Question 3 (15 Points)

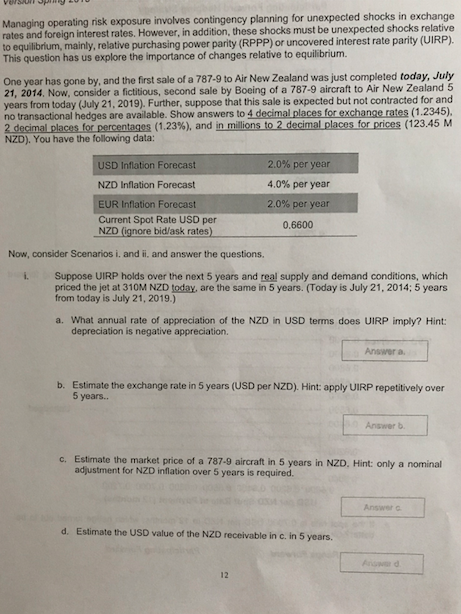

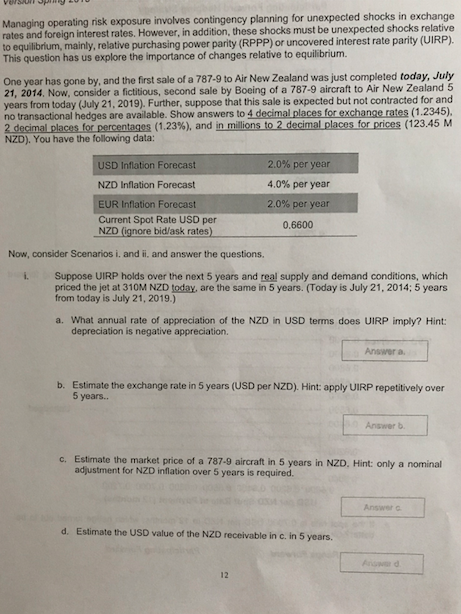

Managing operating risk exposure involves contingency planning for unexpected shocks in exchange rates and foreign interest rates. However, in addition, these shocks must be unexpected shocks relative to equilibrium, mainly, relative purchasing power parity (RPPP) or uncovered interest rate parity (UIRP). This question has us explore the importance of changes relative to equilibrium.

