Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (17 marks) Steven is a financial planner at Morgan Investment Bank. He has just compiled data for the analysis of two assets:

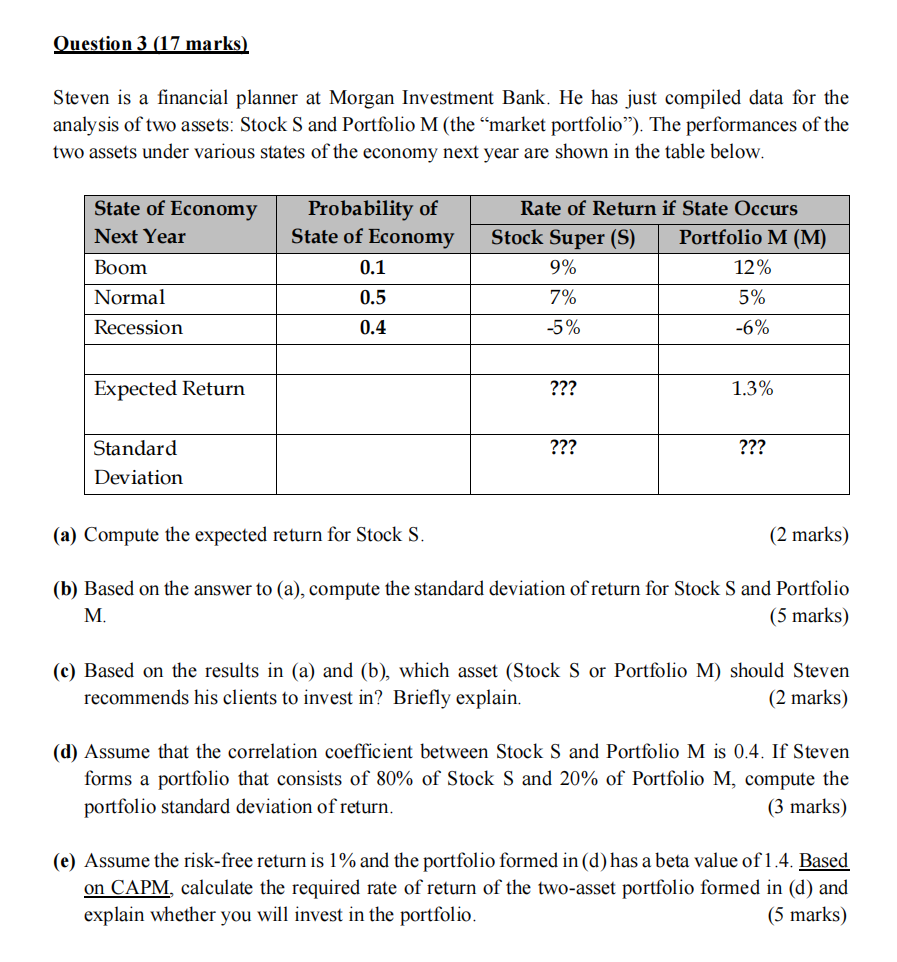

Question 3 (17 marks) Steven is a financial planner at Morgan Investment Bank. He has just compiled data for the analysis of two assets: Stock S and Portfolio M (the market portfolio). The performances of the two assets under various states of the economy next year are shown in the table below. State of Economy Probability of Next Year Boom Normal Recession State of Economy Stock Super (S) 0.1 9% 0.5 7% 0.4 -5% Rate of Return if State Occurs Portfolio M (M) 12% 5% -6% Expected Return ??? 1.3% Standard ??? ??? Deviation (a) Compute the expected return for Stock S. (2 marks) (b) Based on the answer to (a), compute the standard deviation of return for Stock S and Portfolio M. (5 marks) (c) Based on the results in (a) and (b), which asset (Stock S or Portfolio M) should Steven recommends his clients to invest in? Briefly explain. (2 marks) (d) Assume that the correlation coefficient between Stock S and Portfolio M is 0.4. If Steven forms a portfolio that consists of 80% of Stock S and 20% of Portfolio M, compute the portfolio standard deviation of return. (3 marks) (e) Assume the risk-free return is 1% and the portfolio formed in (d) has a beta value of 1.4. Based on CAPM, calculate the required rate of return of the two-asset portfolio formed in (d) and explain whether you will invest in the portfolio. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started