Answered step by step

Verified Expert Solution

Question

1 Approved Answer

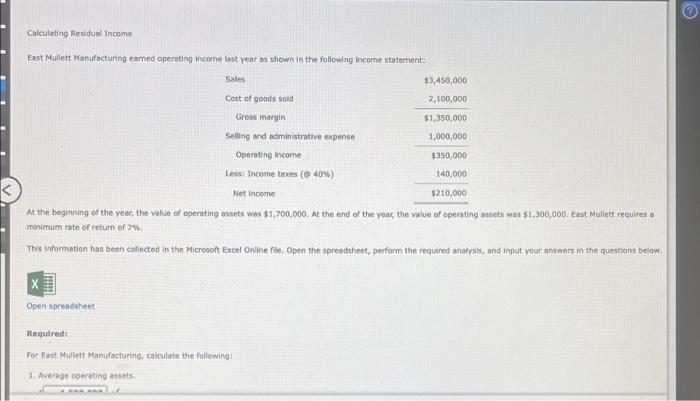

question 2,3, and 4 please Calculating Residual Income East Mullett Manufacturing eamed operating Income last year as shown in the following income statement: Sales $3,450,000

question 2,3, and 4 please

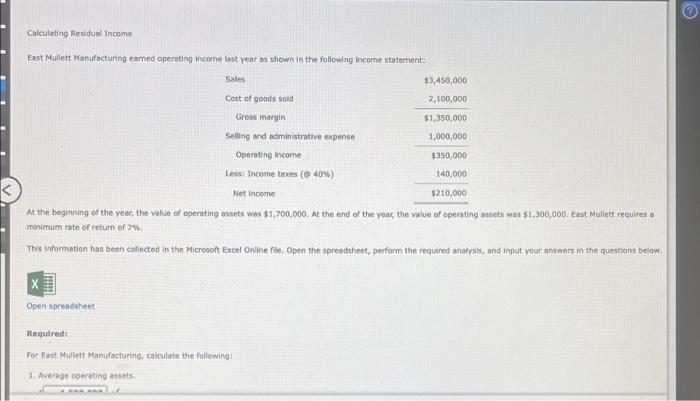

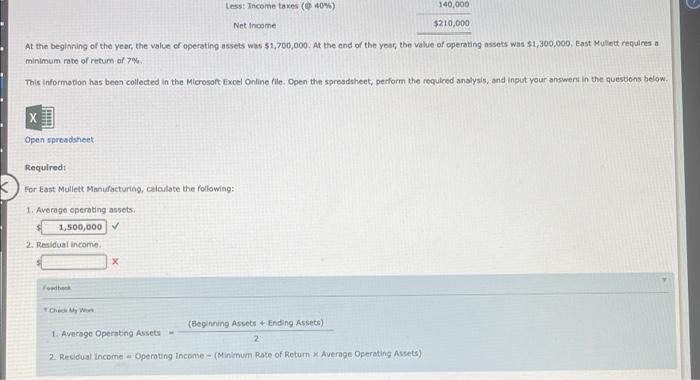

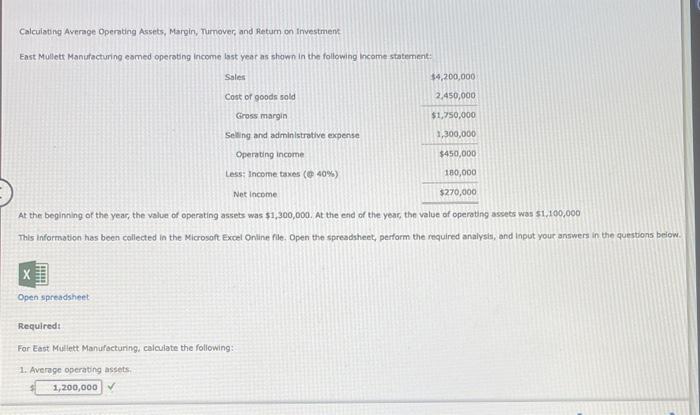

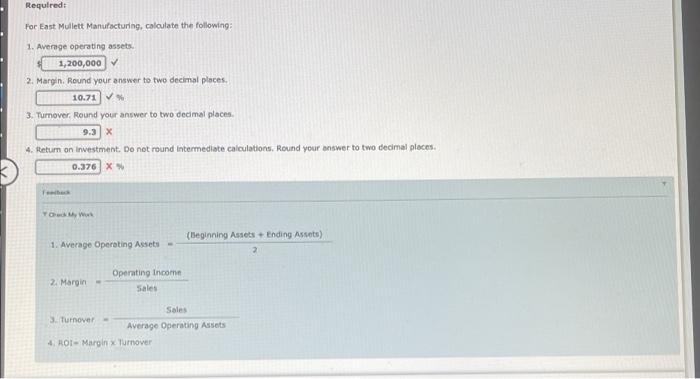

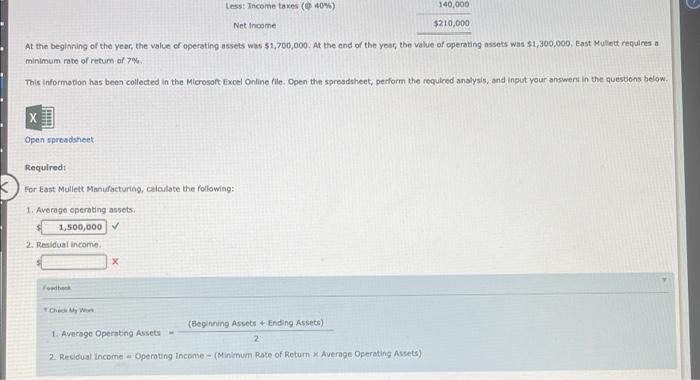

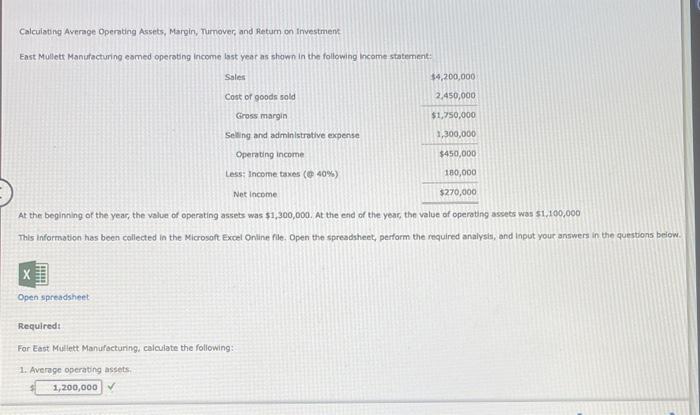

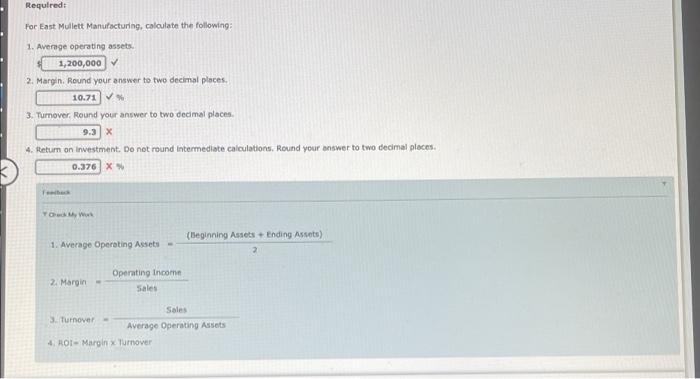

Calculating Residual Income East Mullett Manufacturing eamed operating Income last year as shown in the following income statement: Sales $3,450,000 Cost of goods sold 2.100,000 Gross margin $1,350,000 Selling and administrative expense 1,000,000 Operating income $350,000 Lesst Income taxes (40%) 140,000 Net Income $210,000 At the beginning of the year, the value of operating assets was $1,700,000. At the end of the year, the value of operating assets was $1,300,000. East Mullett requires a minimum rate of retum of 7%. This Information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below: 111111 Open spreadsheet Required: For Fast Mullett Manufacturing, calculate the following: 1 Average operating ass Less Income taxes (40%) 140,000 $210,000 Net Income At the beginning of the year, the value of operating assets was $1,700,000. At the end of the year, the value of operating assets was $1,300,000, East Mullett requires a minimum rate of return of 7% This information has been collected in the Microsoft Excel Online Ille. Open the spreadsheet, perform