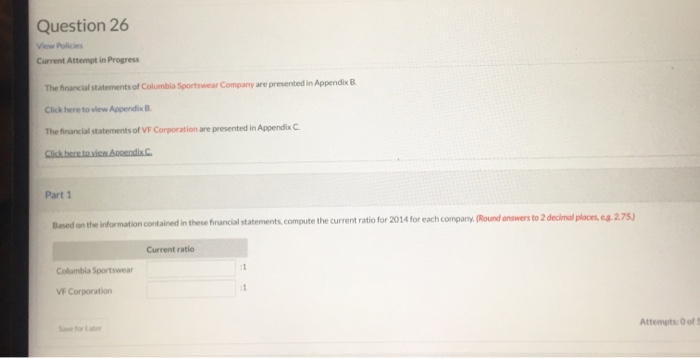

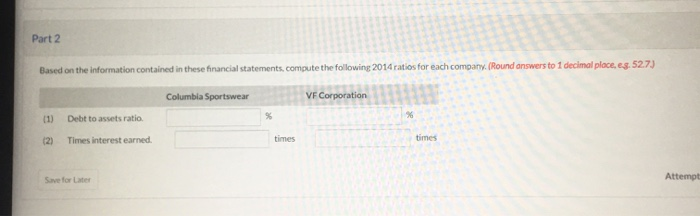

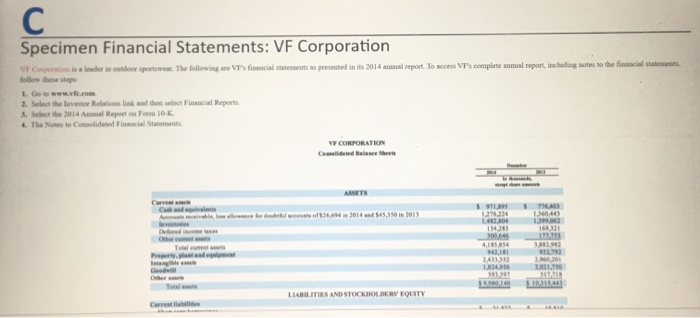

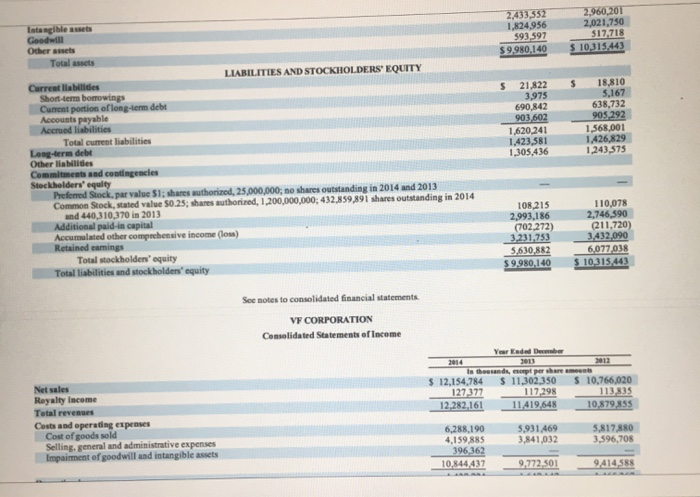

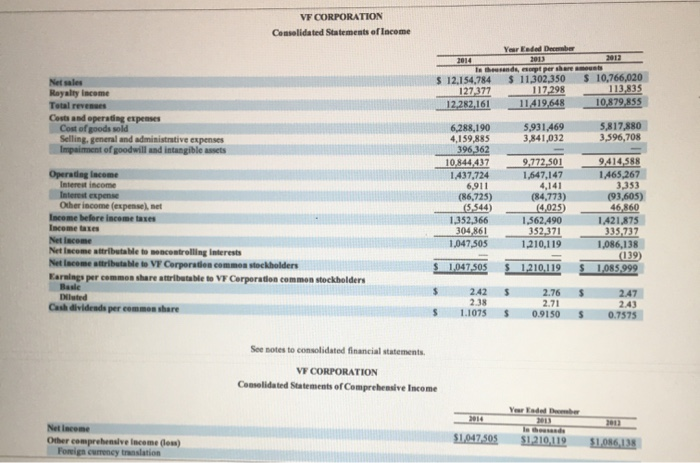

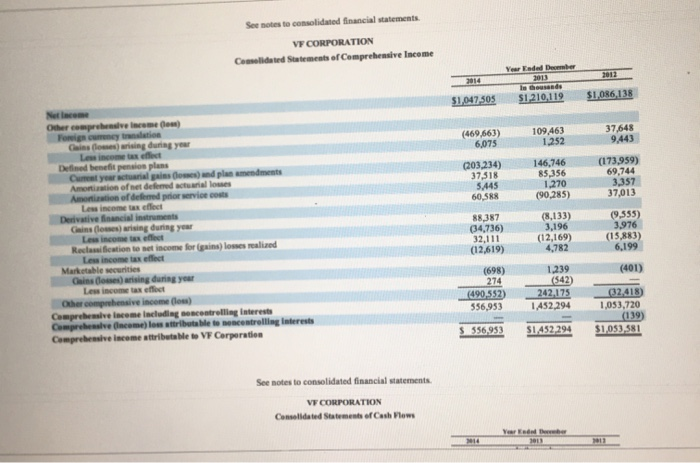

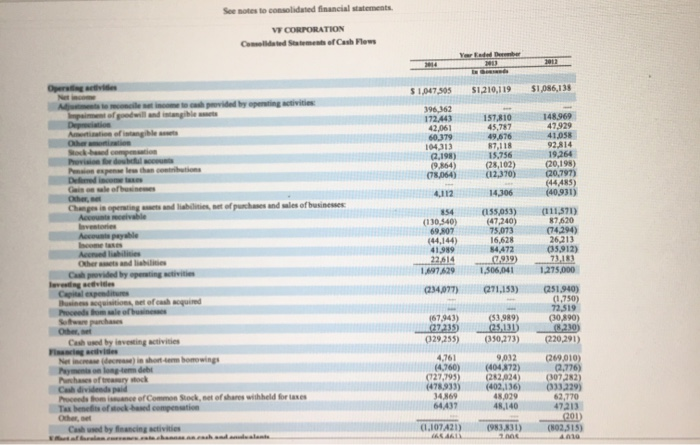

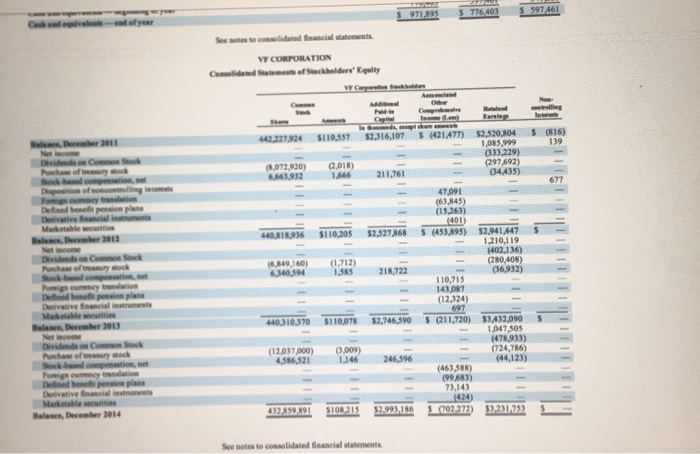

Question 26 View Policies Current Attempt in Progress The financial statements of Columbia Sportswear Company are presented in Appendix B Click here to view Appendix B The financial statements of VF Corporation are presented in Appendix C Click here to view condix Part 1 Based on the information contained in these financial statements, compute the current ratio for 2014 for each company (Round answers to 2 decimal places, s. 2.75) Current ratio Columbia Sportswear VF Corporation Attempts: 0 of Part 2 Based on the information contained in these financial statements, compute the following 2014 ratios for each company. (Round answers to 1 decimal place. es. 52.73 Columbia Sportswear VF Corporation (1) Debt to assets ratio (2) Times interest earned. Save for Later Attempt Specimen Financial Statements: VF Corporation financial statements as presented in 2014 report. To w s VP complete animal report, including notes to the financial statements Viceport a les de sportowe. The following are follow the steps 1. Go to www .com 2. Select the lovestor Relations and th e Financial Reports Select the 2014 An Report on Form 10-K The Note Consolidated Financial Statement VE CORPORATION Coded Base Sheet ANNETS e d el 2014 $45,150 in 2013 143,304 154205 13.0 Other Total 1340 2011.750 G Total 1950,140 51011541 LABILITIES AND STOCKHOLDERS' EQUITY Crew 2,433,552 1,824,956 593,597 $9.980,140 2,960,201 2,021,750 517,718 $ 10,315.443 Intangible assets Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Total current liabilities Long-term debt Other liabilities Commitments and contingencies Stockholders' equity Preferred Stock. par value 51 shares suthorized, 25,000,000, ne shares outstanding in 2014 and 2013 Common Stock, stated value 50.25; shares authorized, 1.200,000,000; 432,859,891 shares outstanding in 2014 and 440,310,370 in 2013 Additional paid in capital Accumulated other comprehensive income (los) Retained carings Total stockholders' equity Total liabilities and stockholders' equity $ 21,822 3,975 690,842 903,602 1.620.241 1,423,581 1,305,436 18,810 5,167 638,732 905,292 1,568,001 1.426.829 1,243,575 108,215 2,993,186 (702272) 3.231,753 5,630.882 $9.980,140 110,078 2,746,590 (211,720) 3,432,090 6,077,038 $ 10,315.443 