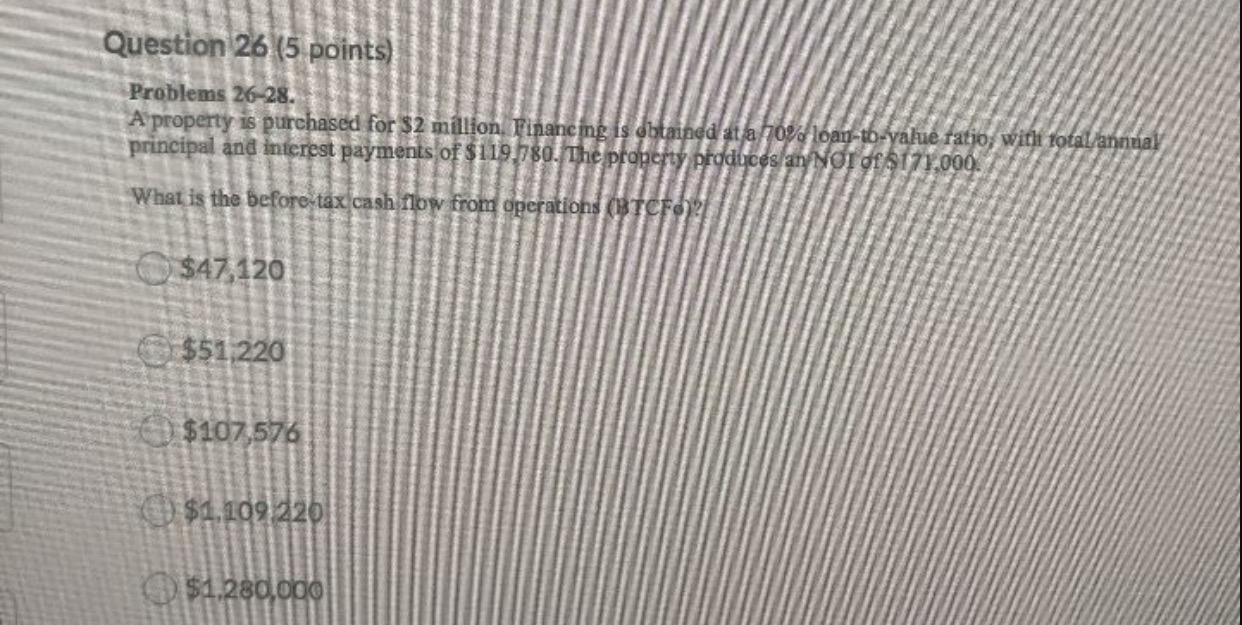

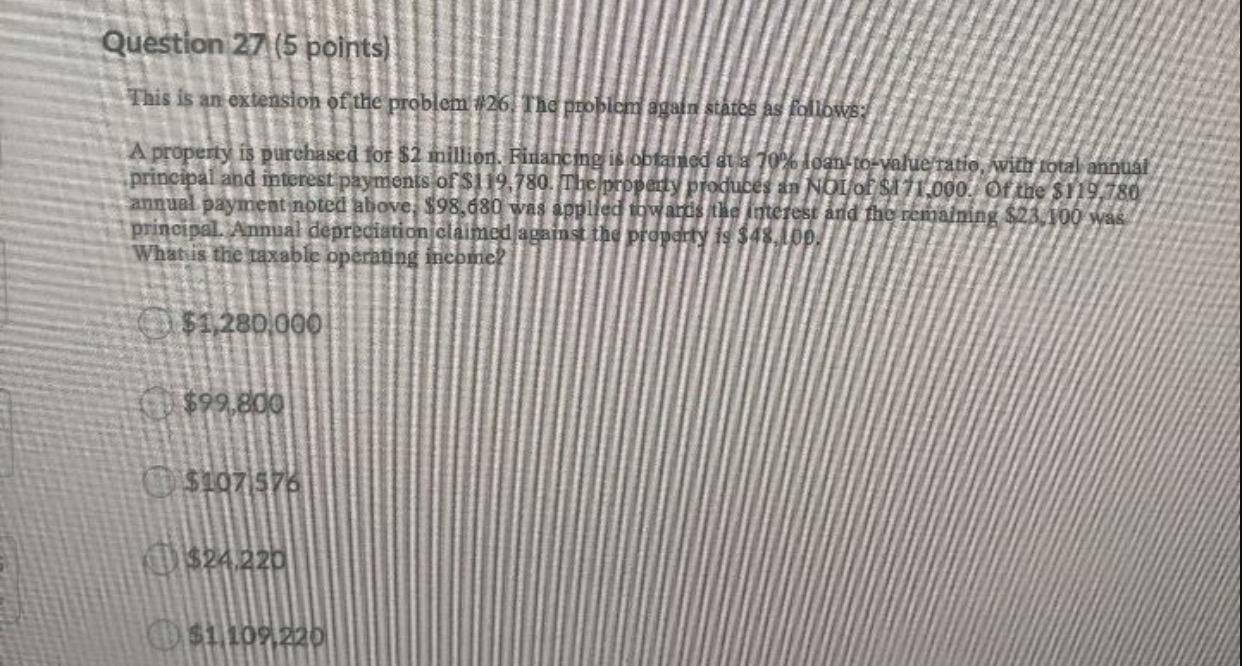

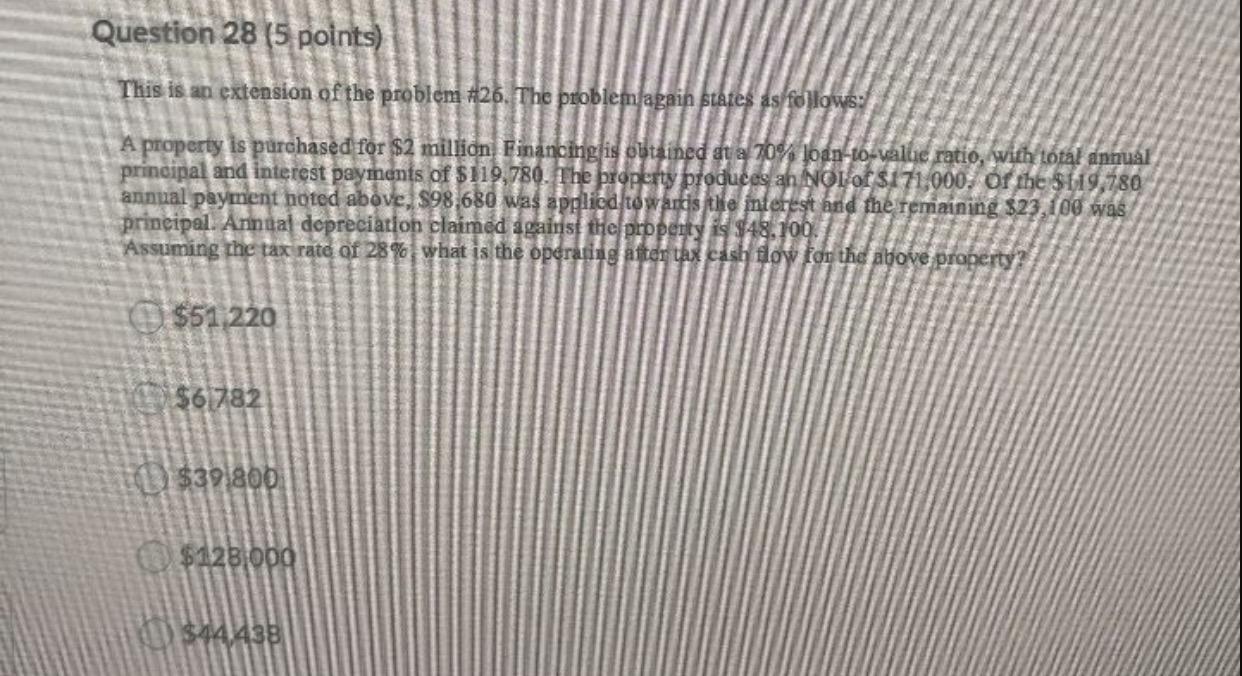

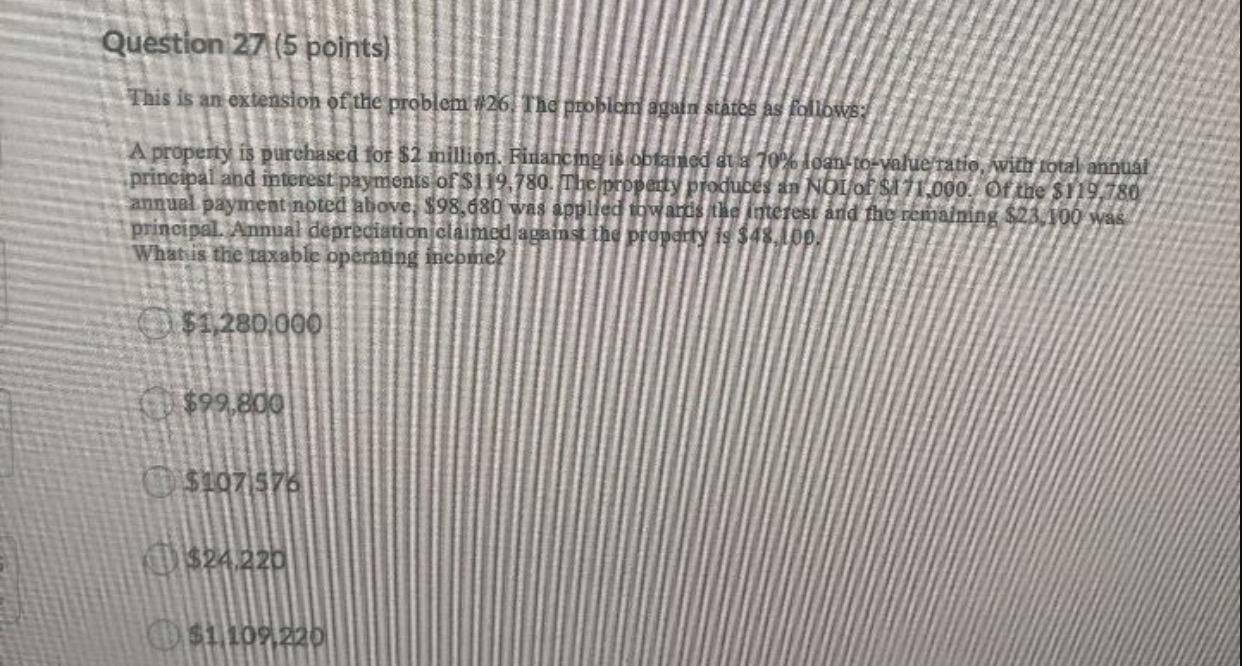

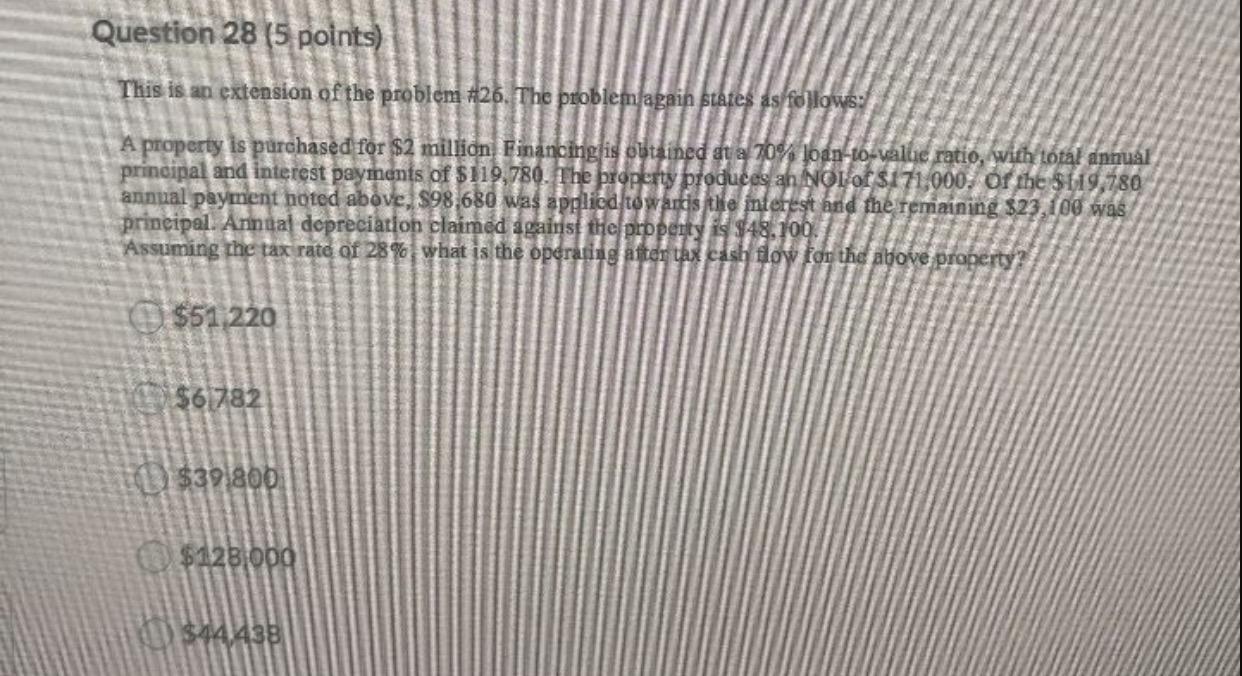

Question 26 (5 points) Problems 26-28. A property is purchased for $2 million. Financing is obtained at a 70% loan-tb-yalie ratio, with total annual principal and interest payments of $119.780. The property produces an NOI Of 171,000. anderen What is the before tax cash flow from operations (BTCF2 $47,120 $51,220 W!!!!!! $107,576 $1,109 220 $1.280,000 Question 27 (5 points) This is an extension of the problem #26. The problem again states as follows: A property is purchased for $2 million. Financing is obtained du 8 70% loan-to-value ratio, with total annual principal and interest payments of $119.780. The