Answered step by step

Verified Expert Solution

Question

1 Approved Answer

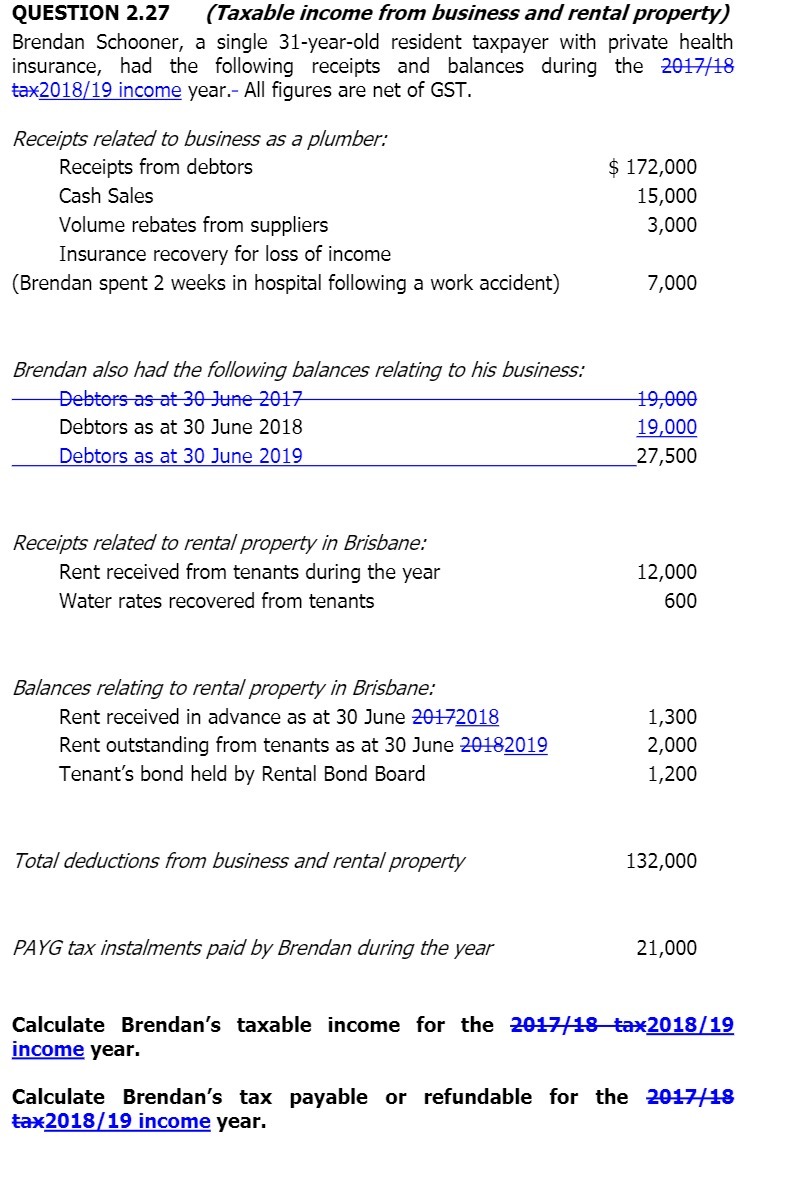

QUESTION 2.27 (Taxable income from business and rental property) Brendan Schooner, a single 31-year-old resident taxpayer with private health insurance, had the following receipts

QUESTION 2.27 (Taxable income from business and rental property) Brendan Schooner, a single 31-year-old resident taxpayer with private health insurance, had the following receipts and balances during the 2017/18 tax2018/19 income year.- All figures are net of GST. Receipts related to business as a plumber: Receipts from debtors Cash Sales Volume rebates from suppliers Insurance recovery for loss of income (Brendan spent 2 weeks in hospital following a work accident) Brendan also had the following balances relating to his business: Debtors as at 30 June 2017 Debtors as at 30 June 2018 Debtors as at 30 June 2019 Receipts related to rental property in Brisbane: Rent received from tenants during the year Water rates recovered from tenants Balances relating to rental property in Brisbane: Rent received in advance as at 30 June 20172018 Rent outstanding from tenants as at 30 June 20182019 Tenant's bond held by Rental Bond Board Total deductions from business and rental property PAYG tax instalments paid by Brendan during the year $ 172,000 15,000 3,000 7,000 19,000 19,000 27,500 12,000 600 1,300 2,000 1,200 132,000 21,000 Calculate Brendan's taxable income for the 2017/18 tax2018/19 income year. Calculate Brendan's tax payable or refundable for the 2017/18 tax2018/19 income year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Brendans Taxable Income for 201718 Tax Year Business Income Receipts P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started