Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 - 10 Marks Charlie's Shoe Store reports the following: 1. October 31, 2020 Bank balance is $50,534 2. The company's books show a

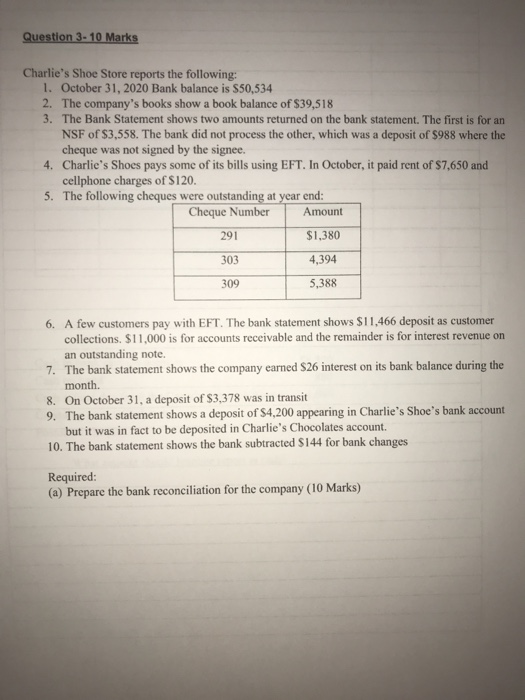

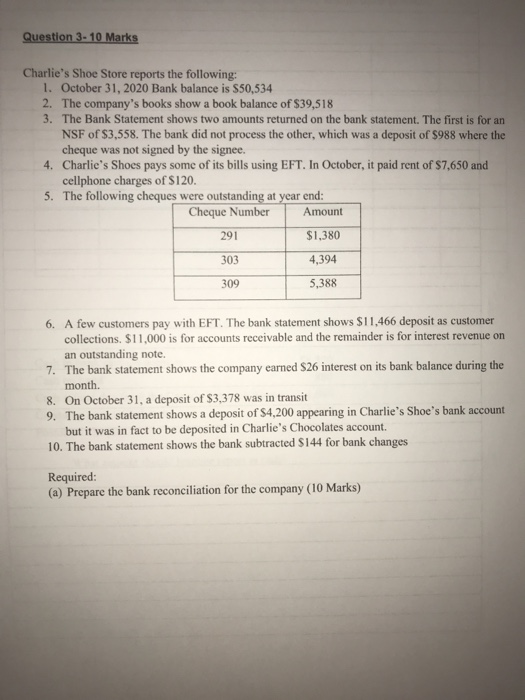

Question 3 - 10 Marks Charlie's Shoe Store reports the following: 1. October 31, 2020 Bank balance is $50,534 2. The company's books show a book balance of $39,518 3. The Bank Statement shows two amounts returned on the bank statement. The first is for an NSF of $3,558. The bank did not process the other, which was a deposit of $988 where the cheque was not signed by the signee. 4. Charlie's Shoes pays some of its bills using EFT. In October, it paid rent of $7.650 and cellphone charges of $120. 5. The following cheques were outstanding at year end: Cheque Number Amount 291 $1,380 303 T 4,394 309 5,388 6. A few customers pay with EFT. The bank statement shows $11.466 deposit as customer collections. $11,000 is for accounts receivable and the remainder is for interest revenue on an outstanding note. 7. The bank statement shows the company earned $26 interest on its bank balance during the month. 8. On October 31, a deposit of $3,378 was in transit 9. The bank statement shows a deposit of $4,200 appearing in Charlie's Shoe's bank account but it was in fact to be deposited in Charlie's Chocolates account. 10. The bank statement shows the bank subtracted $144 for bank changes Required: (a) Prepare the bank reconciliation for the company (10 Marks)

Question 3 - 10 Marks Charlie's Shoe Store reports the following: 1. October 31, 2020 Bank balance is $50,534 2. The company's books show a book balance of $39,518 3. The Bank Statement shows two amounts returned on the bank statement. The first is for an NSF of $3,558. The bank did not process the other, which was a deposit of $988 where the cheque was not signed by the signee. 4. Charlie's Shoes pays some of its bills using EFT. In October, it paid rent of $7.650 and cellphone charges of $120. 5. The following cheques were outstanding at year end: Cheque Number Amount 291 $1,380 303 T 4,394 309 5,388 6. A few customers pay with EFT. The bank statement shows $11.466 deposit as customer collections. $11,000 is for accounts receivable and the remainder is for interest revenue on an outstanding note. 7. The bank statement shows the company earned $26 interest on its bank balance during the month. 8. On October 31, a deposit of $3,378 was in transit 9. The bank statement shows a deposit of $4,200 appearing in Charlie's Shoe's bank account but it was in fact to be deposited in Charlie's Chocolates account. 10. The bank statement shows the bank subtracted $144 for bank changes Required: (a) Prepare the bank reconciliation for the company (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started