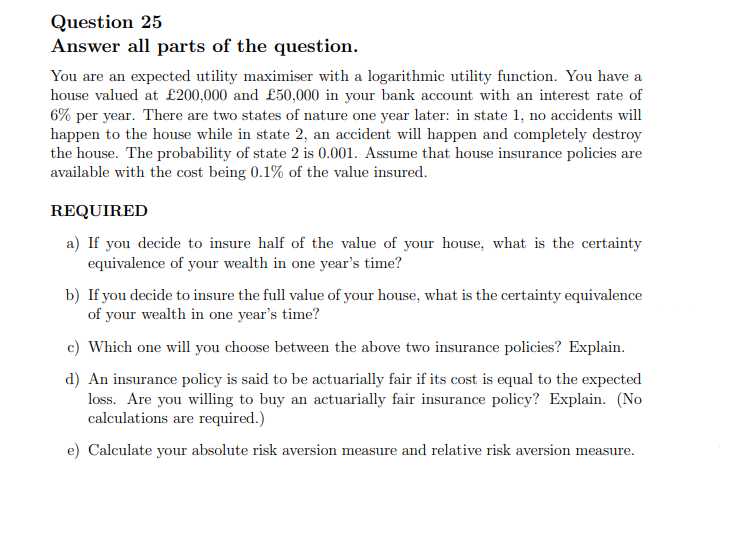

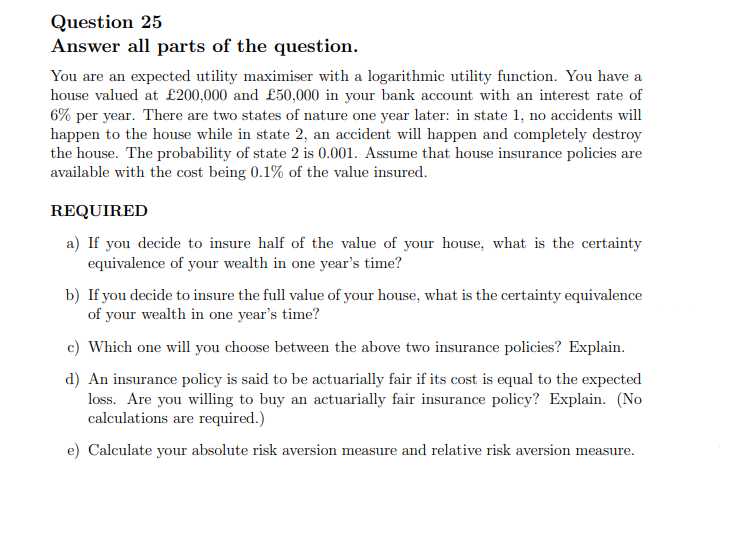

Question 25 Answer all parts of the question. You are an expected utility maximiser with a logarithmic utility function. You have a house valued at 200,000 and 50,000 in your bank account with an interest rate of 6% per year. There are two states of nature one year later: in state 1, no accidents will happen to the house while in state 2, an accident will happen and completely destroy the house. The probability of state 2 is 0.001. Assume that house insurance policies are available with the cost being 0.1% of the value insured. REQUIRED a) If you decide to insure half of the value of your house, what is the certainty equivalence of your wealth in one year's time? b) If you decide to insure the full value of your house, what is the certainty equivalence of your wealth in one year's time? c) Which one will you choose between the above two insurance policies? Explain. d) An insurance policy is said to be actuarially fair if its cost is equal to the expected loss. Are you willing to buy an actuarially fair insurance policy? Explain. (No calculations are required.) e) Calculate your absolute risk aversion measure and relative risk aversion measure. Question 25 Answer all parts of the question. You are an expected utility maximiser with a logarithmic utility function. You have a house valued at 200,000 and 50,000 in your bank account with an interest rate of 6% per year. There are two states of nature one year later: in state 1, no accidents will happen to the house while in state 2, an accident will happen and completely destroy the house. The probability of state 2 is 0.001. Assume that house insurance policies are available with the cost being 0.1% of the value insured. REQUIRED a) If you decide to insure half of the value of your house, what is the certainty equivalence of your wealth in one year's time? b) If you decide to insure the full value of your house, what is the certainty equivalence of your wealth in one year's time? c) Which one will you choose between the above two insurance policies? Explain. d) An insurance policy is said to be actuarially fair if its cost is equal to the expected loss. Are you willing to buy an actuarially fair insurance policy? Explain. (No calculations are required.) e) Calculate your absolute risk aversion measure and relative risk aversion measure