Answered step by step

Verified Expert Solution

Question

1 Approved Answer

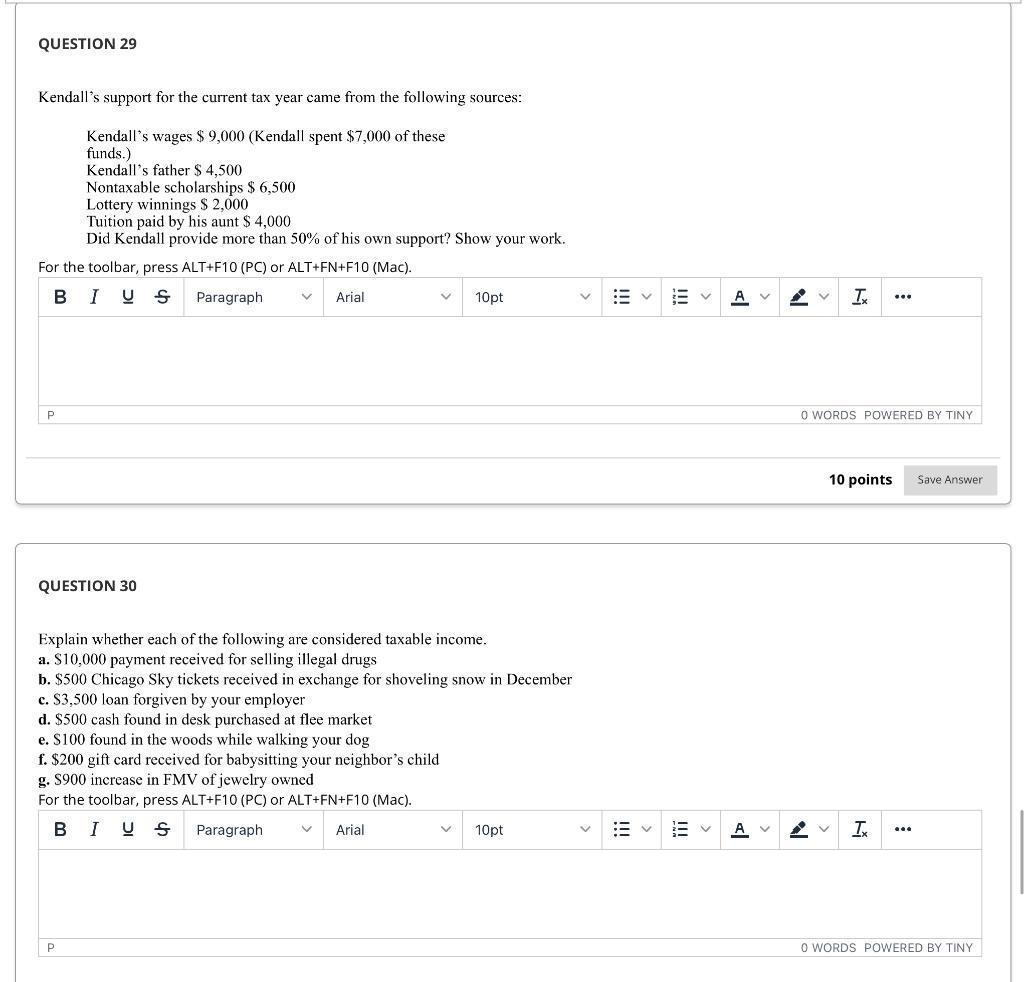

QUESTION 29 Kendall's support for the current tax year came from the following sources: Kendall's wages $9,000 (Kendall spent $7,000 of these funds.) Kendall's

QUESTION 29 Kendall's support for the current tax year came from the following sources: Kendall's wages $9,000 (Kendall spent $7,000 of these funds.) Kendall's father $ 4,500 Nontaxable scholarships $ 6,500 Lottery winnings $2,000 Tuition paid by his aunt $ 4,000 Did Kendall provide more than 50% of his own support? Show your work. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI US P QUESTION 30 Paragraph Arial 10pt Explain whether each of the following are considered taxable income. a. $10,000 payment received for selling illegal drugs b. $500 Chicago Sky tickets received in exchange for shoveling snow in December c. $3,500 loan forgiven by your employer d. $500 cash found in desk purchased at flee market e. S100 found in the woods while walking your dog f. $200 gift card received for babysitting your neighbor's child g. $900 increase in FMV of jewelry owned For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial P !!! A Ix 0 WORDS POWERED BY TINY 10 points Save Answer 10pt A I. 0 WORDS POWERED BY TINY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answer Kendalls income for the current tax year is as follows Wages 9000 after spending 7000 So he m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started