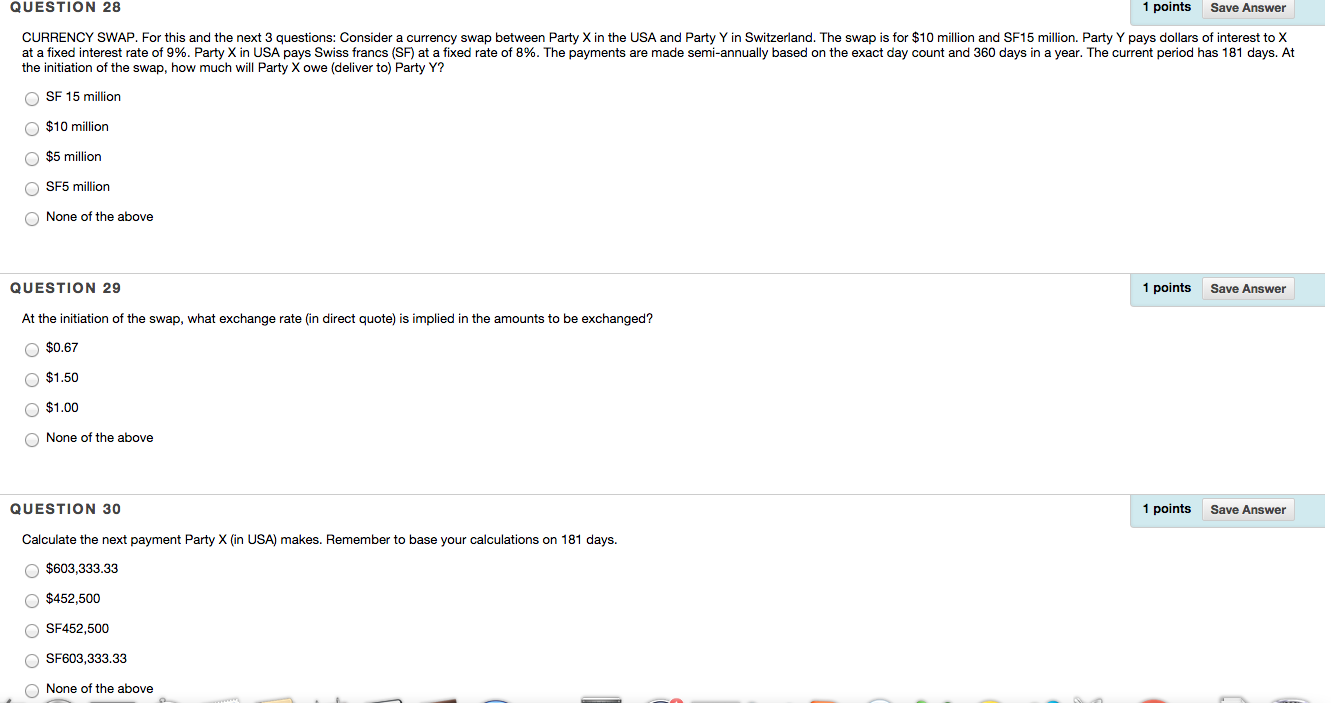

Question: QUESTION 28 1 points Save Answer CURRENCY SWAP. For this and the next 3 questions: Consider a currency swap between Party X in the USA

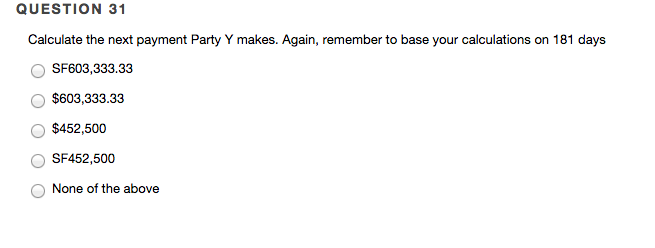

QUESTION 28 1 points Save Answer CURRENCY SWAP. For this and the next 3 questions: Consider a currency swap between Party X in the USA and Party Y in Switzerland. The swap is for $10 million and SF15 million. Party Y pays dollars of interest to X at a fixed interest rate of 9%. Party X in USA pays Swiss francs (SF) at a fixed rate of 8%. The payments are made semi-annually based on the exact day count and 360 days in a year. The current period has 181 days. At the initiation of the swap, how much will Party X owe (deliver to) Party Y"? SF 15 million $10 million $5 milliorn SF5 million None of the above QUESTION 29 1 points Save Answer At the initiation of the swap, what exchange rate (in direct quote) is implied in the amounts to be exchanged? $0.67 $1.50 o $1.00 None of the above QUESTION 30 1 points Save Answer Calculate the next payment Party X (in USA) makes. Remember to base your calculations on 181 days. $603,333.33 $452,500 SF452,500 SF603,333.33 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts