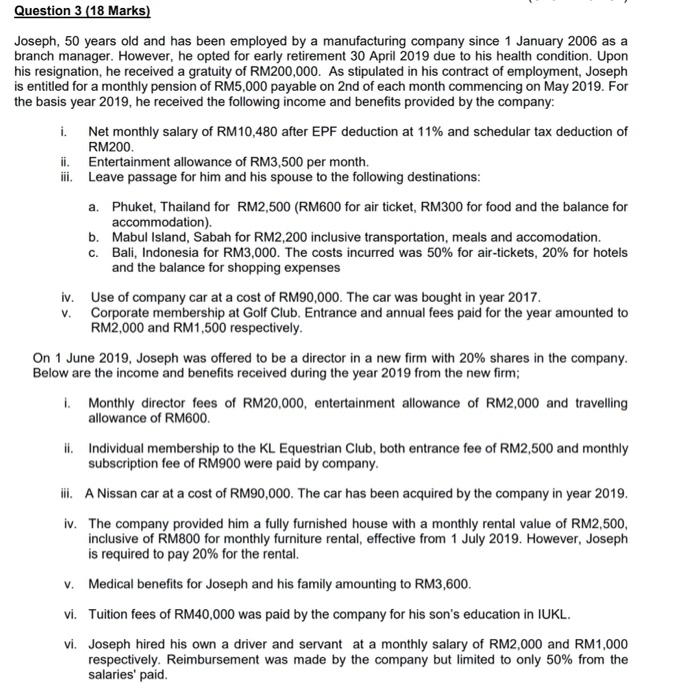

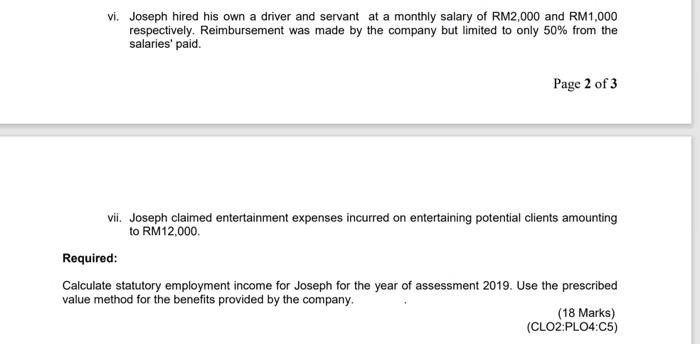

Question 3 (18 Marks) Joseph, 50 years old and has been employed by a manufacturing company since 1 January 2006 as a branch manager. However, he opted for early retirement 30 April 2019 due to his health condition. Upon his resignation, he received a gratuity of RM200,000. As stipulated in his contract of employment, Joseph is entitled for a monthly pension of RM5,000 payable on 2nd of each month commencing on May 2019. For the basis year 2019, he received the following income and benefits provided by the company: i. Net monthly salary of RM10,480 after EPF deduction at 11% and schedular tax deduction of RM200. ii. Entertainment allowance of RM3,500 per month. iii. Leave passage for him and his spouse to the following destinations: a. Phuket, Thailand for RM2,500 (RM600 for air ticket, RM300 for food and the balance for accommodation) b. Mabul Island, Sabah for RM2,200 inclusive transportation, meals and accomodation. C. Bali, Indonesia for RM3,000. The costs incurred was 50% for air-tickets, 20% for hotels and the balance for shopping expenses iv. Use of company car at a cost of RM90,000. The car was bought in year 2017. V. Corporate membership at Golf Club. Entrance and annual fees paid for the year amounted to RM2,000 and RM1,500 respectively. On 1 June 2019, Joseph was offered to be a director in a new firm with 20% shares in the company. Below are the income and benefits received during the year 2019 from the new firm; Monthly director fees of RM20,000, entertainment allowance of RM2,000 and travelling allowance of RM600 ii. Individual membership to the KL Equestrian Club, both entrance fee of RM2,500 and monthly subscription fee of RM900 were paid by company. ii. A Nissan car at a cost of RM90,000. The car has been acquired by the company in year 2019. iv. The company provided him a fully furnished house with a monthly rental value of RM2,500, inclusive of RM800 for monthly furniture rental, effective from 1 July 2019. However, Joseph is required to pay 20% for the rental. V. Medical benefits for Joseph and his family amounting to RM3,600. vi. Tuition fees of RM40,000 was paid by the company for his son's education in IUKL. vi. Joseph hired his own a driver and servant at a monthly salary of RM2,000 and RM1,000 respectively. Reimbursement was made by the company but limited to only 50% from the salaries' paid. vi. Joseph hired his own a driver and servant at a monthly salary of RM2,000 and RM1,000 respectively. Reimbursement was made by the company but limited to only 50% from the salaries' paid. Page 2 of 3 vii. Joseph claimed entertainment expenses incurred on entertaining potential clients amounting to RM12,000. Required: Calculate statutory employment income for Joseph for the year of assessment 2019. Use the prescribed value method for the benefits provided by the company. (18 Marks) (CLO2:PLO4:05)