See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Income Ia h $ 12,154,784 127377 12,282,161 Yerde Dember 2011 ands. be $ 11,302,350 117,298 11.419.648 $ 10,766,020 113,335 10,879,855 Net sales Royalty Income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets 5,931.469 3,841,032 5.817,880 3,596,708 6,288,190 4.159.885 396,362 10.844,437 9.772.501 9.414588 VF CORPORATION Consolidated Statements of Income Yorded Debe I thousands of per there must 12.154,784 $11.302,350 $ 10,766,020 127 377 117,298 113.835 12,282,161 11419.648 10,879,855 Net sales Royalty Income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets 5.931.469 3,841,032 5.817,880 3,596,708 9,772,501 1,647,147 Operating income Interest income Interest expense Other income (expensel.net Income before income taxes Income taxes Net Income Net Income tributable to encontrolling interests Netlacome attributable to V Corporation common stockholders Earnings per common share attributable to V Corporation common stockholders Basle luted Cash dividends per common share 6,288,190 4.159.885 396, 362 10.844,437 1.437,724 6,911 (86,725) (5.544) 1.352,366 304,861 1,047.505 (84,773) 14.025) 1,562,490 352 371 1,210,119 9.414,588 1.465,267 3,353 (93,605) 46,860 1421,875 335.737 1,086,138 (139) 1.085.999 $ 1.047505 $ 1.210.119 $ 2.76 $ 2425 2.38 1.1075 $ 2.71 2.47 2141 0.7575 0.9150 S See notes to consolidated financial statements VE CORPORATION Consolidated Statements of Comprehensive Income Year Eaded the In the sand Net Income Other comprehensive Income dow) Foreign currency translation $1,047,505 $1,210,119 $1,086,138 See notes to consolidated financial statements. VE CORPORATION Calidated Statements of Comprehensive Income $1,047505 SI 210,119 SI 086,138 (469,663) 6,075 109,463 1.252 37,648 9.443 (203.234) 37.518 5445 60,588 146,746 85,356 1,270 (90,285) (173,959) 69.744 3.357 37,013 Netice Other comprehensive c om) Fiction Gains fo r sing during year Les income effect Dend benefit pension plans Cataractal gains dondplas amendments Amortation of net defend actuallows Amortion of defensed prior service costs Low income tax effect Derivative financial instruments Gains ( es) arising during year Les income tax effect Reclassification to set income for gains) losses realized Les income tax effect Marketable securities Gains d es arising during your Less income tax effect Other comprehensive income ou) Comprehensive Income including moncontrolling interests Comprehensive income) los tributable to controlling interest Comprehensive income attributable to VF Corporation 88.387 (34,736) 32.111 (12,619) (8,133) 3,196 (12,169) 4,782 (9,555) 3.976 (15,883) 6,199 (698) (401) 274 1.239 (542) 242,175 1,452,294 (490,552) 556,953 (32.418) 1,053,720 039) $1,053,581 $ 556,953 S1452.294 See notes to consolidated financial statements VF CORPORATION Consolidated Statements of Cash Flows See notes to consolidated financial statements W CORPORATION ated States of Cash Flows C Opera $ 1.047305 $1,210,119 S1096.13 M i lich ided by penting activities pantofwill and stangiblemet 14R.969 Ohio Socked 396162 172443 42,061 60379 104313 198) 1954) (18.054) 157,810 45,787 49,676 87.118 15.756 (28,102) 41,058 92.814 19,264 (20,195) (20,797) (44.485) (40,931) itons (12.370) Pee l than Defectes Gaiss wohne 4,112 14306 and li s t of purchases and wales of businesses Chege is opening Active Apaye (130.540) 69 807 (44,144) 41.989 22.614 1.497629 (155.053) (47,240) 75,073 16.628 54,472 919) 1,506,041 (111,571) 87.620 (74.294) 26.213 5,912) 73.131 1.275.000 (234,077) (271,153) Otheranda Cu provided by operating activities leveg die Capital expedie Bes t of each cuired Poceede hoofhuis Software purchases Oh Cashed by lavesting activities 167,943) 37.235 (29,255) (53.989) 25,131) (350,273) (251.940) (1.750) 72.519 (30.890) (210) (220,291) P Ne w short-term bomwings o tem debt shases of treasury stock Cash dividended c omince of Come Socket of shares withheld forres To benefits of stock based compensation Other Cassed by financing activities 4.761 (4.760) (927,795) (478.933) 1469 64437 9032 (404,872) 22024) (402,136) 48,029 4140 269 010) 2,776) (022821 (33.229) 62.770 47213 (1.107421) (983,831) (NO2.5151 Settec t ed financial statements VT CORPORATION a se Statement of Stockholders' Equity C Ada Other Cere (816) 5110,557 0227.924 52,316,107 S (421477) B , December 2011 52:520 104 1,085.999 (333,229) (297692) (34435) (072.920) 561.932 2018) 1.666 211,761 47.091 (63,845) (15.263) (401) $(453,895) 440.818.936 $110,205 $2.527368 Muhase after stock Disposition of controlling Foreign cu t ie Defined benefi cios plans Derivative franci Matthew Bal , December 2012 come Dividendes Stock Puhase after och For m ation Defined bene pension plans Derivative financial instruments Maritable w rites Bales, December 2013 52,941.447 1.210.119 (402,136) (280,408) (36,932) 49,160) 6.160.594 (1,712) 1,585 218,722 110,715 141.087 (12.124) 410310370 $110.078 52,746.590 $ 211,720) 33432.090 1.047,505 (478,933) (724,786) (44,123) (12037000) 4586.321 (009) 1.146 246,596 Purchase of t urystock Sock-based competin, et Poris currency r ation Defined poplane Derivative financial instruments