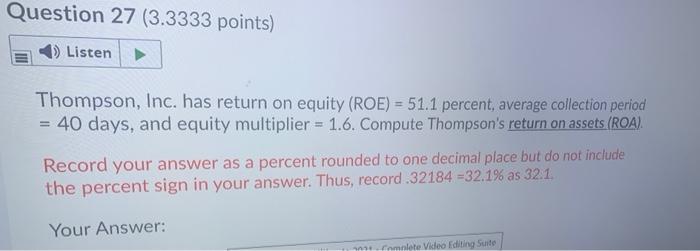

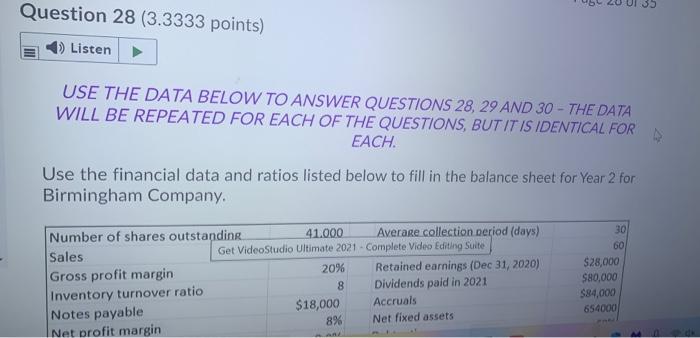

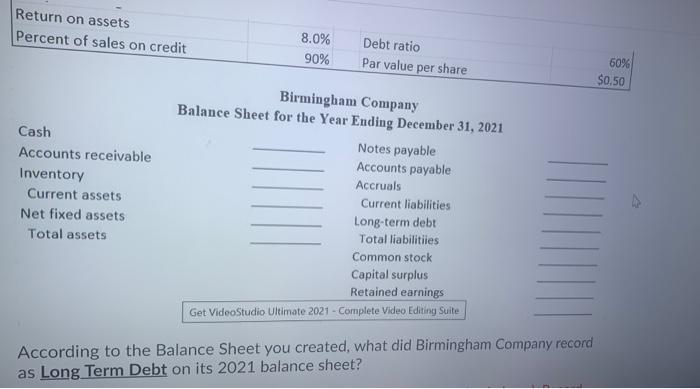

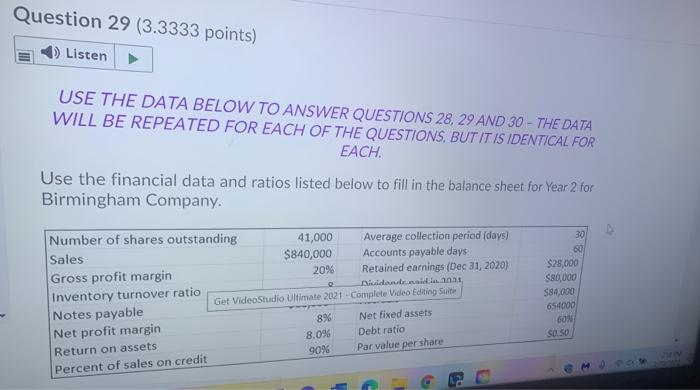

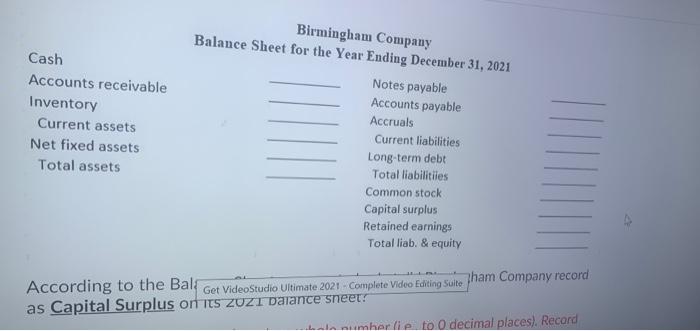

Question 27 (3.3333 points) Listen Thompson, Inc. has return on equity (ROE) = 51.1 percent, average collection period 40 days, and equity multiplier = 1.6. Compute Thompson's return on assets (ROA) Record your answer as a percent rounded to one decimal place but do not include the percent sign in your answer. Thus, record.32184 = 32.1% as 32.1. Your Answer: mlete Video Editing Suite Question 28 (3.3333 points) 1) Listen USE THE DATA BELOW TO ANSWER QUESTIONS 28, 29 AND 30 - THE DATA WILL BE REPEATED FOR EACH OF THE QUESTIONS, BUT IT IS IDENTICAL FOR EACH Use the financial data and ratios listed below to fill in the balance sheet for Year 2 for Birmingham Company. Number of shares outstanding 41.000 Average collection period Sales Get Video Studio Ultimate 2021 - Complete Video Editing Suite Gross profit margin 20% Retained earnings (Dec 31, 2020) 8 Inventory turnover ratio Dividends paid in 2021 Notes payable $18,000 Accruals 8% Net fixed assets Net profit margin 30 60 $28,000 $80,000 $84,000 654000 Return on assets Percent of sales on credit 8.0% 90% Debt ratio Par value per share 6096 $0,50 Cash Accounts receivable Inventory Current assets Net fixed assets Total assets Birmingham Company Balance Sheet for the Year Ending December 31, 2021 Notes payable Accounts payable Accruals Current liabilities Long-term debt Total liabilities Common stock Capital surplus Retained earnings Get Video Studio Ultimate 2021 - Complete Video Editing Suite According to the Balance Sheet you created, what did Birmingham Company record as Long Term Debt on its 2021 balance sheet? Question 29 (3.3333 points) Listen USE THE DATA BELOW TO ANSWER QUESTIONS 28, 29 AND 30 - THE DATA WILL BE REPEATED FOR EACH OF THE QUESTIONS, BUT IT IS IDENTICAL FOR EACH Use the financial data and ratios listed below to fill in the balance sheet for Year 2 for Birmingham Company. Number of shares outstanding 41,000 Average collection period (days) Sales $840,000 Accounts payable days Gross profit margin 20% Retained earnings (Dec 31, 2020) Inventory turnover ratio Dividendid 30 Get Video Studio Ultimate 2021 - Complete Video Editing Site Notes payable Net fixed assets Net profit margin 8.0% Debt ratio Return on assets Par value per share Percent of sales on credit 30 60 $28,000 $80,000 $84,000 654000 8% COM Soso 90% G Cash Accounts receivable Inventory Current assets Net fixed assets Total assets Birmingham Company Balance Sheet for the Year Ending December 31, 2021 Notes payable Accounts payable Accruals Current liabilities Long-term debt Total liabilities Common stock Capital surplus Retained earnings Total liab. & equity According to the Bals Get VideoStudio Ultimate 2021 - Complete Video Editing Suite ham Company record as Capital Surplus on its ZUZI Darance sheet: numharlie to O decimal places). Record