Answered step by step

Verified Expert Solution

Question

1 Approved Answer

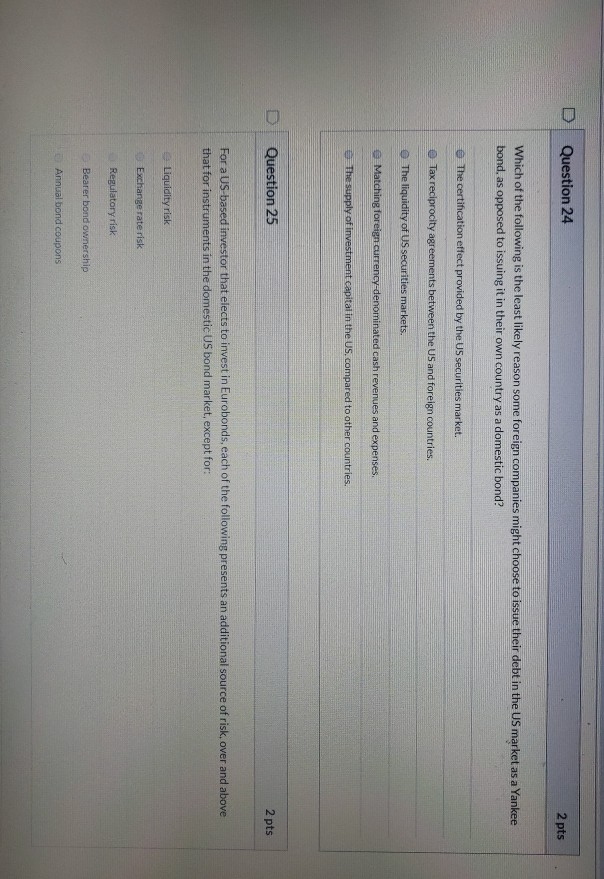

Question 24 2 pts Which of the following is the least likely reason some foreign companies might choose to issue their debt in the US

Question 24 2 pts Which of the following is the least likely reason some foreign companies might choose to issue their debt in the US market as a Yankee bond, as opposed to issuing it in their own country as a domestic bond? The certification effect provided by the US securities market. Tax reciprocity agreements between the US and foreign countries. The liquidity of US securities markets. Matching foreign currency-denominated cash revenues and expenses. The supply of investment capital in the US, compared to other countries. Question 25 2 pts For a US-based investor that elects to invest in Eurobonds, each of the following presents an additional source of risk, over and above that for instruments in the domestic US bond market, except for: Liquidity risk Exchange rate risk Regulatory risk Bearer bond ownership Annual bond coupons

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started