Marble crities Balance, December 2014 (463.588) (99 683) 73.143 1424) 3.002.272) 432359,891 S10R 215 $2.99,186 33,231,753 See notes to consolidated financial statements Question 26 View Policies Current Attempt in Progress The financial statements of Columbia Sportswear Company are presented in Appendix B Click here to view Appendix B The financial statements of VF Corporation are presented in Appendix C Click here to view condix Part 1 Based on the information contained in these financial statements, compute the current ratio for 2014 for each company (Round answers to 2 decimal places, s. 2.75) Current ratio Columbia Sportswear VF Corporation Attempts: 0 of Part 2 Based on the information contained in these financial statements, compute the following 2014 ratios for each company. (Round answers to 1 decimal place. es. 52.73 Columbia Sportswear VF Corporation (1) Debt to assets ratio (2) Times interest earned. Save for Later Attempt Specimen Financial Statements: VF Corporation financial statements as presented in 2014 report. To w s VP complete animal report, including notes to the financial statements Viceport a les de sportowe. The following are follow the steps 1. Go to www .com 2. Select the lovestor Relations and th e Financial Reports Select the 2014 An Report on Form 10-K The Note Consolidated Financial Statement VE CORPORATION Coded Base Sheet ANNETS e d el 2014 $45,150 in 2013 143,304 154205 13.0 Other Total 1340 2011.750 G Total 1950,140 51011541 LABILITIES AND STOCKHOLDERS' EQUITY Crew 2,433,552 1,824,956 593,597 $9.980,140 2,960,201 2,021,750 517,718 $ 10,315.443 Intangible assets Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Total current liabilities Long-term debt Other liabilities Commitments and contingencies Stockholders' equity Preferred Stock. par value 51 shares suthorized, 25,000,000, ne shares outstanding in 2014 and 2013 Common Stock, stated value 50.25; shares authorized, 1.200,000,000; 432,859,891 shares outstanding in 2014 and 440,310,370 in 2013 Additional paid in capital Accumulated other comprehensive income (los) Retained carings Total stockholders' equity Total liabilities and stockholders' equity $ 21,822 3,975 690,842 903,602 1.620.241 1,423,581 1,305,436 18,810 5,167 638,732 905,292 1,568,001 1.426.829 1,243,575 108,215 2,993,186 (702272) 3.231,753 5,630.882 $9.980,140 110,078 2,746,590 (211,720) 3,432,090 6,077,038 $ 10,315.443 See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Income Ia h $ 12,154,784 127377 12,282,161 Yerde Dember 2011 ands. be $ 11,302,350 117,298 11.419.648 $ 10,766,020 