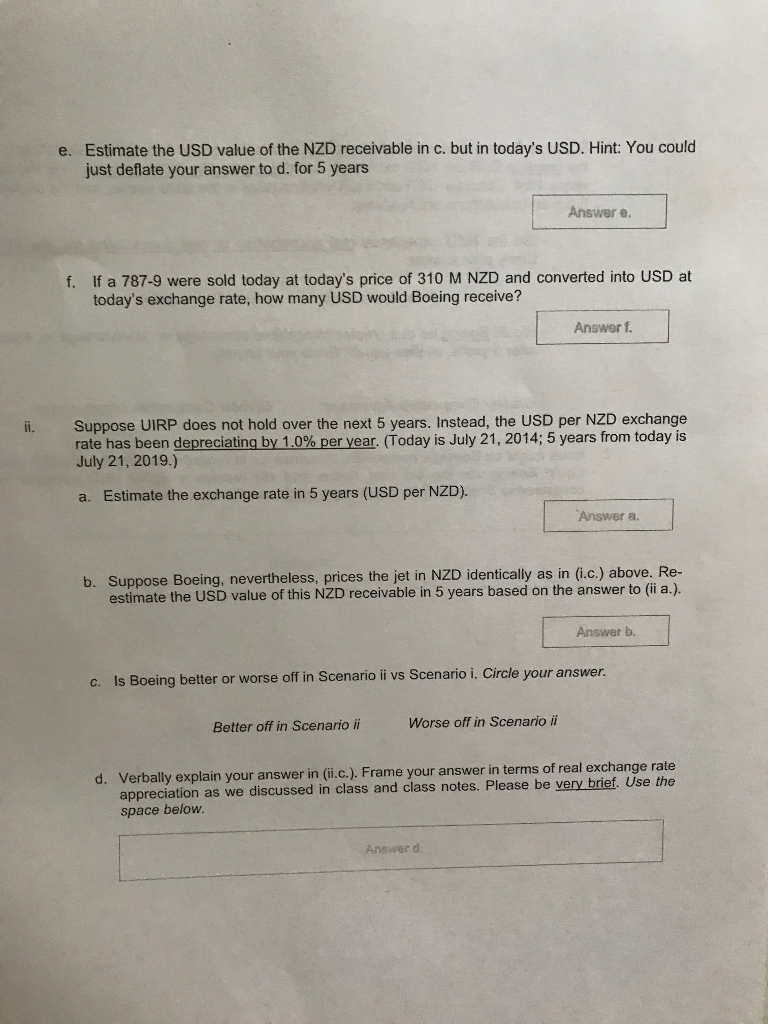

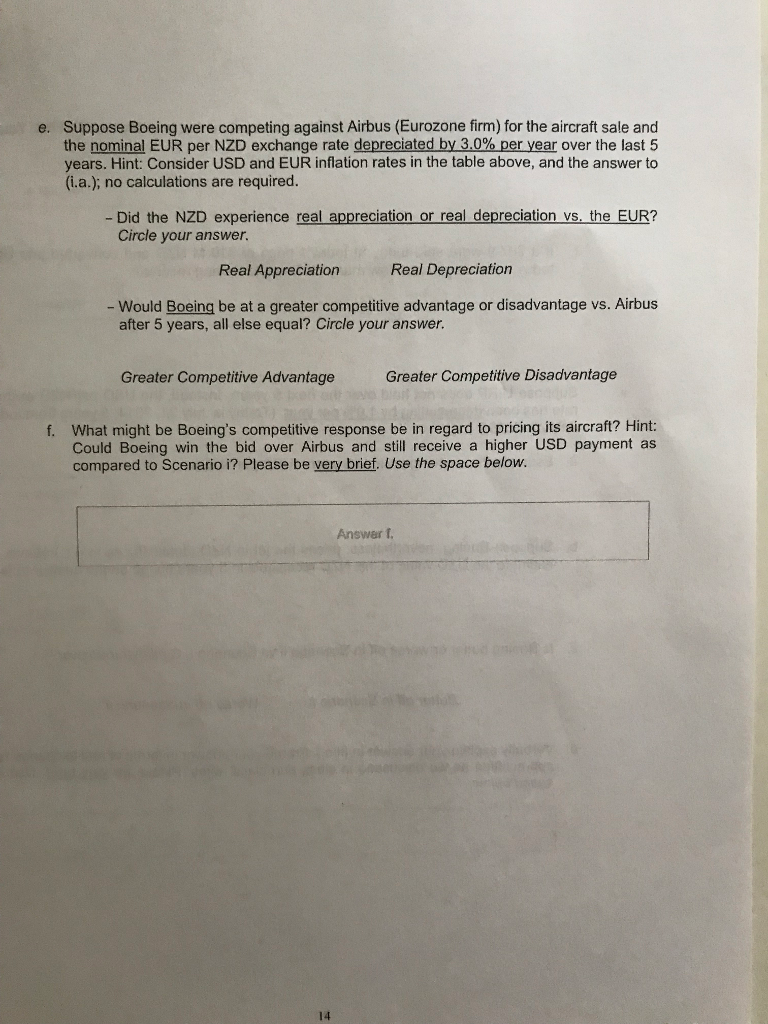

One year has gone by, and the first sale of a 787-9 to Air New Zealand was just completed today, July 21, 2014. Now, consider a fictitious, second sale by Boeing of a 787-9 aircraft to Air New Zealand 5 years from today (July 21, 2019). Further, suppose that this sale is expected but not contracted for and no transactional hedges are available. Show answers to 4 decimal places for exchange rates (1.2345), 2 decimal places for percentages (1.23%), and in millions to 2 decimal places for prices (123.45 M NZD). You have the following data:

