Answered step by step

Verified Expert Solution

Question

1 Approved Answer

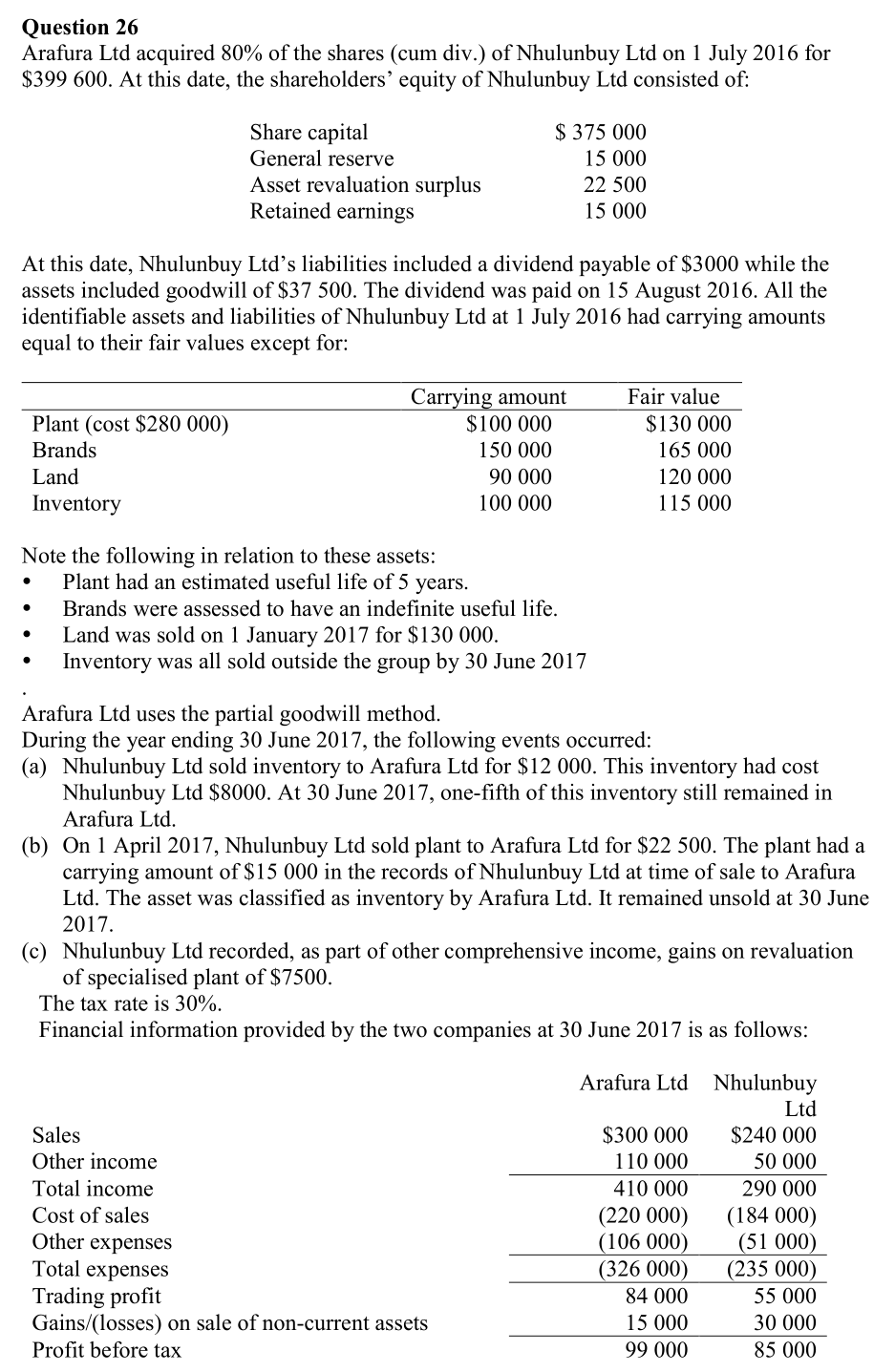

Question 26 Arafura Ltd acquired 80% of the shares (cum div.) of Nhulunbuy Ltd on 1 July 2016 for S399 600. At this date, the

