Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2B (i) You have just been engaged as the auditor for Asempa Company Ltd. During your first audit as the external auditor of the

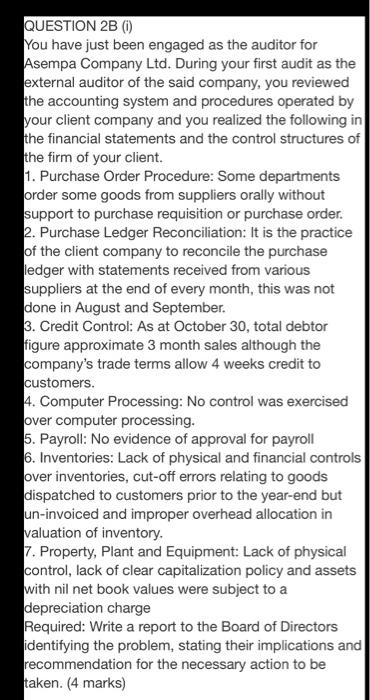

QUESTION 2B (i)

You have just been engaged as the auditor for Asempa Company Ltd. During your first audit as the external auditor of the said company, you reviewed the accounting system and procedures operated by your client company and you realized the following in the financial statements and the control structures of the firm of your client.

1. Purchase Order Procedure: Some departments order some goods from suppliers orally without support to purchase requisition or purchase order.

2. Purchase Ledger Reconciliation: It is the practice of the client company to reconcile the purchase ledger with statements received from various suppliers at the end of every month, this was not done in August and September.

3. Credit Control: As at October 30, total debtor figure approximate 3 month sales although the companys trade terms allow 4 weeks credit to customers.

4. Computer Processing: No control was exercised over computer processing.

5. Payroll: No evidence of approval for payroll

6. Inventories: Lack of physical and financial controls over inventories, cut-off errors relating to goods

dispatched to customers prior to the year-end but un-invoiced and improper overhead allocation in

valuation of inventory.

7. Property, Plant and Equipment: Lack of physical control, lack of clear capitalization policy and assets

with nil net book values were subject to a depreciation charge

Required: Write a report to the Board of Directors identifying the problem, stating their implications and

recommendation for the necessary action to be taken. (4 marks)

QUESTION 2B (ii)

You are the manager responsible for the audit of Bole Company, a chain of health and leisure clubs owned and managed by the Phil Addis family. The audit for the year ended 30 November 2019 is nearing completion and the draft financial statements recognize total assets of GH27 million and profit before tax of GH2.2 million. The audit senior has left the following file notes for your consideration during your review of the audit working papers:

DC: ACD01-F004

1. Cash transfers

During a review of the cash book, a receipt of GH350,000 was identified which was accompanied by the description BD. Bank statements showed that the following day a nearly identical amount was transferred into a bank account held in a foreign country. When I asked the financial controller about this, she requested that I speak to Mr. Addis, as he has sole responsibility for cash management. According to Mr. Addis, an old friend of his, Ababa Ethiop, has loaned the money to the company to fund further expansion and the money has been invested until it is needed. Documentary evidence concerning the transaction has been requested from Mr. Addis but has not yet been received.

2. Legal dispute

At the year end, Bole Company reversed a provision relating to an ongoing legal dispute with an ex-employee who was claiming GH150,000 for unfair dismissal. This amount was provided in full in the financial statements for the year ended 30 November 2018 but has now been reversed because Mr. Addis believes it is now likely that Bole Company will successfully defend the legal case. Mr. Addis has not been available to discuss this matter and no additional documentary evidence has been made available since the end of the previous years audit. The audit report was unmodified in the previous year.

Required: Evaluate the implications for the completion of the audit, recommending any further actions which should be taken by your audit firm. [3 marks]

[Total = 15 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started