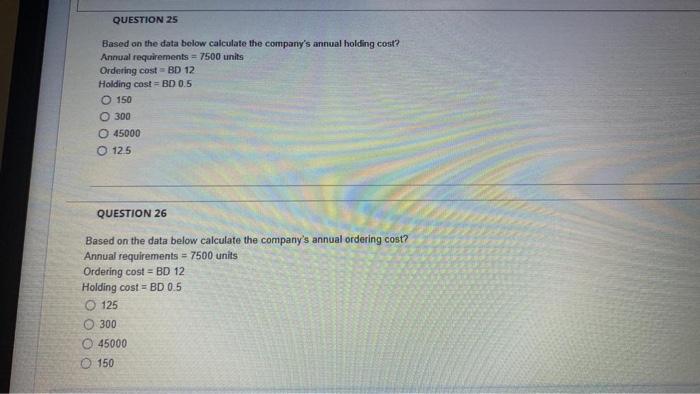

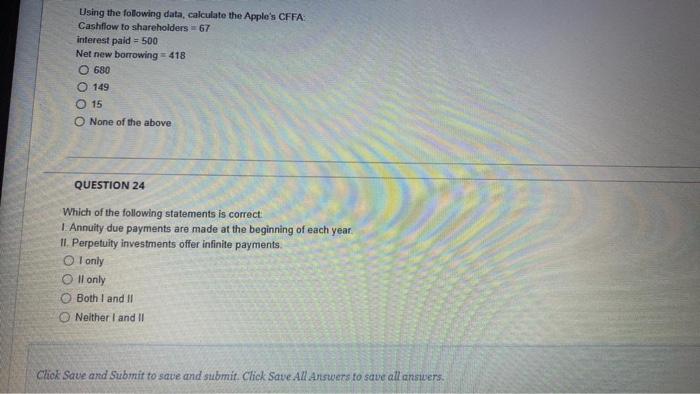

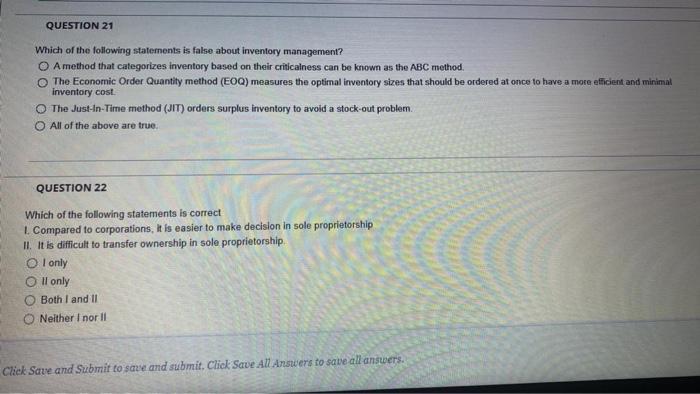

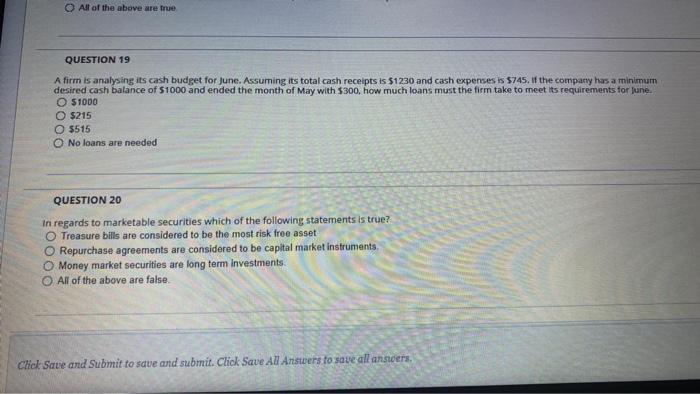

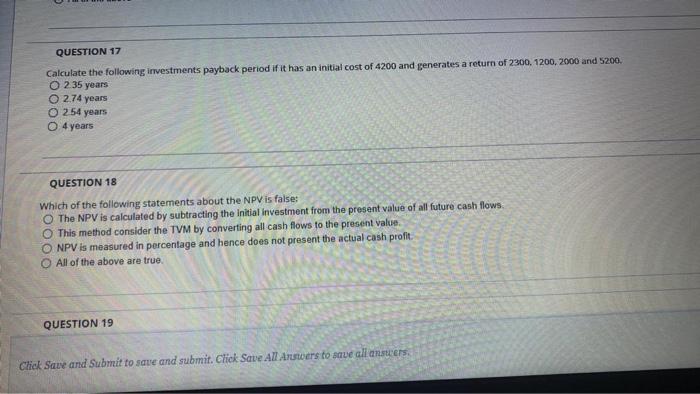

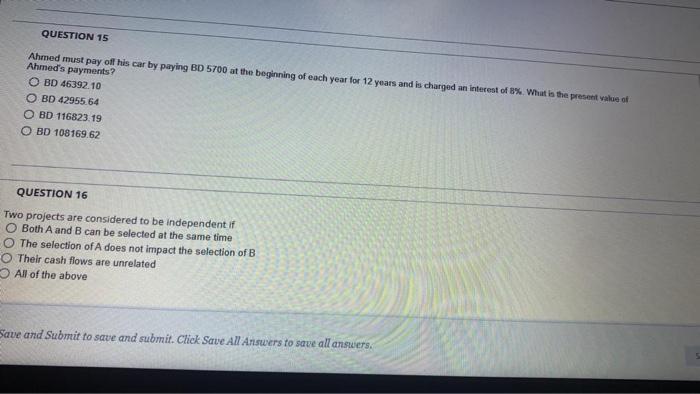

QUESTION 25 Based on the data below calculate the company's annual holding cost? Annual requirements = 7500 units Ordering cost-BD 12 Holding cost = BD 0.5 O150 300 O 45000 12.5 QUESTION 26 Based on the data below calculate the company's annual ordering cost? Annual requirements = 7500 units Ordering cost BD 12 Holding cost BD 0.5 125 300 45000 O 150 Using the following data, calculate the Apple's CFFA Cashflow to shareholders = 67 interest paid = 500 Net new borrowing 418 O 680 149 15 O None of the above. QUESTION 24 Which of the following statements is correct I. Annuity due payments are made at the beginning of each year II. Perpetuity investments offer infinite payments. Ol only Oll only Both I and II Neither I and II Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 21 Which of the following statements is false about inventory management? O A method that categorizes inventory based on their criticalness can be known as the ABC method. O The Economic Order Quantity method (EOQ) measures the optimal inventory sizes that should be ordered at once to have a more efficient and minimal inventory cost. O The Just-In-Time method (JIT) orders surplus inventory to avoid a stock-out problem. O All of the above are true.. QUESTION 22 Which of the following statements is correct 1. Compared to corporations, it is easier to make decision in sole proprietorship II. It is difficult to transfer ownership in sole proprietorship. OI only Oll only Both I and II Neither I nor Il Click Save and Submit to save and submit. Click Save All Answers to save all answers. All of the above