0.703 0.645 0592 0.544 0.500 0.460 0.424 0.391 0361 0333 0.308 0.284 0.263 0243 0.225 0.209 0.194 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0352 0322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 11 0650 0.585 0.527 0.475 0.429 0.388 0.350 0317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0286 0257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 13 0.601 0530 0.469 0415 0.368 0.326 0.290 0258 0229 0204 0182 0163 0.145 0.130 0.116 0.104 0.093 14 0.577 0.505 0.442 0.388 0.340 0299 0.263 0.232 0205 0.181 01600141 0.125 0.11 0.099 0.088 0.078 15 0555 0.481 0.417 0.362 0.315 0.275 0.239 0209 0.183 0.160 0.140 0.123 0108 0.095 0.084 0.074 0.065 EXHIBIT 128-2 Present Value of an Annuity of $1 In Arrears; |- (1+r) Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 0.962 0.952 0943 0935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0833 15% 16% 17% 18% 19% 20% 2 1886 1859 1833 1808 1783 1759 1736 1713 1690 1668 1647 1626 1605 1.585 1.566 1.547 1.528 3 2.775 2723 2673 2.624 2.577 2.531 2.487 2.444 2.402 2361 2322 2283 2246 2210 2.174 2.140 2.106 SAMSUNG 15 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 EXHIBIT 128-2 Present Value of an Annuity of $1 In Arrears: ; L' - (+] Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.962 0.952 0943 0.935 0.926 0.917 0.909 0.901 0893 0.885 0.877 0.870 0.862 0855 0847 0.840 0.833 2 1886 1859 1833 1.808 1783 1759 1736 1713 1690 1668 1647 1626 1605 1585 1566 1547 1528 3 2.775 2.723 2673 2624 2.577 2.531 2.487 2.444 2402 2361 2322 2283 2246 2210 2174 2140 2106 3.630 3.546 3.465 3.387 3.312 3.240 3170 3.102 3.037 2.974 2914 2.855 2798 2743 2690 2639 2.589 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3199 3.127 3.058 2.991 6 5242 5.076 4.917 4.767 4.623 4.486 4355 4.231 4.111 3.998 3.889 3.784 3.685 3,589 3.498 3410 3326 6.002 5786 5.582 5.389 5.206 5.033 4.868 4712 4.564 4.423 4.288 4160 4.039 3.922 3.812 3.706 3.605 8 6733 6.463 6.210 5.971 57475.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3,837 7.435 7108 6.802 6.515 6.247 5.995 5.759 5.537 5328 5132 4.946 477 4.607 4451 4303 4.163 4.031 10 8111 7722 7360 7024 6710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4833 4.659 4.494 4339 4.192 11 8760 8306 7.887 749971396.805 6.495 6 207 5938 5.687 5.453 5234 5.029 4836 4.656 4.486 4.327 12 9.385 8.863 8.384 7943 7.536 7161 6.814 6.492 6194 5.918 5.660 5.421 5197 4988 4793 4.611 4439 13 9.986 9.394 8.853 8.358 7904 7487 7103 6.750 6.424 6122 5.842 5.583 5342 5118 4910 4715 4.533 14 10.563 9.899 9.295 8745 8244 7.786 7367 6.982 6.628 6.302 6.002 5.724 5.468 5229 5.008 4802 4.611 15 11118 10.380 9.712 9.108 8.559 8061 7.606 7191 6.811 6.462 6.142 5.847 5.575 5324 5.092 4.876 4.675 9 $(151,658) $(105,847) $11,000 $(44,847)