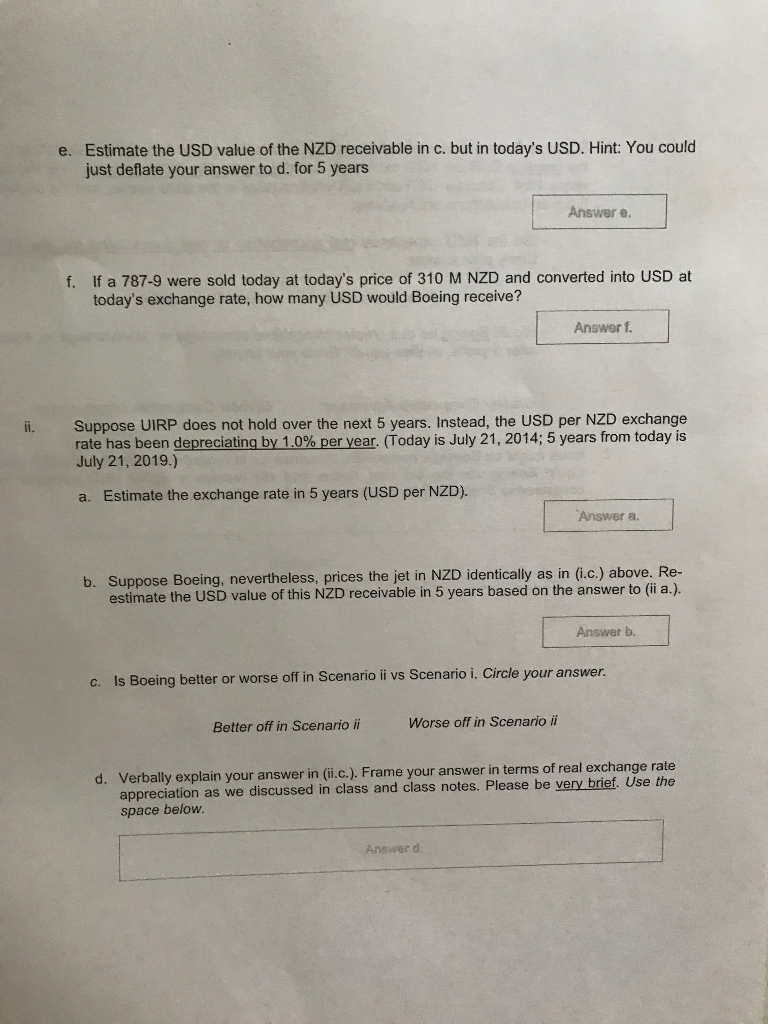

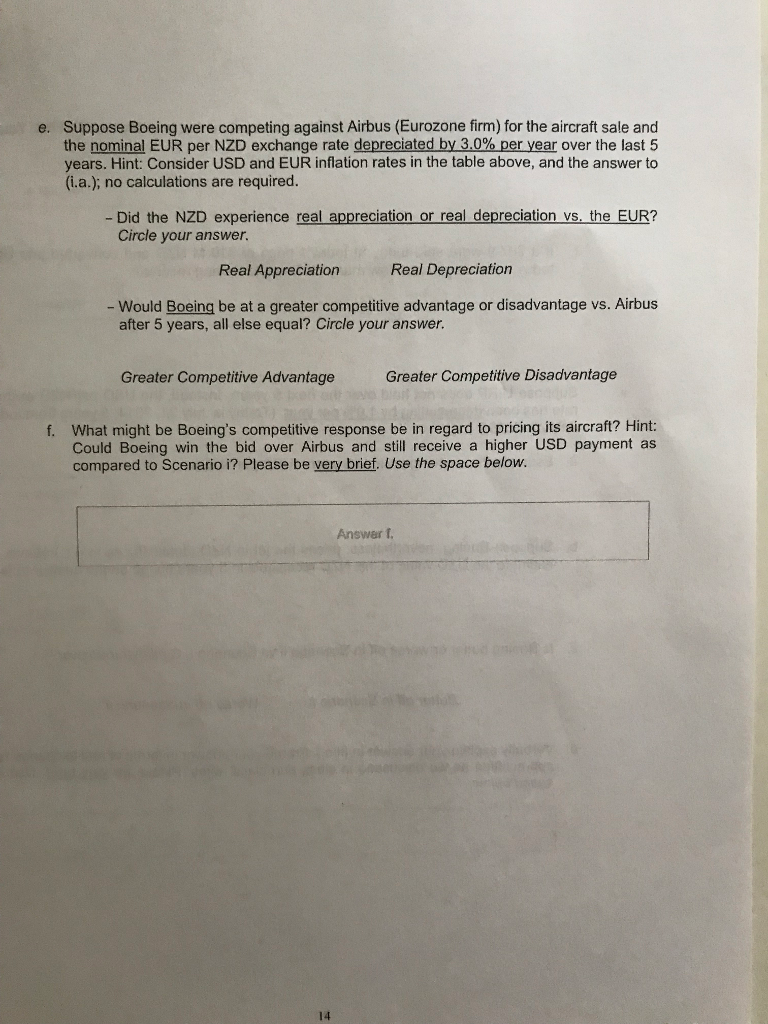

Managing operating risk exposure involves contingency planning for unexpected shocks in exchange rates and foreign interest rates. However, in addition, these shocks must be unexpected shocks relative to equilibrium, mainly, relative purchasing power parity (RPPP) or uncovered interest rate parity (UIRP). This question has us explore the importance of changes relative to equilibrium. One year has gone by, and the first sale of a 787-9 to Air New Zealand was just completed today, July 21, 2014. Now, consider a fictitious, second sale by Boeing of a 787-9 aircraft to Air New Zealand 5 years from today (July 21, 2019). Further, suppose that this sale is expected but not contracted for and no transactional hedges are available. Show answers to 4 decimal places for exchange rates (1.2345), 2 decimal places for percentages (1.23%), and in millions to 2dec mal places orpr ces (123.45 M NZD). You have the following data: USD Inflation Forecast NZD Inflation Forecast EUR Inflation Forecast Current Spot Rate USD per NZD (ignore bid/ask rates) 2.0% per year 4.0% per year 2.0% per year 0.6600 Now, consider Scenarios i. and ii. and answer the questions. i Suppose UIRP holds over the next 5 years and real supply and demand conditions, which priced the jet at 310M NZD today, are the same in 5 years. (Today is July 21, 2014; 5 years from today is July 21, 2019.) a. What annual rate of appreciation of the NZD in USD terms does UIRP imply? Hint: depreciation is negative appreciation. Answer a. Estimate the exchange rate in 5 years (USD per NZD). Hint: apply UIRP repetitively over 5 years.. b. Answer b c. Estimate the market price of a 787-9 aircraft in 5 years in NZD, Hint: only a nominal adjustment for NZD inflation over 5 years is required. Answer d. Estimate the USD value of the NZD receivable in c. in 5 years. 