113,335 10,879,855 Net sales Royalty Income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets 5,931.469 3,841,032 5.817,880 3,596,708 6,288,190 4.159.885 396,362 10.844,437 9.772.501 9.414588 VF CORPORATION Consolidated Statements of Income Yorded Debe I thousands of per there must 12.154,784 $11.302,350 $ 10,766,020 127 377 117,298 113.835 12,282,161 11419.648 10,879,855 Net sales Royalty Income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets 5.931.469 3,841,032 5.817,880 3,596,708 9,772,501 1,647,147 Operating income Interest income Interest expense Other income (expensel.net Income before income taxes Income taxes Net Income Net Income tributable to encontrolling interests Netlacome attributable to V Corporation common stockholders Earnings per common share attributable to V Corporation common stockholders Basle luted Cash dividends per common share 6,288,190 4.159.885 396, 362 10.844,437 1.437,724 6,911 (86,725) (5.544) 1.352,366 304,861 1,047.505 (84,773) 14.025) 1,562,490 352 371 1,210,119 9.414,588 1.465,267 3,353 (93,605) 46,860 1421,875 335.737 1,086,138 (139) 1.085.999 $ 1.047505 $ 1.210.119 $ 2.76 $ 2425 2.38 1.1075 $ 2.71 2.47 2141 0.7575 0.9150 S See notes to consolidated financial statements VE CORPORATION Consolidated Statements of Comprehensive Income Year Eaded the In the sand Net Income Other comprehensive Income dow) Foreign currency translation $1,047,505 $1,210,119 $1,086,138 See notes to consolidated financial statements. VE CORPORATION Calidated Statements of Comprehensive Income $1,047505 SI 210,119 SI 086,138 (469,663) 6,075 109,463 1.252 37,648 9.443 (203.234) 37.518 5445 60,588 146,746 85,356 1,270 (90,285) (173,959) 69.744 3.357 37,013 Netice Other comprehensive c om) Fiction Gains fo r sing during year Les income effect Dend benefit pension plans Cataractal gains dondplas amendments Amortation of net defend actuallows Amortion of defensed prior service costs Low income tax effect Derivative financial instruments Gains ( es) arising during year Les income tax effect Reclassification to set income for gains) losses realized Les income tax effect Marketable securities Gains d es arising during your Less income tax effect Other comprehensive income ou) Comprehensive Income including moncontrolling interests Comprehensive income) los tributable to controlling interest Comprehensive income attributable to VF Corporation 88.387 (34,736) 32.111 (12,619) (8,133) 3,196 (12,169) 4,782 (9,555) 3.976 (15,883) 6,199 (698) (401) 274 1.239 (542) 242,175 1,452,294 (490,552) 556,953 (32.418) 1,053,720 039) $1,053,581 $ 556,953 S1452.294 See notes to consolidated financial statements VF CORPORATION Consolidated Statements of Cash Flows See notes to consolidated financial statements W CORPORATION ated States of Cash Flows C Opera $ 1.047305 $1,210,119 S1096.13 M i lich ided by penting activities pantofwill and stangiblemet 14R.969 Ohio Socked 396162 172443 42,061 60379 104313 198) 1954) (18.054) 157,810 45,787 49,676 87.118 15.756 (28,102) 41,058 92.814 19,264 (20,195) (20,797) (44.485) (40,931) itons (12.370) Pee l than Defectes Gaiss wohne 4,112 14306 and li s t of purchases and wales of businesses Chege is opening Active Apaye (130.540) 69 807 (44,144) 41.989 22.614 1.497629 (155.053) (47,240) 75,073 16.628 54,472 919) 1,506,041 (111,571) 87.620 (74.294) 26.213 5,912) 73.131 1.275.000 (234,077) (271,153) Otheranda Cu provided by operating activities leveg die Capital expedie Bes t of each cuired Poceede hoofhuis Software purchases Oh Cashed by lavesting activities 167,943) 37.235 (29,255) (53.989) 25,131) (350,273) (251.940) (1.750) 72.519 (30.890) (210) (220,291) P Ne w short-term bomwings o tem debt shases of treasury stock Cash dividended c omince of Come Socket of shares withheld forres To benefits of stock based compensation Other Cassed by financing activities 4.761 (4.760) (927,795) (478.933) 1469 64437 9032 (404,872) 22024) (402,136) 48,029 4140 269 010) 2,776) (022821 (33.229) 62.770 47213 (1.107421) (983,831) (NO2.5151 Settec t ed financial statements VT CORPORATION a se Statement of Stockholders' Equity C Ada Other Cere (816) 5110,557 0227.924 52,316,107 S (421477) B , December 2011 52:520 104 1,085.999 (333,229) (297692) (34435) (072.920) 561.932 2018) 1.666 211,761 47.091 (63,845) (15.263) (401) $(453,895) 440.818.936 $110,205 $2.527368 Muhase after stock Disposition of controlling Foreign cu t ie Defined benefi cios plans Derivative franci Matthew Bal , December 2012 come Dividendes Stock Puhase after och For m ation Defined bene pension plans Derivative financial instruments Maritable w rites Bales, December 2013 52,941.447 1.210.119 (402,136) (280,408) (36,932) 49,160) 6.160.594 (1,712) 1,585 218,722 110,715 141.087 (12.124) 410310370 $110.078 52,746.590 $ 211,720) 33432.090 1.047,505 (478,933) (724,786) (44,123) (12037000) 4586.321 (009) 1.146 246,596 Purchase of t urystock Sock-based competin, et Poris currency r ation Defined poplane Derivative financial instruments Marble crities Balance, December 2014 (463.588) (99 683) 73.143 1424) 3.002.272) 432359,891 S10R 215 $2.99,186 33,231,753 See notes to consolidated financial statements