Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (15 marks) Fadi owns a rental property in Sydney. The property is a two-storey townhouse. Downstairs is designated as a barber business

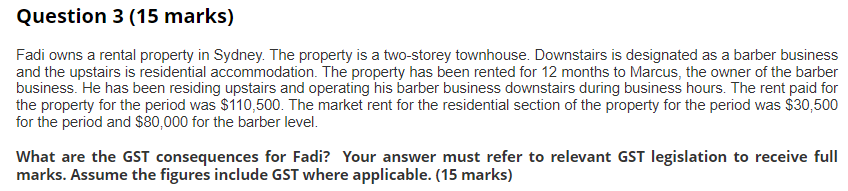

Question 3 (15 marks) Fadi owns a rental property in Sydney. The property is a two-storey townhouse. Downstairs is designated as a barber business and the upstairs is residential accommodation. The property has been rented for 12 months to Marcus, the owner of the barber business. He has been residing upstairs and operating his barber business downstairs during business hours. The rent paid for the property for the period was $110,500. The market rent for the residential section of the property for the period was $30,500 for the period and $80,000 for the barber level. What are the GST consequences for Fadi? Your answer must refer to relevant GST legislation to receive full marks. Assume the figures include GST where applicable. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In Australia the Goods and Services Tax GST legislation applies to the supply of goods and services including rental properties According to the relev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started