Question

QUESTION 3 (15 Marks) Donald Dump started a business that manufactures cleaning materials during 2018. The business, Dump Cleaning Chemicals is a registered VAT vendor

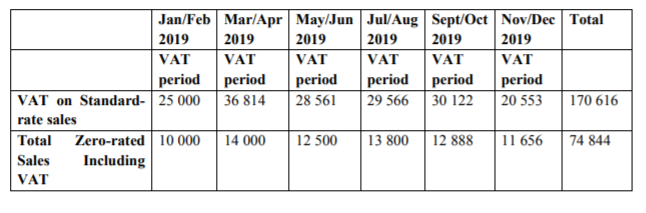

QUESTION 3 (15 Marks) Donald Dump started a business that manufactures cleaning materials during 2018. The business, Dump Cleaning Chemicals is a registered VAT vendor and is registered to pay VAT on a bi-monthly basis. Dump Cleaning Chemicals' financial year ends on 31 December. On 16 December 2019, the business experienced a catastrophic fire that destroyed its warehouse and administration building. Nearly all the inventory which was held on hand at that date and nearly all the financial records have been destroyed, except for the following information: 1. Inventory on hand on 31 December 2018 amounted to R250 000. 2. The business maintains a Mark-up of 25% on cost. 3. The VAT returns noted the following details: a. Output tax declared:  Input Tax You are required to: 1. The business only purchases from other VAT registered businesses 2. The following purchases were made during the year: 2.1 Total inventory purchased (incl. VAT): R950 000

Input Tax You are required to: 1. The business only purchases from other VAT registered businesses 2. The following purchases were made during the year: 2.1 Total inventory purchased (incl. VAT): R950 000

2.2 Entertainment cost (incl. VAT): R1 350 2.3 Transportation costs (incl. VAT): a. Transportation Inward: R13 450 b. Transport Outward: R18 650 3. A customer required some modifications to be made to a product, Dump Cleaning Chemicals incurred R2 450 (incl. VAT) to modify the product for the clients needs.

Assuming a VAT rate of 15%, calculate the closing inventory value which Dump Cleaning Chemicals recover from its insurance service provider.

Jan/Feb Mar Apr May/Jun Jul Aug Sept/Oct Nov/Dec Total 2019 2019 2019 2019 2019 2019 VAT VAT VAT VAT VAT VAT period period period period period period VAT on Standard-25 000 36 814 28 561 29 566 30 122 20 553 170 616 rate sales Total Zero-rated 10 000 14 000 12 500 13 800 12 888 11 656 74 844 Sales Including VAT Jan/Feb Mar Apr May/Jun Jul Aug Sept/Oct Nov/Dec Total 2019 2019 2019 2019 2019 2019 VAT VAT VAT VAT VAT VAT period period period period period period VAT on Standard-25 000 36 814 28 561 29 566 30 122 20 553 170 616 rate sales Total Zero-rated 10 000 14 000 12 500 13 800 12 888 11 656 74 844 Sales Including VATStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started