12 Managing operating risk exposure involves contingency planning for unexpected shocks in exchange rates and foreign interest rates. However, in addition, these shocks must be unexpected shocks relative to equilibrium, mainly, relative purchasing power parity (RPPP) or uncovered interest rate parity (UIRP). This question has us explore the importance of changes relative to equilibrium. One year has gone by, and the first sale of a 787-9 to Air New Zealand was just completed today, July 21, 2014. Now, consider a fictitious, second sale by Boeing of a 787-9 aircraft to Air New Zealand 5 years from today (July 21, 2019). Further, suppose that this sale is expected but not contracted for and no transactional hedges are available. Show answers to 4 decimal places for exchange rates (1.2345), 2 decimal places for percentages (1.23%), and in millions to 2dec mal places orpr ces (123.45 M NZD). You have the following data: USD Inflation Forecast NZD Inflation Forecast EUR Inflation Forecast Current Spot Rate USD per NZD (ignore bid/ask rates) 2.0% per year 4.0% per year 2.0% per year 0.6600 Now, consider Scenarios i. and ii. and answer the questions. i Suppose UIRP holds over the next 5 years and real supply and demand conditions, which priced the jet at 310M NZD today, are the same in 5 years. (Today is July 21, 2014; 5 years from today is July 21, 2019.) a. What annual rate of appreciation of the NZD in USD terms does UIRP imply? Hint: depreciation is negative appreciation. Answer a. Estimate the exchange rate in 5 years (USD per NZD). Hint: apply UIRP repetitively over 5 years.. b. Answer b c. Estimate the market price of a 787-9 aircraft in 5 years in NZD, Hint: only a nominal adjustment for NZD inflation over 5 years is required. Answer d. Estimate the USD value of the NZD receivable in c. in 5 years. 12