Answered step by step

Verified Expert Solution

Question

1 Approved Answer

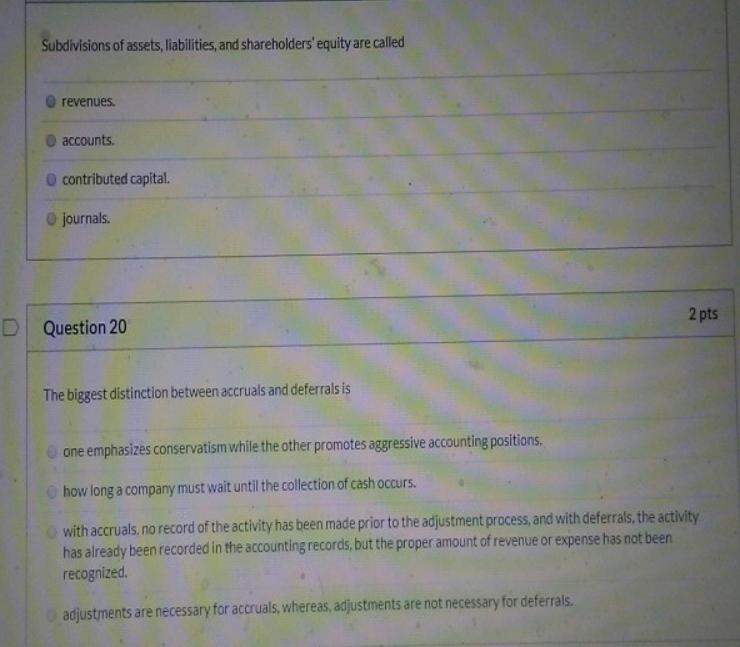

Subdivisions of assets, liabilities, and shareholders' equity are called revenues. O accounts. O contributed capital. O journals. D Question 20 2 pts The biggest

Subdivisions of assets, liabilities, and shareholders' equity are called revenues. O accounts. O contributed capital. O journals. D Question 20 2 pts The biggest distinction between accruals and deferrals is one emphasizes conservatism while the other promotes aggressive accounting positions. how long a company must wait until the collection of cash occurs. with accruals, no record of the activity has been made prior to the adjustment process, and with deferrals, the activity has already been recorded in the accounting records, but the proper amount of revenue or expense has not been recognized. O adjustments are necessary for accruals, whereas, adjustments are not necessary for deferrals.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

19 Subdivision of assets liabilities and shareholders equity are called ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started