are true. QUESTION 19 A firm is analysing its cash budget for June. Assuming its total cash receipts is $1230 and cash expenses is $745. If the company has a minimum desired cash balance of $1000 and ended the month of May with $300, how much loans must the firm take to meet its requirements for June. $1000 O $215 O $515 O No loans are needed i QUESTION 20 In regards to marketable securities which of the following statements is true? O Treasure bills are considered to be the most risk free asset O Repurchase agreements are considered to be capital market instruments. Money market securities are long term investments. All of the above are false. Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 17 Calculate the following investments payback period if it has an initial cost of 4200 and generates a return of 2300, 1200, 2000 and 5200. O 2.35 years O 2.74 years O 254 years O 4 years QUESTION 18 Which of the following statements about the NPV is false: O The NPV is calculated by subtracting the initial investment from the present value of all future cash flows. This method consider the TVM by converting all cash flows to the present value. O NPV is measured in percentage and hence does not present the actual cash profit. All of the above are true. QUESTION 19 Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 15 Ahmed must pay off his car by paying BD 5700 at the beginning of each year for 12 years and is charged an interest of 8%. What is the present value of Ahmed's payments? OBD 46392.10 OBD 42955.64 OBD 116823.19 OBD 108169.62 QUESTION 16 Two projects are considered to be independent if Both A and B can be selected at the same time O The selection of A does not impact the selection of B Their cash flows are unrelated All of the above Save and Submit to save and submit. Click Save All Answers to save all answers