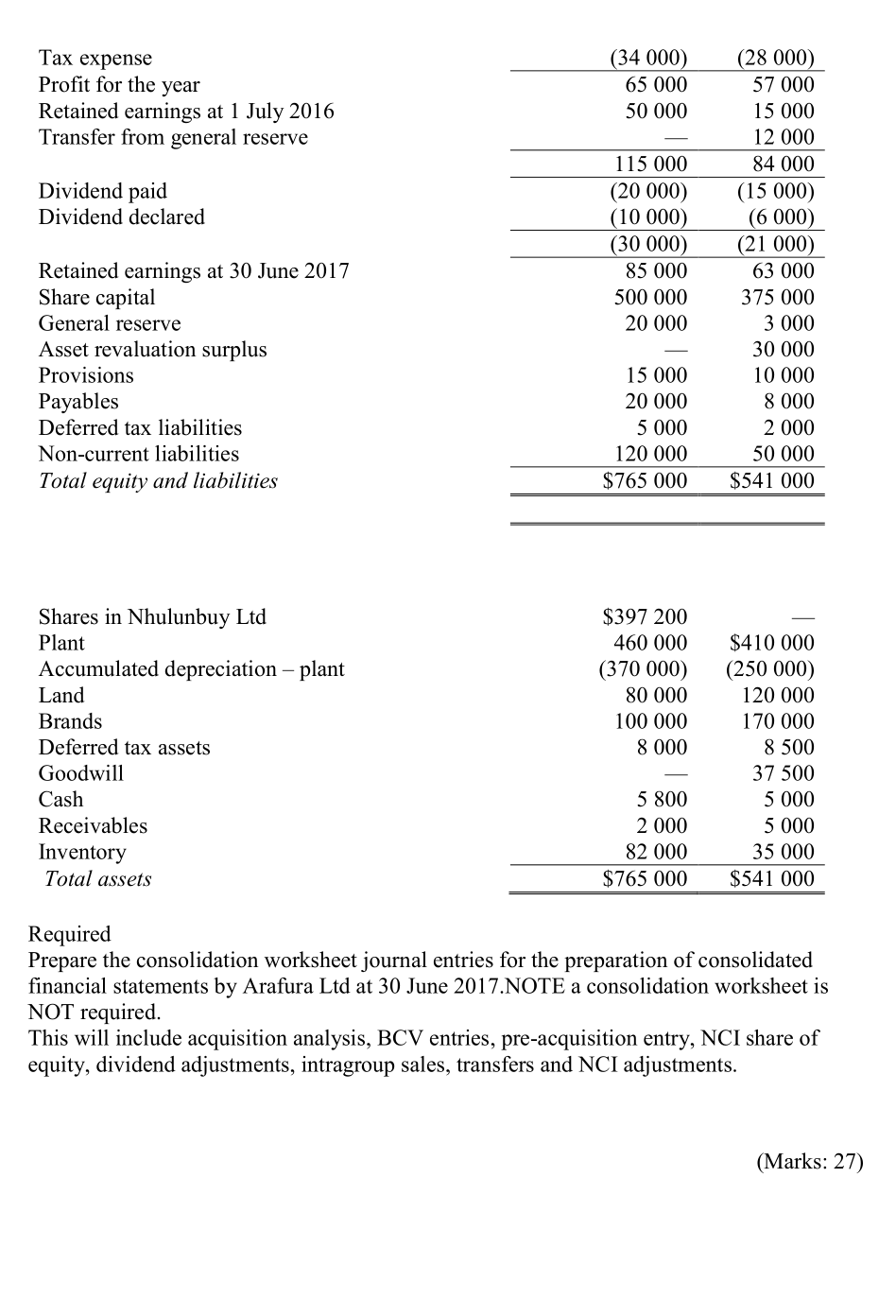

Question 26 Arafura Ltd acquired 80% of the shares (cum div.) of Nhulunbuy Ltd on 1 July 2016 for S399 600. At this date, the shareholders' equity of Nhulunbuy Ltd consisted of: Share capital Jeneral reserve Asset revaluation surplus Retained earnings S 375 000 15 000 22 500 15 000 At this date, Nhulunbuy Ltd's liabilities included a dividend payable of $3000 while the assets included goodwill of S37 500. The dividend was paid on 15 August 2016. All the identifiable assets and liabilities of Nhulunbuy Ltd at 1 July 2016 had carrying amounts equal to their fair values except for: Carrving amount Fair value Plant (cost $280 000) Brands Land Inventory S100 000 150 000 90 000 100 000 S130 000 165 000 120 000 115 000 Note the following in relation to these assets: Plant had an estimated useful life of 5 years. Brands were assessed to have an indefinite useful life. Land was sold on 1 January 2017 for $130 000 . Inventory was all sold outside the group by 30 June 201'7 Arafura Ltd uses the partial goodwill method. During the year ending 30 June 2017, the following events occurred: (a) Nhulunbuy Ltd sold inventory to Arafura Ltd for $12 000. This inventory had cost Nhulunbuy Ltd $8000. At 30 June 2017, one-fifth of this inventory still remained in Arafura Ltd (b) On 1 April 2017, Nhulunbuy Ltd sold plant to Arafura Ltd for $22 500. The plant had a carrying amount of $15 000 in the records of Nhulunbuy Ltd at time of sale to Arafura Ltd. The asset was classified as inventory by Arafura Ltd. It remained unsold at 30 June 2017. (c) Nhulunbuy Ltd recorded, as part of other comprehensive income, gains on revaluation of specialised plant of $7500. The tax rate is 30% Financial information provided by the two companies at 30 June 2017 is as follows: Arafura Ltd Sales Other income Total income Cost of sales Other expenses Total expenses Trading profit Gains/(losses) on sale of non-current assets Profit before tax $300 000 110 000 410 000 (220 000) 106 000 (326 000) 84 000 15 000 99 000 Nhulunbuy Ltd $240 000 50 000 290 000 (184 000) 51 000 (235 000) 55 000 30 000 85 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started