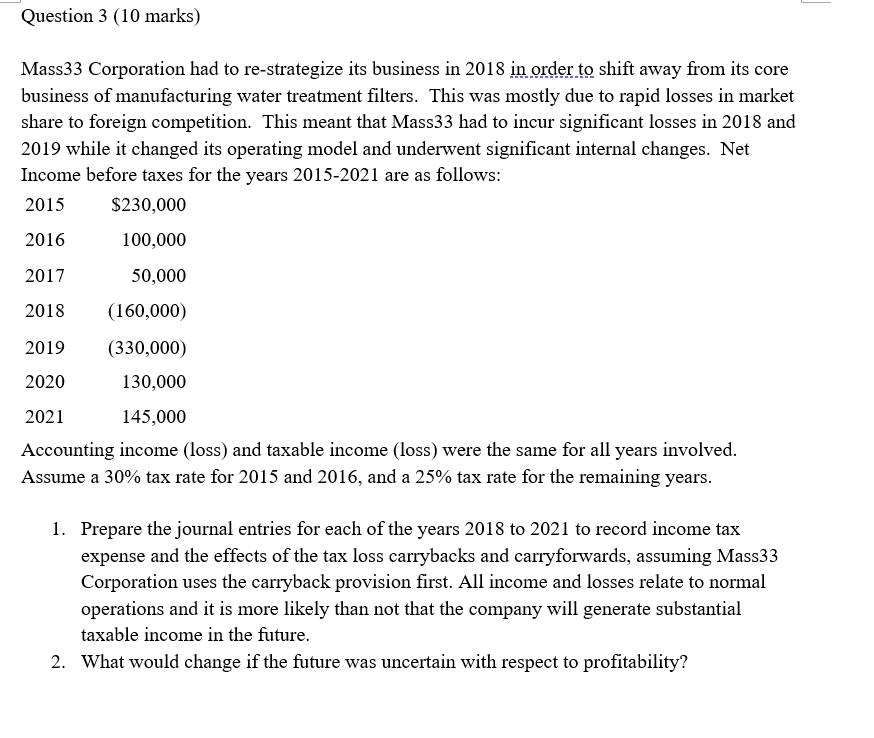

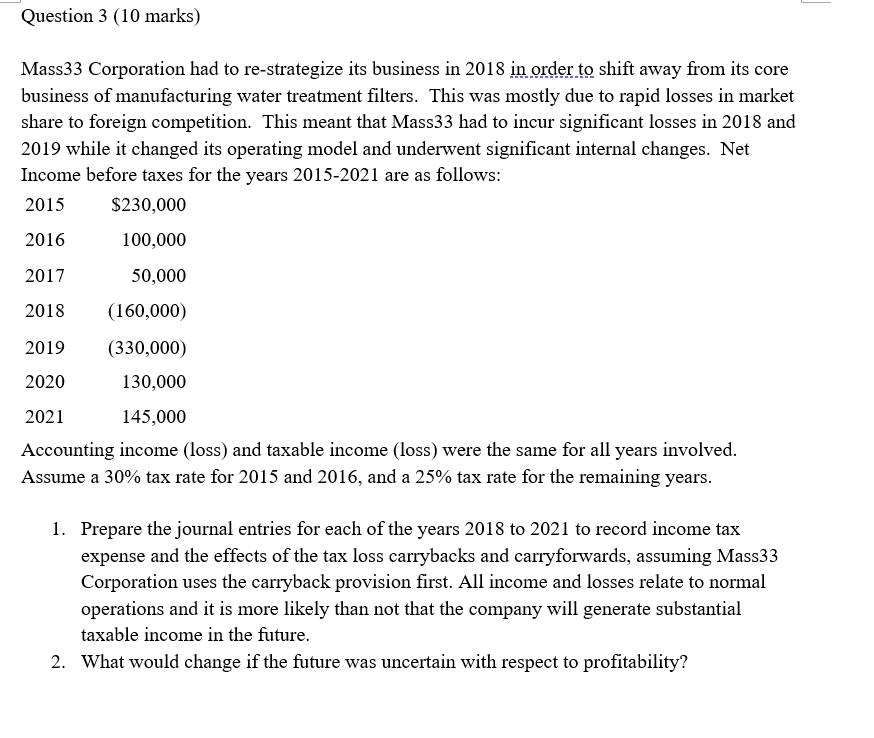

Question 3 (10 marks) Mass33 Corporation had to re-strategize its business in 2018 in order to shift away from its core business of manufacturing water treatment filters. This was mostly due to rapid losses in market share to foreign competition. This meant that Mass33 had to incur significant losses in 2018 and 2019 while it changed its operating model and underwent significant internal changes. Net Income before taxes for the years 2015-2021 are as follows: 2015 $230,000 2016 100,000 2017 50,000 2018 (160,000) 2019 (330,000) 2020 130,000 2021 145,000 Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2015 and 2016, and a 25% tax rate for the remaining years. 1. Prepare the journal entries for each of the years 2018 to 2021 to record income tax expense and the effects of the tax loss carrybacks and carryforwards, assuming Mass33 Corporation uses the carryback provision first. All income and losses relate to normal operations and it is more likely than not that the company will generate substantial taxable income in the future. 2. What would change if the future was uncertain with respect to profitability? Question 3 (10 marks) Mass33 Corporation had to re-strategize its business in 2018 in order to shift away from its core business of manufacturing water treatment filters. This was mostly due to rapid losses in market share to foreign competition. This meant that Mass33 had to incur significant losses in 2018 and 2019 while it changed its operating model and underwent significant internal changes. Net Income before taxes for the years 2015-2021 are as follows: 2015 $230,000 2016 100,000 2017 50,000 2018 (160,000) 2019 (330,000) 2020 130,000 2021 145,000 Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2015 and 2016, and a 25% tax rate for the remaining years. 1. Prepare the journal entries for each of the years 2018 to 2021 to record income tax expense and the effects of the tax loss carrybacks and carryforwards, assuming Mass33 Corporation uses the carryback provision first. All income and losses relate to normal operations and it is more likely than not that the company will generate substantial taxable income in the future. 2. What would change if the future was uncertain with respect to profitability