property produces an NOL OF $171.000. Of the $119,780 annual payment noted above, $98,680 was applied towards the interest and the remaining $23,100 was principal. Annual depreciation claimed against the property is $48. Lob. What is the taxable operating income $1,280.000 $99,800 $107 576 $24, 220 D$11109,220 Question 28 (5 points) This is an extension of the problem #26. The problem again states as follows: A property is purchased for $2 million Financing is obtained at a 70% loan-to-vallie ratio, with total annual principal and interest payinents of $119,780. The property produces an Nol of $171.000. Of the $119,780 annual payment noted above, 598,680 was applied towards the interest and the remaining $23.100 was principal. Annual depreciation claimed against the property is $48.100. Assuming the tax rate of 28% what is the operating after tax cash flow for the above property? $51 220 $6 782 1!!!! $39 800 $128.00 Question 26 (5 points) Problems 26-28. A property is purchased for $2 million. Financing is obtained at a 70% loan-tb-yalie ratio, with total annual principal and interest payments of $119.780. The property produces an NOI Of 171,000. anderen What is the before tax cash flow from operations (BTCF2 $47,120 $51,220 W!!!!!! $107,576 $1,109 220 $1.280,000 Question 27 (5 points) This is an extension of the problem #26. The problem again states as follows: A property is purchased for $2 million. Financing is obtained du 8 70% loan-to-value ratio, with total annual principal and interest payments of $119.780. The property produces an NOL OF $171.000. Of the $119,780 annual payment noted above, $98,680 was applied towards the interest and the remaining $23,100 was principal. Annual depreciation claimed against the property is $48. Lob. What is the taxable operating income $1,280.000 $99,800 $107 576 $24, 220 D$11109,220 Question 28 (5 points) This is an extension of the problem #26. The problem again states as follows: A property is purchased for $2 million Financing is obtained at a 70% loan-to-vallie ratio, with total annual principal and interest payinents of $119,780. The property produces an Nol of $171.000. Of the $119,780 annual payment noted above, 598,680 was applied towards the interest and the remaining $23.100 was principal. Annual depreciation claimed against the property is $48.100. Assuming the tax rate of 28% what is the operating after tax cash flow for the above property? $51 220 $6 782 1!!!! $39 800 $128.00