Answered step by step

Verified Expert Solution

Question

1 Approved Answer

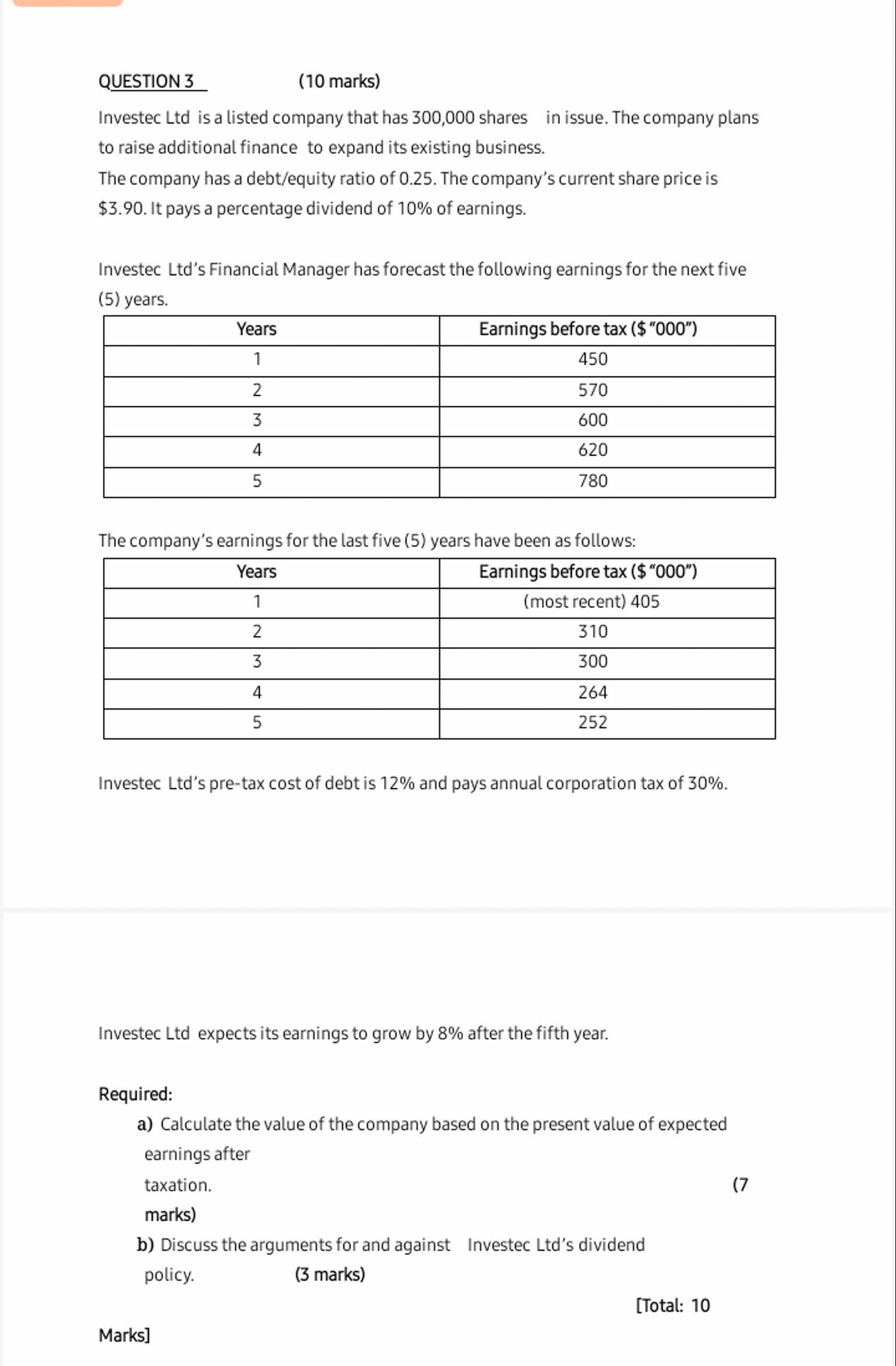

QUESTION 3 ( 1 0 marks ) Investec Ltd is a listed company that has 3 0 0 , 0 0 0 shares in issue.

QUESTION

marks

Investec Ltd is a listed company that has shares in issue. The company plans

to raise additional finance to expand its existing business.

The company has a debtequity ratio of The company's current share price is

$ It pays a percentage dividend of of earnings.

Investec Ltds Financial Manager has forecast the following earnings for the next five

years.

The company's earnings for the last five years have been as follows:

Investec Ltds pretax cost of debt is and pays annual corporation tax of

Investec Ltd expects its earnings to grow by after the fifth year.

Required:

a Calculate the value of the company based on the present value of expected

earnings after

taxation.

marks

b Discuss the arguments for and against Investec Ltds dividend

policy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started