Answered step by step

Verified Expert Solution

Question

1 Approved Answer

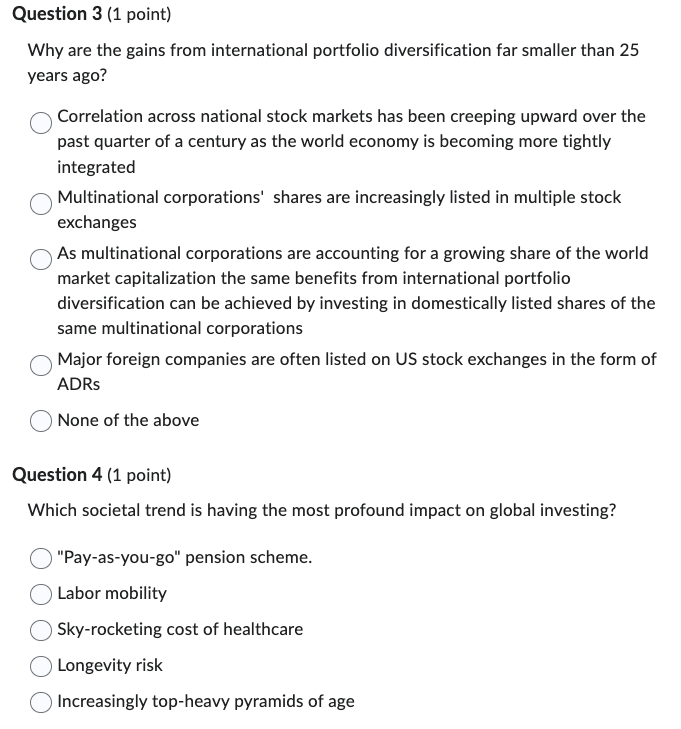

Question 3 (1 point) Why are the gains from international portfolio diversification far smaller than 25 years ago? Correlation across national stock markets has

Question 3 (1 point) Why are the gains from international portfolio diversification far smaller than 25 years ago? Correlation across national stock markets has been creeping upward over the past quarter of a century as the world economy is becoming more tightly integrated Multinational corporations' shares are increasingly listed in multiple stock exchanges As multinational corporations are accounting for a growing share of the world market capitalization the same benefits from international portfolio diversification can be achieved by investing in domestically listed shares of the same multinational corporations Major foreign companies are often listed on US stock exchanges in the form of ADRs None of the above Question 4 (1 point) Which societal trend is having the most profound impact on global investing? "Pay-as-you-go" pension scheme. Labor mobility Sky-rocketing cost of healthcare Longevity risk Increasingly top-heavy pyramids of age

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 3 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started