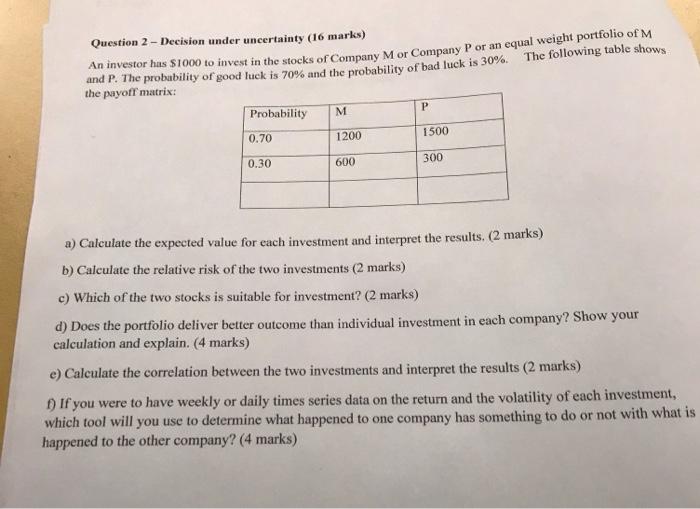

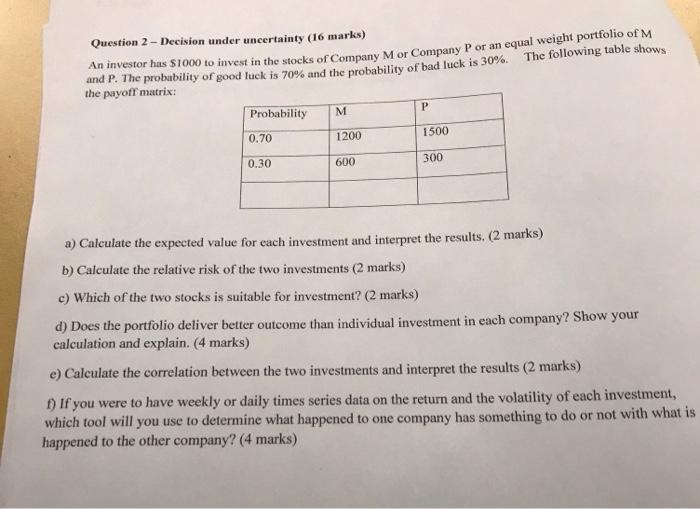

Question 2-Decision under uncertainty (16 marks) An investor has $1000 to invest in the stocks of Company M or Company P or an equal weight portfolio of M and P. The probubility of good luck is 70% and the probability of bad luck is 30%. The following table shows the payoff matrix: a) Calculate the expected value for each investment and interpret the results, (2 marks) b) Calculate the relative risk of the two investments ( 2 marks) c) Which of the two stocks is suitable for investment? (2 marks) d) Does the portfolio deliver better outcome than individual investment in each company? Show your calculation and explain. (4 marks) c) Calculate the correlation between the two investments and interpret the results ( 2 marks) f) If you were to have weekly or daily times series data on the return and the volatility of each investment, which tool will you use to determine what happened to one company has something to do or not with what i happened to the other company? (4 marks) Question 2-Decision under uncertainty (16 marks) An investor has $1000 to invest in the stocks of Company M or Company P or an equal weight portfolio of M and P. The probubility of good luck is 70% and the probability of bad luck is 30%. The following table shows the payoff matrix: a) Calculate the expected value for each investment and interpret the results, (2 marks) b) Calculate the relative risk of the two investments ( 2 marks) c) Which of the two stocks is suitable for investment? (2 marks) d) Does the portfolio deliver better outcome than individual investment in each company? Show your calculation and explain. (4 marks) c) Calculate the correlation between the two investments and interpret the results ( 2 marks) f) If you were to have weekly or daily times series data on the return and the volatility of each investment, which tool will you use to determine what happened to one company has something to do or not with what i happened to the other company? (4 marks) Question 2-Decision under uncertainty (16 marks) An investor has $1000 to invest in the stocks of Company M or Company P or an equal weight portfolio of M and P. The probubility of good luck is 70% and the probability of bad luck is 30%. The following table shows the payoff matrix: a) Calculate the expected value for each investment and interpret the results, (2 marks) b) Calculate the relative risk of the two investments ( 2 marks) c) Which of the two stocks is suitable for investment? (2 marks) d) Does the portfolio deliver better outcome than individual investment in each company? Show your calculation and explain. (4 marks) c) Calculate the correlation between the two investments and interpret the results ( 2 marks) f) If you were to have weekly or daily times series data on the return and the volatility of each investment, which tool will you use to determine what happened to one company has something to do or not with what i happened to the other company? (4 marks) Question 2-Decision under uncertainty (16 marks) An investor has $1000 to invest in the stocks of Company M or Company P or an equal weight portfolio of M and P. The probubility of good luck is 70% and the probability of bad luck is 30%. The following table shows the payoff matrix: a) Calculate the expected value for each investment and interpret the results, (2 marks) b) Calculate the relative risk of the two investments ( 2 marks) c) Which of the two stocks is suitable for investment? (2 marks) d) Does the portfolio deliver better outcome than individual investment in each company? Show your calculation and explain. (4 marks) c) Calculate the correlation between the two investments and interpret the results ( 2 marks) f) If you were to have weekly or daily times series data on the return and the volatility of each investment, which tool will you use to determine what happened to one company has something to do or not with what i happened to the other company? (4 marks)