the required analys, and input your answers in the question below. X Open spreadsheet Required: For East Mulleet Manufacturing, calculate the following: 1. Average operating assets 1,500,000 2. Residual income X Food Oh My W (Beginning Assets + Ending Assets) 1. Average Operating Assets - 2 2. Residual income Operating Income - (Minimum Rate of Return x Average Operating Assets) Calculating Average Operating Assets, Margin, Turnover, and Retum on Investment East Mullett Manufacturing eamed operating income last year as shown in the following income statement Sales $4,200,000 Cost of goods sold 2,450,000 Gross margin $1,750,000 1,300,000 Selling and administrative expense Operating income $450,000 Less: Income taxes (40%) 180,000 Net Income $270,000 At the beginning of the year, the value of operating assets was $1,300,000. At the end of the year, the value of operating assets was $1,100,000 This information has been collected in the Microsoft Excel Online Pile. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Required: For East Mullett Manufacturing calculate the following: 1. Average operating assets 1,200,000 Required: For East Mullett Manufacturing, calculate the following: 1. Average operating assets. 1,200,000 2. Margin. Round your answer to two decimal places 10.71 3. Turnover. Round your answer to two decimal places 9.3 X 4. Return on investment. Do not round Intermediate calculations, Round your answer to two decimal places 0.376X YOW (Beginning Assets + Ending Assets) 1. Average Operating Assets 2. Margin - Operating Income Sales Sales 3. Turnover Average Operating Assets 4. ROT- Margin x Turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started