Answered step by step

Verified Expert Solution

Question

1 Approved Answer

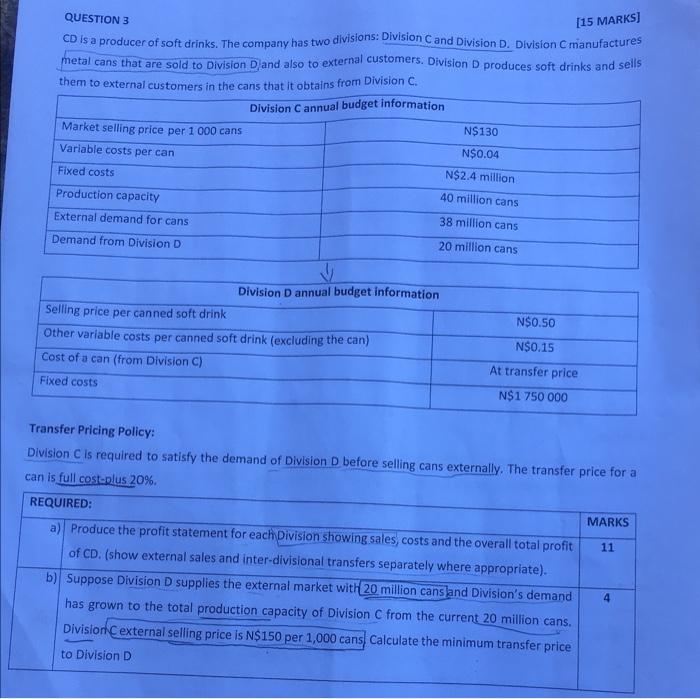

QUESTION 3 [15 MARKS] CD is a producer of soft drinks. The company has two divisions: Division C and Division D. Division C manufactures

QUESTION 3 [15 MARKS] CD is a producer of soft drinks. The company has two divisions: Division C and Division D. Division C manufactures metal cans that are sold to Division Djand also to external customers. Division D produces soft drinks and sells them to external customers in the cans that it obtains from Division C. Division C annual budget information Market selling price per 1 000 cans Variable costs per can Fixed costs Production capacity External demand for cans Demand from Division D Division D annual budget information Selling price per canned soft drink Other variable costs per canned soft drink (excluding the can) Cost of a can (from Division C) Fixed costs N$130 N$0.04 N$2.4 million 40 million cans 38 million cans 20 million cans N$0.50 N$0.15 At transfer price N$1 750 000 Transfer Pricing Policy: Division C is required to satisfy the demand of Division D before selling cans externally. The transfer price for a can is full cost-plus 20%. REQUIRED: a) Produce the profit statement for each Division showing sales, costs and the overall total profit of CD. (show external sales and inter-divisional transfers separately where appropriate). b) Suppose Division D supplies the external market with 20 million cansland Division's demand. has grown to the total production capacity of Division C from the current 20 million cans. Division Cexternal selling price is N$150 per 1,000 cans Calculate the minimum transfer price to Division D MARKS 11 4

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Transfer Cost The interdepartmental transfer price is fullcost 20 The full is determined by adding t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started