Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2B & 2C please, thanks Question 2 (25 Marks) Megan and Ray Limited (hereafter referred to as Megan and Ray or the company) is

Question 2B & 2C please, thanks

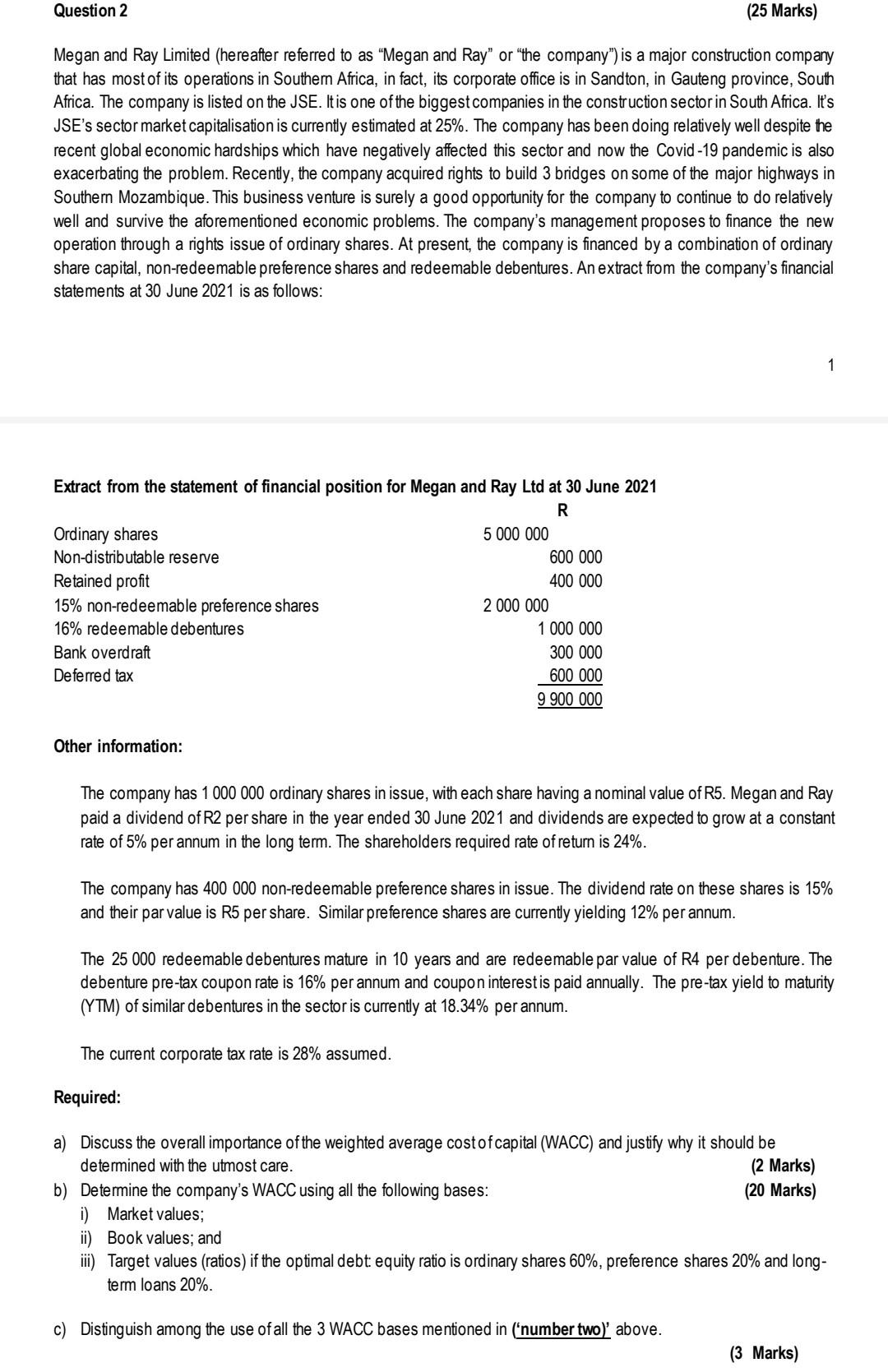

Question 2 (25 Marks) Megan and Ray Limited (hereafter referred to as "Megan and Ray" or "the company") is a major construction company that has most of its operations in Southem Africa, in fact, its corporate office is in Sandton, in Gauteng province, South Africa. The company is listed on the JSE. It is one of the biggest companies in the construction sector in South Africa. It's JSE's sector market capitalisation is currently estimated at 25\%. The company has been doing relatively well despite the recent global economic hardships which have negatively affected this sector and now the Covid-19 pandemic is also exacerbating the problem. Recently, the company acquired rights to build 3 bridges on some of the major highways in Southern Mozambique. This business venture is surely a good opportunity for the company to continue to do relatively well and survive the aforementioned economic problems. The company's management proposes to finance the new operation through a rights issue of ordinary shares. At present, the company is financed by a combination of ordinary share capital, non-redeemable preference shares and redeemable debentures. An extract from the company's financial statements at 30 June 2021 is as follows: Extract from the statement of financial position for Megan and Ray Ltd at 30 June 2021 Other information: The company has 1000000 ordinary shares in issue, with each share having a nominal value of R5. Megan and Ray paid a dividend of R2 per share in the year ended 30 June 2021 and dividends are expected to grow at a constant rate of 5% per annum in the long term. The shareholders required rate of return is 24%. The company has 400000 non-redeemable preference shares in issue. The dividend rate on these shares is 15% and their par value is R5 per share. Similar preference shares are currently yielding 12% per annum. The 25000 redeemable debentures mature in 10 years and are redeemable par value of R4 per debenture. The debenture pre-tax coupon rate is 16% per annum and coupon interest is paid annually. The pre-tax yield to maturity (YTM) of similar debentures in the sector is currently at 18.34% per annum. The current corporate tax rate is 28% assumed. Required: a) Discuss the overall importance of the weighted average cost of capital (WACC) and justify why it should be determined with the utmost care. (2 Marks) b) Determine the company's WACC using all the following bases: (20 Marks) i) Market values; ii) Book values; and iii) Target values (ratios) if the optimal debt: equity ratio is ordinary shares 60%, preference shares 20% and longterm loans 20%. Question 2 (25 Marks) Megan and Ray Limited (hereafter referred to as "Megan and Ray" or "the company") is a major construction company that has most of its operations in Southem Africa, in fact, its corporate office is in Sandton, in Gauteng province, South Africa. The company is listed on the JSE. It is one of the biggest companies in the construction sector in South Africa. It's JSE's sector market capitalisation is currently estimated at 25\%. The company has been doing relatively well despite the recent global economic hardships which have negatively affected this sector and now the Covid-19 pandemic is also exacerbating the problem. Recently, the company acquired rights to build 3 bridges on some of the major highways in Southern Mozambique. This business venture is surely a good opportunity for the company to continue to do relatively well and survive the aforementioned economic problems. The company's management proposes to finance the new operation through a rights issue of ordinary shares. At present, the company is financed by a combination of ordinary share capital, non-redeemable preference shares and redeemable debentures. An extract from the company's financial statements at 30 June 2021 is as follows: Extract from the statement of financial position for Megan and Ray Ltd at 30 June 2021 Other information: The company has 1000000 ordinary shares in issue, with each share having a nominal value of R5. Megan and Ray paid a dividend of R2 per share in the year ended 30 June 2021 and dividends are expected to grow at a constant rate of 5% per annum in the long term. The shareholders required rate of return is 24%. The company has 400000 non-redeemable preference shares in issue. The dividend rate on these shares is 15% and their par value is R5 per share. Similar preference shares are currently yielding 12% per annum. The 25000 redeemable debentures mature in 10 years and are redeemable par value of R4 per debenture. The debenture pre-tax coupon rate is 16% per annum and coupon interest is paid annually. The pre-tax yield to maturity (YTM) of similar debentures in the sector is currently at 18.34% per annum. The current corporate tax rate is 28% assumed. Required: a) Discuss the overall importance of the weighted average cost of capital (WACC) and justify why it should be determined with the utmost care. (2 Marks) b) Determine the company's WACC using all the following bases: (20 Marks) i) Market values; ii) Book values; and iii) Target values (ratios) if the optimal debt: equity ratio is ordinary shares 60%, preference shares 20% and longterm loans 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started