Answered step by step

Verified Expert Solution

Question

1 Approved Answer

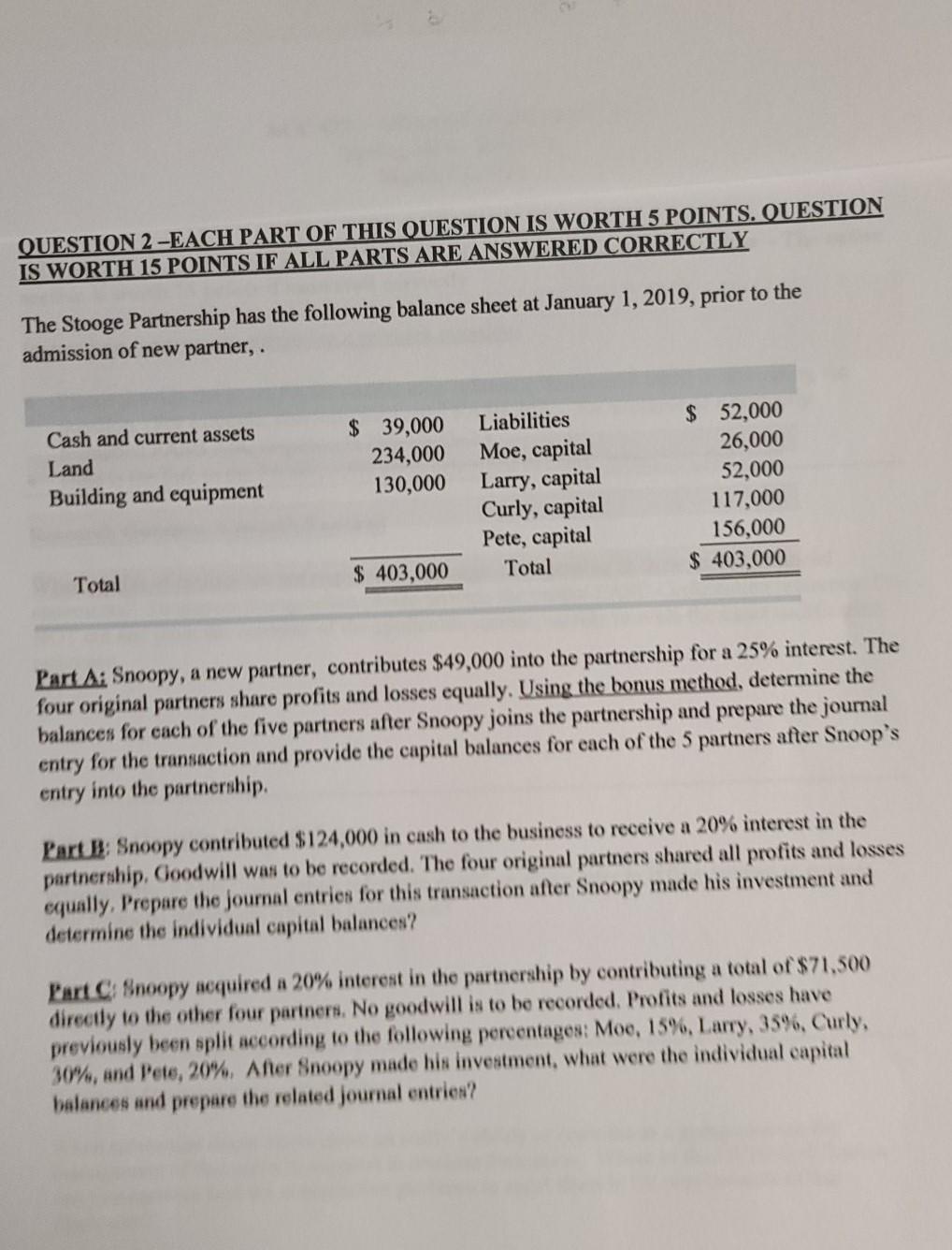

QUESTION 2-EACH PART OF THIS QUESTION IS WORTH 5 POINTS. QUESTION IS WORTH 15 POINTS IF ALL PARTS ARE ANSWERED CORRECTLY The Stooge Partnership has

QUESTION 2-EACH PART OF THIS QUESTION IS WORTH 5 POINTS. QUESTION IS WORTH 15 POINTS IF ALL PARTS ARE ANSWERED CORRECTLY The Stooge Partnership has the following balance sheet at January 1, 2019, prior to the admission of new partner, . Cash and current assets Land Building and equipment $ 39,000 234,000 130,000 Liabilities Moe, capital Larry, capital Curly, capital Pete, capital Total $ 52,000 26,000 52,000 117,000 156,000 $ 403,000 Total $ 403,000 Part A: Snoopy, a new partner, contributes $49,000 into the partnership for a 25% interest. The four original partners share profits and losses equally. Using the bonus method, determine the balances for each of the five partners after Snoopy joins the partnership and prepare the journal entry for the transaction and provide the capital balances for each of the 5 partners after Snoop's entry into the partnership. Part B: Snoopy contributed $124,000 in cash to the business to receive a 20% interest in the partnership, Goodwill was to be recorded. The four original partners shared all profits and losses equally. Prepare the journal entries for this transaction after Snoopy made his investment and determine the individual capital balances? Part C Snoopy acquired a 20% interest in the partnership by contributing a total of $71.500 directly to the other four partners. No goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Moe, 15%, Larry, 35%, Curly, 30%, and Pete, 20%. After Snoopy made his investment, what were the individual capital balances and prepare the related journal entrien

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started